Answered step by step

Verified Expert Solution

Question

1 Approved Answer

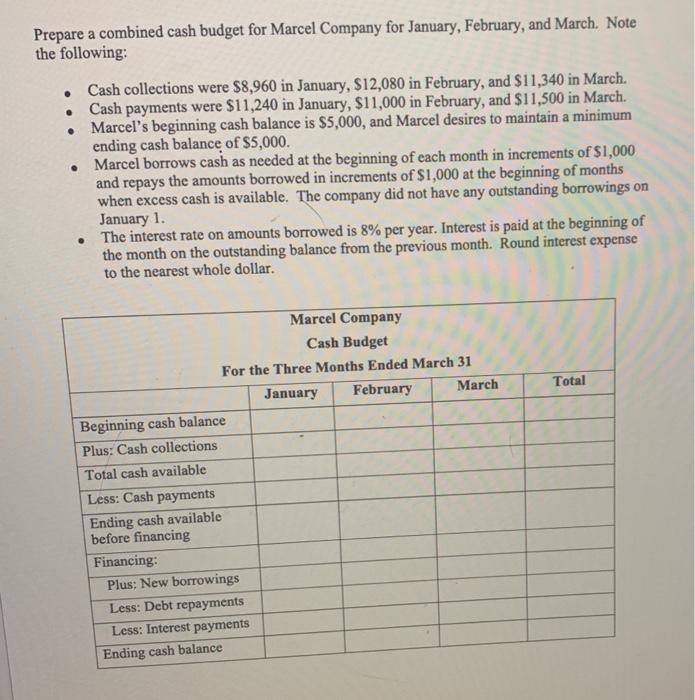

Prepare a combined cash budget for Marcel Company for January, February, and March. Note the following: . Cash collections were $8,960 in January, $12,080

Prepare a combined cash budget for Marcel Company for January, February, and March. Note the following: . Cash collections were $8,960 in January, $12,080 in February, and $11,340 in March. Cash payments were $11,240 in January, $11,000 in February, and $11,500 in March. Marcel's beginning cash balance is $5,000, and Marcel desires to maintain a minimum ending cash balance of $5,000. Marcel borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The company did not have any outstanding borrowings on January 1. The interest rate on amounts borrowed is 8% per year. Interest is paid at the beginning of the month on the outstanding balance from the previous month. Round interest expense to the nearest whole dollar. Marcel Company Cash Budget For the Three Months Ended March 31 January February Total Beginning cash balance Plus: Cash collections Total cash available Less: Cash payments Ending cash available before financing Financing: Plus: New borrowings Less: Debt repayments Less: Interest payments Ending cash balance March

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Borrowings need at the beginning of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started