Prepare a cash forecast for the six months ended 30th september 2021

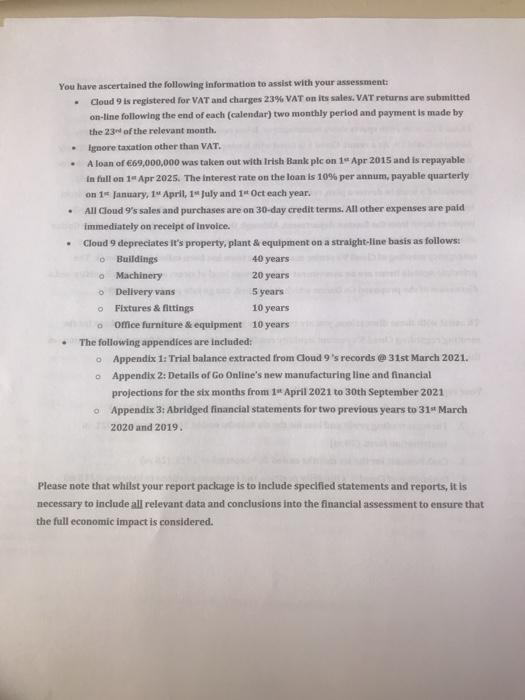

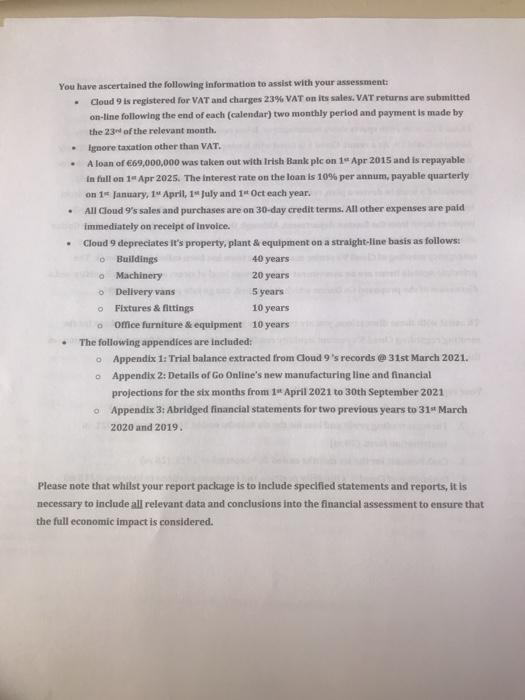

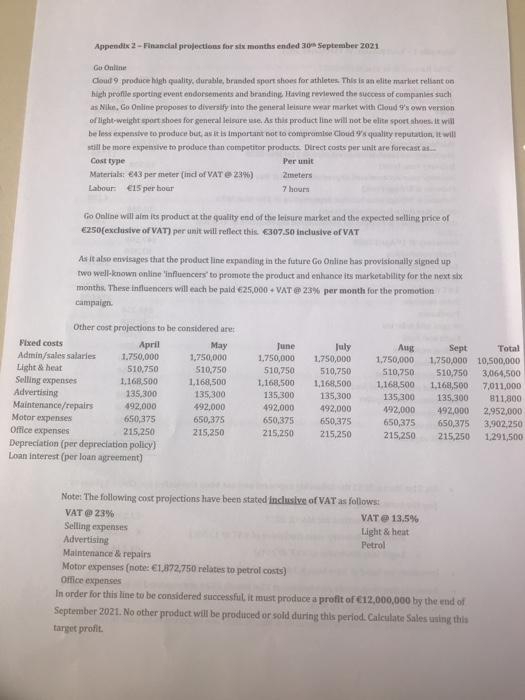

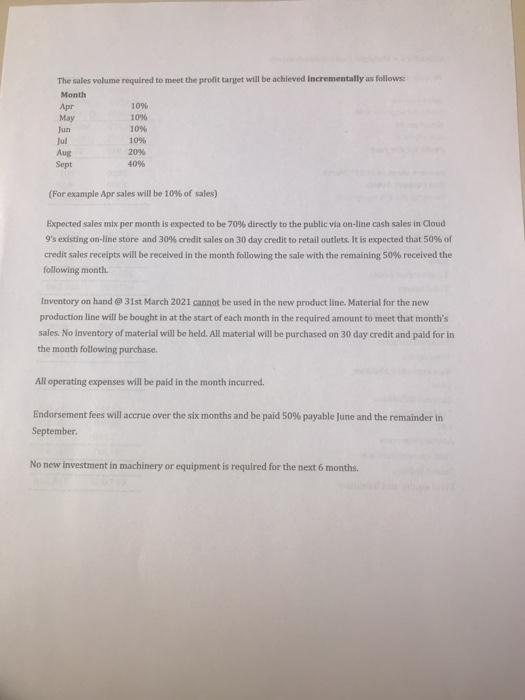

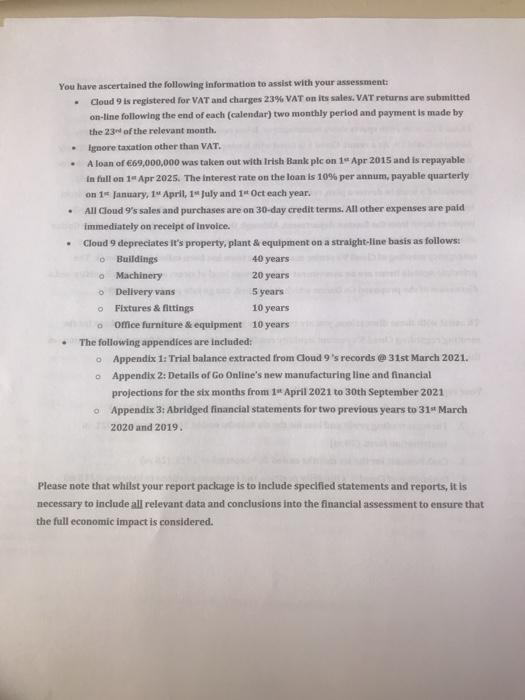

. You have ascertained the following information to assist with your assessment Cloud 9 is registered for VAT and charges 23% VAT on its sales. VAT returns are submitted on-line following the end of each (calendar) two monthly period and payment is made by the 23 of the relevant month. ignore taxation other than VAT. A loan of 69,000,000 was taken out with Irish Bank plc on 1 Apr 2015 and is repayable in full on 1 Apr 2025. The interest rate on the loan is 10% per annum, payable quarterly on 1 January, 1 April, 14 July and 1 Oct each year. All Cloud 9's sales and purchases are on 30-day credit terms. All other expenses are paid immediately on receipt of invoice. Cloud 9 depreciates it's property, plant & equipment on a straight-line basis as follows: Buildings 40 years Machinery Delivery vans Fixtures & fittings 10 years once furniture & equipment 10 years The following appendices are included: Appendix 1: Trial balance extracted from Cloud 9's records @31st March 2021. Appendix 2: Details of Go Online's new manufacturing line and financial projections for the six months from 1 April 2021 to 30th September 2021 Appendix 3: Abridged financial statements for two previous years to 31** March 2020 and 2019 20 years 5 years Please note that whilst your report package is to include specified statements and reports, it is necessary to include all relevant data and conclusions into the financial assessment to ensure that the full economic impact is considered. Appendix 2 - Financial projections for six months ended on September 2021 Go Online Cloud 9 produce high quality, durable, branded sport shoes for athletes. This is an elite market reliant on hich profile sporting event endorsements and brandin. Having reviewed the success of companies such as Nilus, Go Online proposer to diversify into the general leisure wear market with Cloud 9's own version of light weight sport shoes for general leisure use. As this product line will not be elite sport shoes. It will be less expensive to product but as it is important not to compromise Cloud quality reputation. It will still be more expensive to produce than competitor products Direct costs per unit are forecast a Per unit Material ex3 per meter (ind of VAT 23%) 2meters Labour 15 per hour 7 hours Casttype Go Online will aim its product at the quality end of the leisure market and the expected selling price of 250 (exclusive of VAT) per unit will reflect this 307.50 inclusive of VAT As it also envisages that the product line expanding in the future Go Online has provisionally signed up two well-known online influencers to promote the product and enhance its marketability for the next six months. These influencers will each be paid 25.000 VAT 23% per month for the promotion campaign Other cost projections to be considered are: Fixed costs April May Admin/sales salaries 1.750,000 1,750,000 Light & heat 510,750 510,750 Selling expenses 1.168,500 1.168,500 Advertising 135,300 135,300 Maintenance/repairs 492,000 492,000 Motor expenses 650,375 650,375 215,250 215,250 Depreciation (per depreciation policy) Loan interest (per loan agreement) June 1.750,000 510,750 1.168,500 135,300 492,000 650,375 215,250 