Answered step by step

Verified Expert Solution

Question

1 Approved Answer

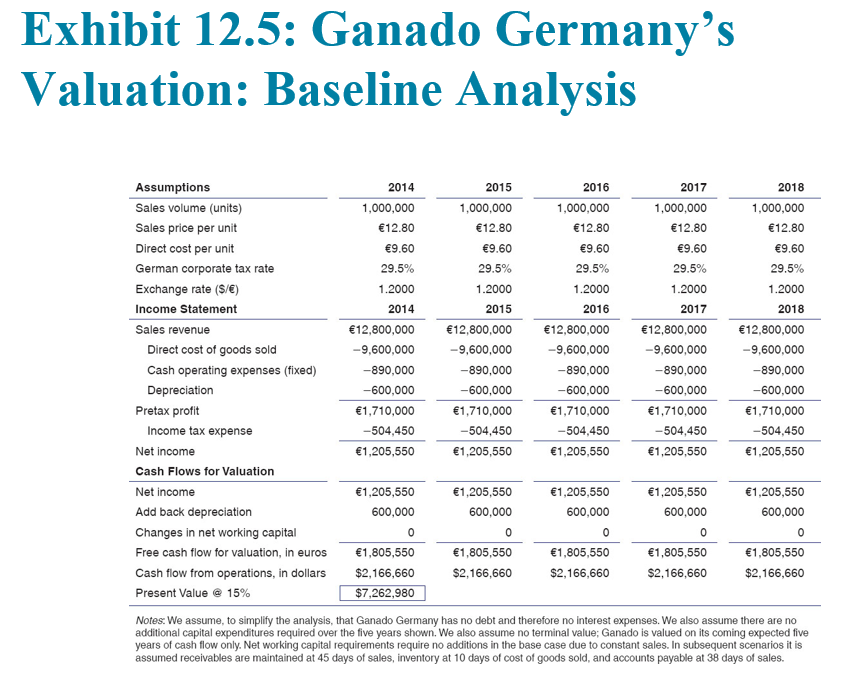

prepare a cashflow/income statment Exhibit 12.5: Ganado Germany's Valuation: Baseline Analysis Assumptions 2014 2015 2016 2017 2018 Sales volume (units) 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000

prepare a cashflow/income statment

Exhibit 12.5: Ganado Germany's Valuation: Baseline Analysis Assumptions 2014 2015 2016 2017 2018 Sales volume (units) 1,000,000 1,000,000 1,000,000 1,000,000 1,000,000 Sales price per unit 12.80 12.80 12.80 12.80 12.80 Direct cost per unit 9.60 9.60 9.60 9.60 9.60 German corporate tax rate 29.5% 29.5% 29.5% 29.5% 29.5% Exchange rate ($/) 1.2000 1.2000 1.2000 1.2000 1.2000 Income Statement 2014 2015 2016 2017 2018 Sales revenue 12,800,000 12,800,000 12,800,000 12,800,000 12,800,000 Direct cost of goods sold - 9,600,000 -9,600,000 -9,600,000 -9,600,000 -9,600,000 Cash operating expenses (fixed) -890,000 -890,000 -890,000 -890,000 -890,000 Depreciation -600,000 -600,000 -600,000 -600,000 -600,000 Pretax profit 1,710,000 1,710,000 1,710,000 1,710,000 1,710,000 Income tax expense -504,450 -504,450 -504,450 -504,450 -504,450 Net income 1,205,550 1,205,550 1,205,550 1,205,550 1,205,550 Cash Flows for Valuation Net income 1,205,550 1,205,550 1,205,550 1,205,550 1,205,550 Add back depreciation 600,000 600,000 600,000 600,000 600,000 Changes in net working capital 0 0 0 0 0 Free cash flow for valuation, in euros 1,805,550 1,805,550 1,805,550 1,805,550 1,805,550 Cash flow from operations, in dollars $2,166,660 $2,166,660 $2,166,660 $2,166,660 $2,166,660 Present Value @ 15% $7,262,980 Notes: We assume, to simplify the analysis, that Ganado Germany has no debt and therefore no interest expenses. We also assume there are no additional capital expenditures required over the five years shown. We also assume no terminal value; Ganado is valued on its coming expected five years of cash flow only. Net working capital requirements require no additions in the base case due to constant sales. In subsequent scenarios it is assumed receivables are maintained at 45 days of sales, inventory at 10 days of cost of goods sold, and accounts payable at 38 days of sales. Measuring Operating Exposure: Ganado Germany (4 of 7) Case 3: Sales Price Increases Other Variables Remain Constant Assume the euro sales price is raised from 12.80 to 15.36 per unit to maintain the same U.S. dollar-equivalent price and that all other variables remain constant Also assume that volume remains constant in spite of this price increase; that is, customers expect to pay the same dollar- equivalent price, and local costs do not change Ganado Germany is now better off following the depreciation than it was before because the sales price, which is pegged to the international price level, increased and volume did not dropNet income rises to 3,010,350 per year, with operating cash flow rising to 3,561,254 in 2014 and 3,610,350 per year in the following four years Ganado Germany has now increased in value to $12,059,761Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started