Question

Prepare a Cash Flow Budget for The Company If Manufacturing Is Achieved. The company wants to keep a minimum of $ 30,000.00 cash at all

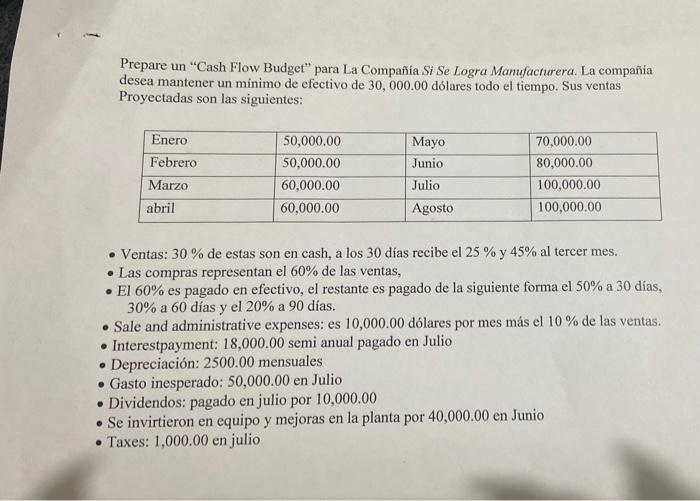

Prepare a "Cash Flow Budget" for The Company If Manufacturing Is Achieved. The company wants to keep a minimum of $ 30,000.00 cash at all times. Your Projected sales are as follows:

Sales: 30% of these are in cash, after 30 days you receive 25% and 45% in the third month.

Purchases represent 60% of sales,

60% is paid in cash, the rest is paid as follows: 50% at 30 days, 0% at 60 days and 20% at 90 days.

Sale and administrative expenses: it is $ 10,000.00 per month plus 10% of sales.

Interestpayment: 18,000.00 semi annual paid in July Depreciation: 2500.00 per month

Unexpected expense: 50,000.00 in July

Dividends: paid in July for 10,000.00

Invested in equipment and plant improvements for 40,000.00 in June

Taxes: 1,000.00 in July

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started