July 1.750,000 510,750 1,168,500 135,300 492,000 650,375 215.250 Aug 1.750,000 S10,750 1.168,500 135 300 192,000 650,375 215.250 Sept Total 1,750,000 10,500,000 510,750 3,064,500 1.168,500 7,011,000 135,300 811,800 492,000 2,952,000 650,375 3,902,250 215,250 1,291,500 Office expenses Note: The following cost projections have been stated inclusive of VAT as follows: VAT v 23% VAT 185% Selling expenses Light & heat Advertising Petrol Maintenance & repairs Motor expenses (note: 1,872,750 relates to petrol costs) Office expenses In order for this line to be considered successful it must produce a profit of 12,000,000 by the end of September 2021. No other product will be produced or sold during this period. Calculate Sales using this target profit The sales volume required to meet the profit tart will be achieved incrementally as follows: Month Apr 109 May 10 Jun 10% Jul 109 Aug 20% Sept 40% (For example Apr sales will be 10% of sales) Expected sales mix per month is expected to be 70% directly to the puble via on-line cash sales in Goud 9's existing on-line store and 30% credit sales on 30 day credit to retail cutlets. It is expected that 50% of credit sales receipts will be received in the month following the sale with the remaining 50% received the following month triventory on hand @ 31st March 2021 cannot be used in the new product line. Material for the new production line will be bought in at the start of each month in the required amount to meet that month's sales. No inventory of material will be held. All material will be purchased on 30 day credit and paid for in the month following purchase All operating expenses will be paid in the month incurred. Endorsement fees will accrue over the six months and be paid 50% payable June and the remainder in September No new investment in machinery or equipment is required for the next 6 months . You have ascertained the following information to assist with your assessment Cloud 9 is registered for VAT and charges 23% VAT on its sales. VAT returns are submitted on-line following the end of each (calendar) two monthly period and payment is made by the 23 of the relevant month. ignore taxation other than VAT. A loan of 69,000,000 was taken out with Irish Bank plc on 1 Apr 2015 and is repayable in full on 1 Apr 2025. The interest rate on the loan is 10% per annum, payable quarterly on 1 January, 1 April, 14 July and 1 Oct each year. All Cloud 9's sales and purchases are on 30-day credit terms. All other expenses are paid immediately on receipt of invoice. Cloud 9 depreciates it's property, plant & equipment on a straight-line basis as follows: Buildings 40 years Machinery Delivery vans Fixtures & fittings 10 years once furniture & equipment 10 years The following appendices are included: Appendix 1: Trial balance extracted from Cloud 9's records @31st March 2021. Appendix 2: Details of Go Online's new manufacturing line and financial projections for the six months from 1 April 2021 to 30th September 2021 Appendix 3: Abridged financial statements for two previous years to 31** March 2020 and 2019 20 years 5 years Please note that whilst your report package is to include specified statements and reports, it is necessary to include all relevant data and conclusions into the financial assessment to ensure that the full economic impact is considered. Appendix 2 - Financial projections for six months ended on September 2021 Go Online Cloud 9 produce high