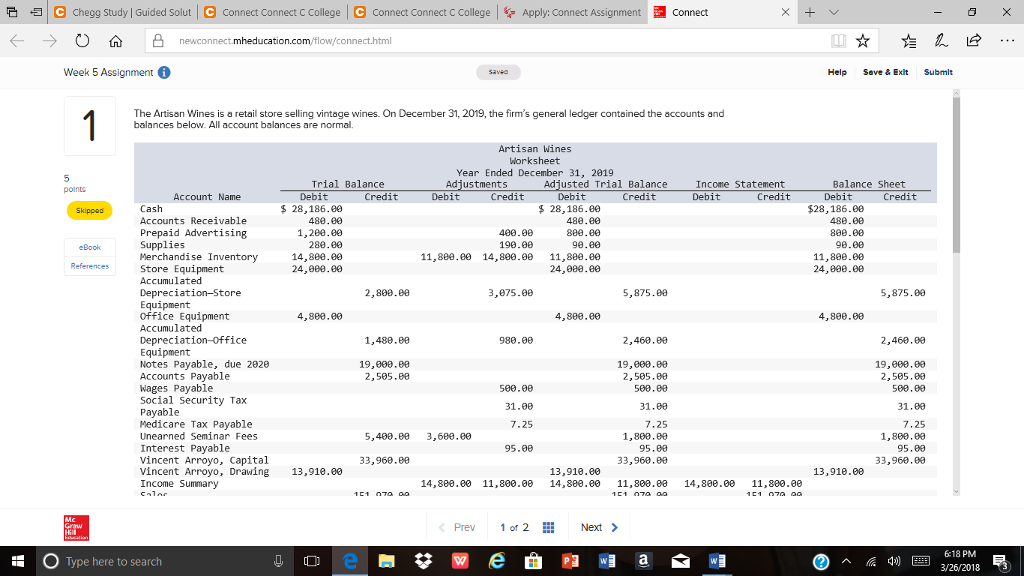

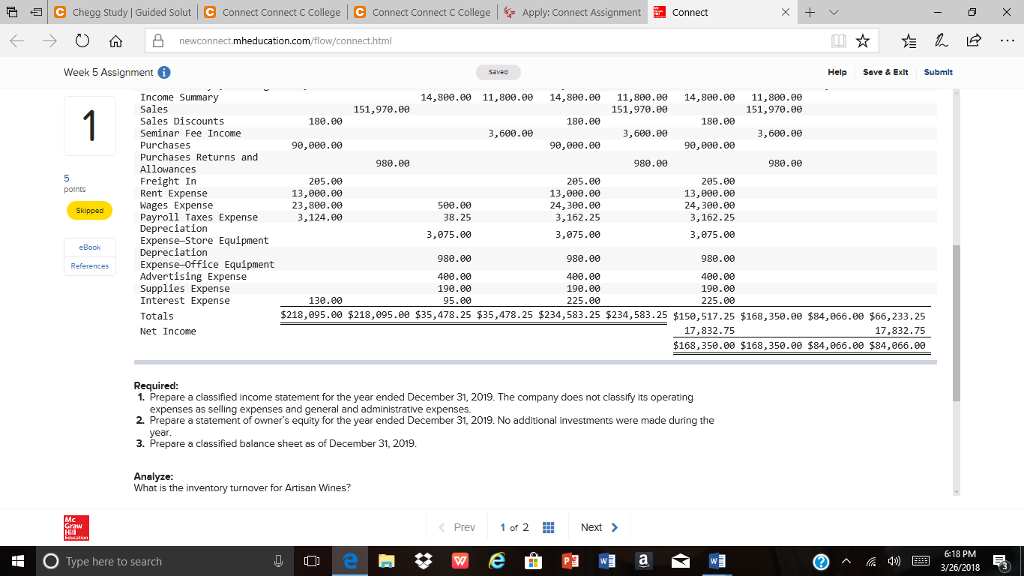

Prepare a classified income statement for the year ended December 31, 2019. The company does not classify its operating expenses as selling expenses and general and administrative expenses. (Round your answers to 2 decimal places.)

