Answered step by step

Verified Expert Solution

Question

1 Approved Answer

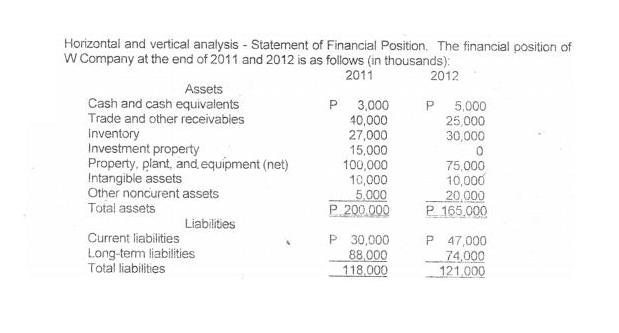

Horizontal and vertical analysis - Statement of Financial Position. The financial position of W Company at the end of 2011 and 2012 is as

Horizontal and vertical analysis - Statement of Financial Position. The financial position of W Company at the end of 2011 and 2012 is as follows (in thousands): 2011 2012 Assets Cash and cash equivalents Trade and other receivables Inventory Investment property Property, plant, and equipment (net) Intangible assets Other noncurent assets Total assets Liabilities Current liabilities Long-term liabilities Total liabilities P 3,000 P 5,000 40,000 25,000 27,000 30,000 15,000 0 100,000 10,000 5,000 P 200.000 P 30,000 88,000 118,000 75,000 10,000 20,000 P. 165,000 P 47,000 74,000 121,000 Prepare a comparative statement of financial position showing peso and percentage changes for 2012 as compared with 2011. b. Prepare a ordinary-size statement of financial position as of December 31, 2011 and 2012 Based on your data derived in requirements 1 and 2, comment on the financial position of W Company as of December 31, 2012. C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Comparative Statement of Financial Position 2012 vs 2011 Change in Cash and Equivalents 2012 Cash and Equivalents 2011 Cash and Equivalents P5000 P3000 P2000 Percentage Change Change 2011 Cash and E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started