quality, durable, branded sport shoes for athletes. This is an elite market reliant on hich profile sporting event endorsements and brandin. Having reviewed the success of companies such as Nilus, Go Online proposer to diversify into the general leisure wear market with Cloud 9's own version of light weight sport shoes for general leisure use. As this product line will not be elite sport shoes. It will be less expensive to product but as it is important not to compromise Cloud quality reputation. It will still be more expensive to produce than competitor products Direct costs per unit are forecast a Per unit Material ex3 per meter (ind of VAT 23%) 2meters Labour 15 per hour 7 hours Casttype Go Online will aim its product at the quality end of the leisure market and the expected selling price of 250 (exclusive of VAT) per unit will reflect this 307.50 inclusive of VAT As it also envisages that the product line expanding in the future Go Online has provisionally signed up two well-known online influencers to promote the product and enhance its marketability for the next six months. These influencers will each be paid 25.000 VAT 23% per month for the promotion campaign Other cost projections to be considered are: Fixed costs April May Admin/sales salaries 1.750,000 1,750,000 Light & heat 510,750 510,750 Selling expenses 1.168,500 1.168,500 Advertising 135,300 135,300 Maintenance/repairs 492,000 492,000 Motor expenses 650,375 650,375 215,250 215,250 Depreciation (per depreciation policy) Loan interest (per loan agreement) June 1.750,000 510,750 1.168,500 135,300 492,000 650,375 215,250 July 1.750,000 510,750 1,168,500 135,300 492,000 650,375 215.250 Aug 1.750,000 S10,750 1.168,500 135 300 192,000 650,375 215.250 Sept Total 1,750,000 10,500,000 510,750 3,064,500 1.168,500 7,011,000 135,300 811,800 492,000 2,952,000 650,375 3,902,250 215,250 1,291,500 Office expenses Note: The following cost projections have been stated inclusive of VAT as follows: VAT v 23% VAT 185% Selling expenses Light & heat Advertising Petrol Maintenance & repairs Motor expenses (note: 1,872,750 relates to petrol costs) Office expenses In order for this line to be considered successful it must produce a profit of 12,000,000 by the end of September 2021. No other product will be produced or sold during this period. Calculate Sales using this target profit The sales volume required to meet the profit tart will be achieved incrementally as follows: Month Apr 109 May 10 Jun 10% Jul 109 Aug 20% Sept 40% (For example Apr sales will be 10% of sales) Expected sales mix per month is expected to be 70% directly to the puble via on-line cash sales in Goud 9's existing on-line store and 30% credit sales on 30 day credit to retail cutlets. It is expected that 50% of credit sales receipts will be received in the month following the sale with the remaining 50% received the following month triventory on hand @ 31st March 2021 cannot be used in the new product line. Material for the new production line will be bought in at the start of each month in the required amount to meet that month's sales. No inventory of material will be held. All material will be purchased on 30 day credit and paid for in the month following purchase All operating expenses will be paid in the month incurred. Endorsement fees will accrue over the six months and be paid 50% payable June and the remainder in September No new investment in machinery or equipment is required for the next 6 months