Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a cash budget for the month of December 2023. Smart Toys Pty Ltd is considering changing its depreciation method from straight-line to reducing balance

Smart Toys Pty Ltd is considering changing its depreciation method from straight-line to reducing balance for its warehouse computer system. What will be the effect of any increased depreciation expense on the cash balance?

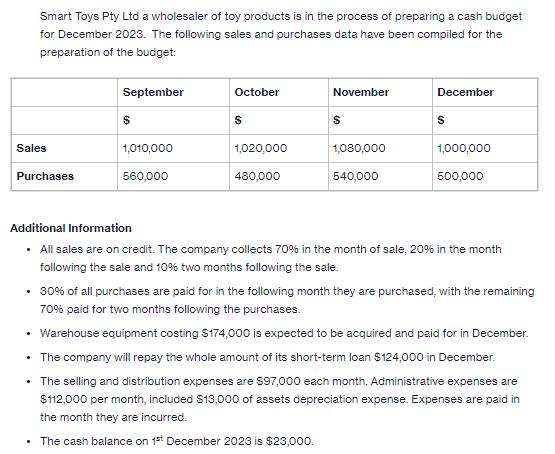

Smart Toys Pty Ltd a wholesaler of toy products is in the process of preparing a cash budget for December 2023. The following sales and purchases data have been compiled for the preparation of the budget: Sales Purchases September $ 1,010,000 560,000 October $ 1,020,000 480,000 November $ 1,080,000 540,000 December S 1,000,000 500,000 Additional Information All sales are on credit. The company collects 70% in the month of sale, 20% in the month following the sale and 10% two months following the sale. 30% of all purchases are paid for in the following month they are purchased, with the remaining 70% paid for two months following the purchases. Warehouse equipment costing $174,000 is expected to be acquired and paid for in December. The company will repay the whole amount of its short-term loan $124,000 in December. The selling and distribution expenses are $97,000 each month. Administrative expenses are $112,000 per month, included $13,000 of assets depreciation expense. Expenses are paid in the month they are incurred. The cash balance on 1st December 2023 is $23,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the cash budget for December 2023 we need to calculate the cash receipts and cash payment...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started