Question

Prepare a consolidated income statement and balance sheet for the fiscal year ending December 31, 2021. You will need to recreate the equity method journal

Prepare a consolidated income statement and balance sheet for the fiscal year ending December 31, 2021. You will need to recreate the equity method journal entries for Paper Company for the year and use a consolidation worksheet to complete this task.

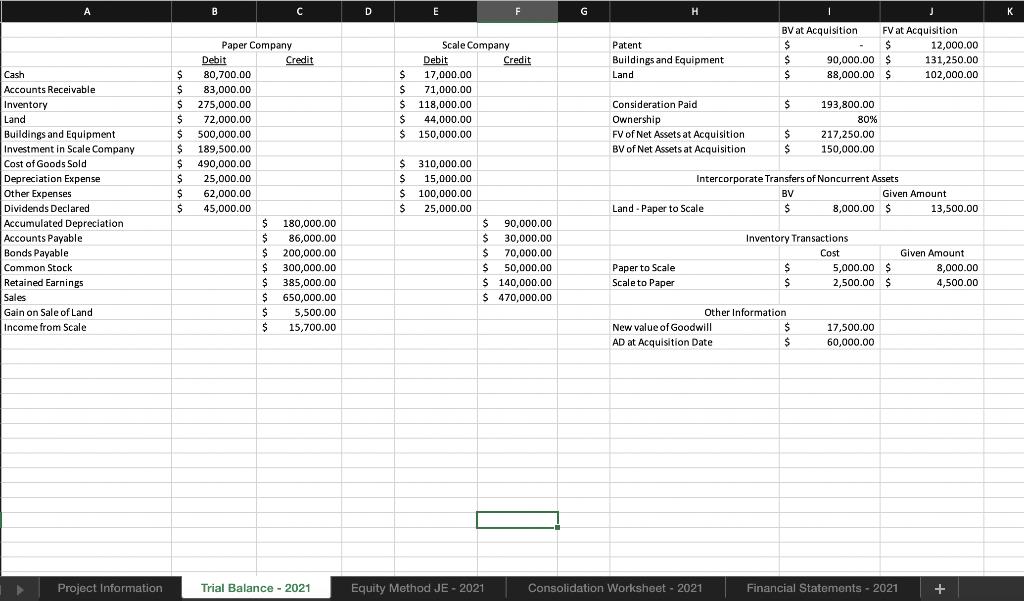

Use the relevant tabs in the assignment spreadsheet. Information (also provided without description in the Trial Balance – 2021 tab): In 2020 Paper Company acquired 80% of the common stock of Scale Company for $193,800 in cash. The FV of the net assets was determined to be $217,250. This included an unrecorded patent worth $12,000, undervaluation of buildings and equipment of $41,250, and undervalued land of $14,000. Any remaining differential was determined to be due to goodwill. Scale Company reported common stock of $100,000 and retained earnings of $50,000 at the time of acquisition. Scale Company had Accumulated Depreciation at the time of $60,000 on its buildings and equipment. In 2021 Paper Company's accounting staff determined that the value of the goodwill related to the acquisition was impaired and Goodwill was now best valued at $17,500. In 2021 Scale Company sold inventory to Paper Company for $4,500 and had an original cost of $2,500. Paper Company sold inventory to Scale Company for $8,000 when it had an original cost of $5,000. Neither Paper nor Scale Company had sold the inventory to a third party by the end of December 31, 2021. Paper Company sold land to Scale Company originally costing $8,000 for $13,500.

Presume Paper Company uses the full equity method to account for the activities of Scale Company.

1. Please use the information in the following tabs to complete the project. You will need to create consolidated income statements and balance sheets and consolidation worksheets for 2021. Assume the Paper Company uses the Full Equity Method.

2. Do not simply type in numbers into the consolidation worksheets and financial statements. Instead, use formulas, cell references, and etc.

3. I will expect to see your final financial statements change if I change something in any of the relevant statements. I also expect to see the statements articulate from year to year and in each period.

A Cash Accounts Receivable Inventory Land Buildings and Equipment Investment in Scale Company Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Gain on Sale of Land Income from Scale Project Information B Paper Company Debit $ 80,700.00 83,000.00 $ $ 275,000.00 $ 72,000.00 $ $ $ $ 500,000.00 $ 189,500.00 $ 490,000.00 25,000.00 62,000.00 45,000.00 $ $ Credit $ 180,000.00 $ 86,000.00 $ 200,000.00 $ 300,000.00 $ 385,000.00 650,000.00 5,500.00 $ 15,700.00 Trial Balance - 2021 D $ $ $ $ $ $ $ E Scale Company Debit 17,000.00 71,000.00 118,000.00 44,000.00 150,000.00 310,000.00 15,000.00 100,000.00 $ $ 25,000.00 F Equity Method JE - 2021 Credit $ 90,000.00 $ $ 30,000.00 70,000.00 50,000.00 140,000.00 $ $ $ 470,000.00 G H Patent Buildings and Equipment Land Consideration Paid Ownership FV of Net Assets at Acquisition BV of Net Assets at Acquisition. Paper to Scale Scale to Paper Land - Paper to Scale BV at Acquisition FV at Acquisition $ $ $ $ 90,000.00 $ 88,000.00 $ $ $ $ Intercorporate Transfers of Noncurrent Assets BV $ New value of Goodwill AD at Acquisition Date Consolidation Worksheet - 2021 $ $ Other Information 193,800.00. 80% Inventory Transactions. Cost $ 217,250.00 150,000.00 $ 8,000.00 $ Given Amount 5,000.00 $ 2,500.00 $ 17,500.00 60,000.00 12,000.00 131,250.00 102,000.00 Financial Statements - 2021 13,500.00 Given Amount 8,000.00 4,500.00 + K

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Paper Company Income Statement For the Year Ended December 31 2021 Revenues Paper Company sales to S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started