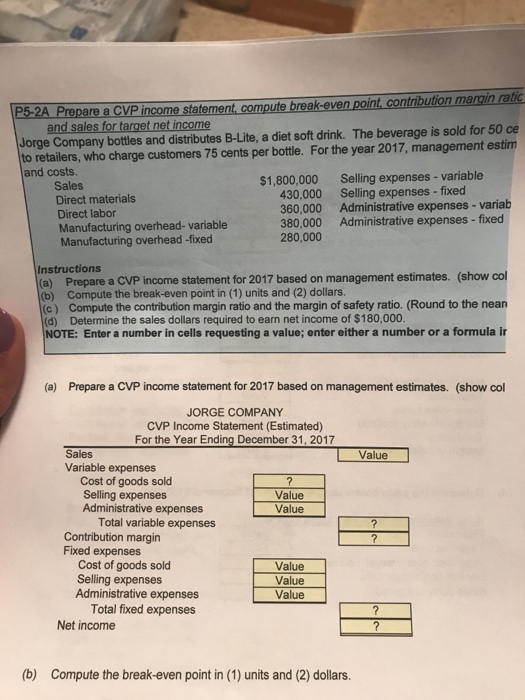

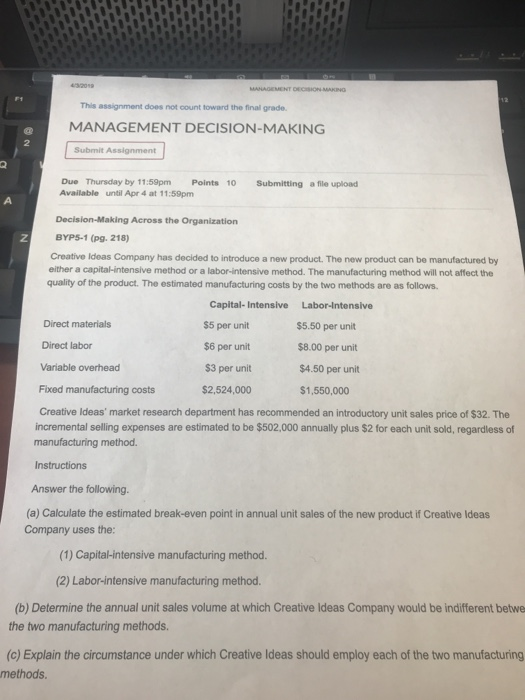

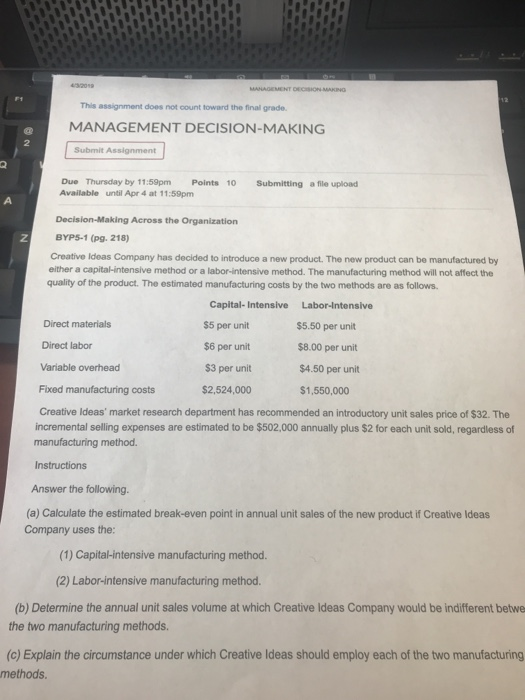

Prepare a CVP income statement, compute break-even point, contribution margin ratic Jorge Company botles and distributes B-Lite, a diet soft drink. The beverage is sold for 50 ce to retailers, who charge customers 75 cents per bottle. For the year 2017, management estim and costs. and sales for target net income $1,800,000 Selling expenses- variable Sales Direct materials Direct labor Manufacturing overhead-variable Manufacturing overhead -fixed 430,000 Selling expenses-fixed 360,000 Administrative expenses-variab 380,000 Administrative expenses-fixed 280,000 Instructions Prepare a CVP income statement for 2017 based on management estimates. (show col (a) (b) Compute the break-even point in (1) units and (2) dollars. c) Compute the contribution margin ratio and the margin of safety ratio. (Round to the nean (d) Determine the sales dollars required to earn net income of $180,000 NOTE: Enter a number in cells requesting a value; enter either a number or a formula i (a) Prepare a CVP income statement for 2017 based on management estimates. (show col JORGE COMPANY CVP Income Statement (Estimated) Sales Variable expenses Value Cost of goods sold Selling expenses Administrative expenses Value Value Total variable expenses Contribution margin Fixed expenses Cost of goods sold Selling expenses Administrative expenses Value Value Value Total fixed expenses Net income (b) Compute the break-even point in (1) units and (2) dollars. This assignment does not count toward the final grade MANAGEMENT DECISION-MAKING 2 2 Due Thursday by 11:59pm Points 10 Submitting a file upload Available until Apr 4 at 11:59pm Decision-Making Across the Organization BYPS-1 (pg. 218) Creative Ideas Company has decided to introduce a new product. The new product can be manufactured by either a capital-intensive method or a labor-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows Capital- Intensive $5 per unit $6 per unit $3 per unit $2,524,000 Labor-Intensive $5.50 per unit $8.00 per unit $4.50 per unit $1,550,000 Direct materials Direct labor Variable overhead Fixed manufacturing costs Creative Ideas' market research department has recommended an introductory unit sales price of $32. The incremental selling expenses are estimated to be $502,000 annually plus $2 for each unit sold, regardless of manufacturing method. Instructions Answer the following. (a) Calculate the estimated break-even point in annual unit sales of the new product if Creative Ideas Company uses the: (1) Capital-intensive manufacturing method. (2) Labor-intensive manufacturing method. (b) Determine the annual unit sales volume at which Creative Ideas Company would be indifferent betwe the two manufacturing methods (c) Explain the circumstance under which Creative Ideas should employ each of the two manufacturing methods