| | |

| | | ARTISAN WINES | | | | | Income Statement | | | | | | | | | | Operating revenue | | | | | | | | | | | | | | | | | | | | | | | | Net sales | | | | | | | | Cost of goods sold | | | | | | | | Merchandise inventory, January 1, 2019 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Delivered cost of purchases | $0.00 | | | | | | | | | | | | | | | Net delivered cost of purchases | | | | | | | | Goods available for sale | | 0.00 | | | | | | | | | | | | | | Cost of goods sold | | | | | | | | | | | $0.00 | | | | | Operating expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total operating expenses | | | 0.00 | | | | | Income from operations | | | $0.00 | | | | | Other income | | | | | | | | | | | | | | | | | | | 0.00 | | | | | Other expenses | | | | | | | | | | | | | | | | | | | 0.00 | | | | | Net nonoperating income | | | 0.00 | | | | | | | | $0.00 | | | | |

| | |

Prepare a statement of owners equity for the year ended December 31, 2019. No additional investments were made during the year. (Round your answers to 2 decimal places.)

| | |

| | | ARTISAN WINES | | | | Statement of Owner's Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | $0.00 | | | | | | $0.00 | | | |

Prepare a classified balance sheet as of December 31, 2019. (Round your answers to 2 decimal places.)

| | |

| | | ARTISAN WINES | | | | | Balance Sheet | | | | | | | | | | Assets | | | | | | | | Current assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total current assets | | | $0.00 | | | | | Plant and equipment: | | | | | | | | Store equipment | | | | | | | | | | | | | | | | Office equipment | | | | | | | | | | | | | | | | Total plant and equipment | | | 0.00 | | | | | Total assets | | | $0.00 | | | | | Liabilities and Owner's Equity | | | | | | | | Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Total current liabilities | | | $0.00 | | | | | Owner's equity: | | | | | | | | | | | | | | | | | | | | | | | | Total liabilities and owner's equity | | | $0.00 | | | | | | | | | | | | |

What is the inventory turnover for Artisan Wines? (Round your answer to 2 decimal places.)

? 5] e chegg study | Guided Solut l e Connect Connect C College l e Connect Connect C College l tr Apply: Connect Assignment Connect Help Save & Exit Submlt The Artisan Wines is a retail store selling vintage wines. On December 31, 2019, the firm's general ledger contained the accounts and balances below. All account balances are normal. Artisan Wines Worksheet Year Ended December 31, 2019 Trial Balance Debit Adjustments Adjusted Trial Balance Income Statement Debit Balance Sheet Debit Account Name Credit Credit Debit Credit Credit Credit $ 28,186.00 488.00 1,200.00 288.00 14,880.e0 24,800.e0 $28,186.00 488.00 898.08 98.08 11,808.60 24,00.e0 $ 28,186.00 Accounts Receivable Prepaid Advertising Supplies Mechandise Inventory Store Equipment Accumulated Depreciation-Store Equipment Office Equipment Accumulated Depreciation-Office Equipment Notes Payable, due 2826 Accounts Payable Wages Payable Social Security Tax Payable Medicare Tax Payable Unearned Seminar Fees Interest Payable vincent Arroyo, Capital Vincent Arroyo, Drawing Income Summary 80.8 98.8 190.8e 11,888.60 14,800. 11,880.8e 24,880.e0 2,808.00 3,675.00 5,875.84e 5,875.8e 4,880.00 4,889.80 4,800.60 1,430.0e 980.00 2,460.0e 2,460.8e 19,800.80 2, 505.ee 19,800.80 2, 505.e0 500.80 19,900.80 2, 505. e0 500.80 31.80 509 .0? 1,800.8e 95.80 33,960.80 1,860.e0 95.80 33,968.80 5,40e.e0 3,680.80 95.0e 33,960.80 13,910.80 13,918.e0 13,918.6e 14,880.e0 11,800.00 14,880.80 11,800.80 14,880.00 11,800.8e Prev 2 6 18 PM Type here to search