Answered step by step

Verified Expert Solution

Question

1 Approved Answer

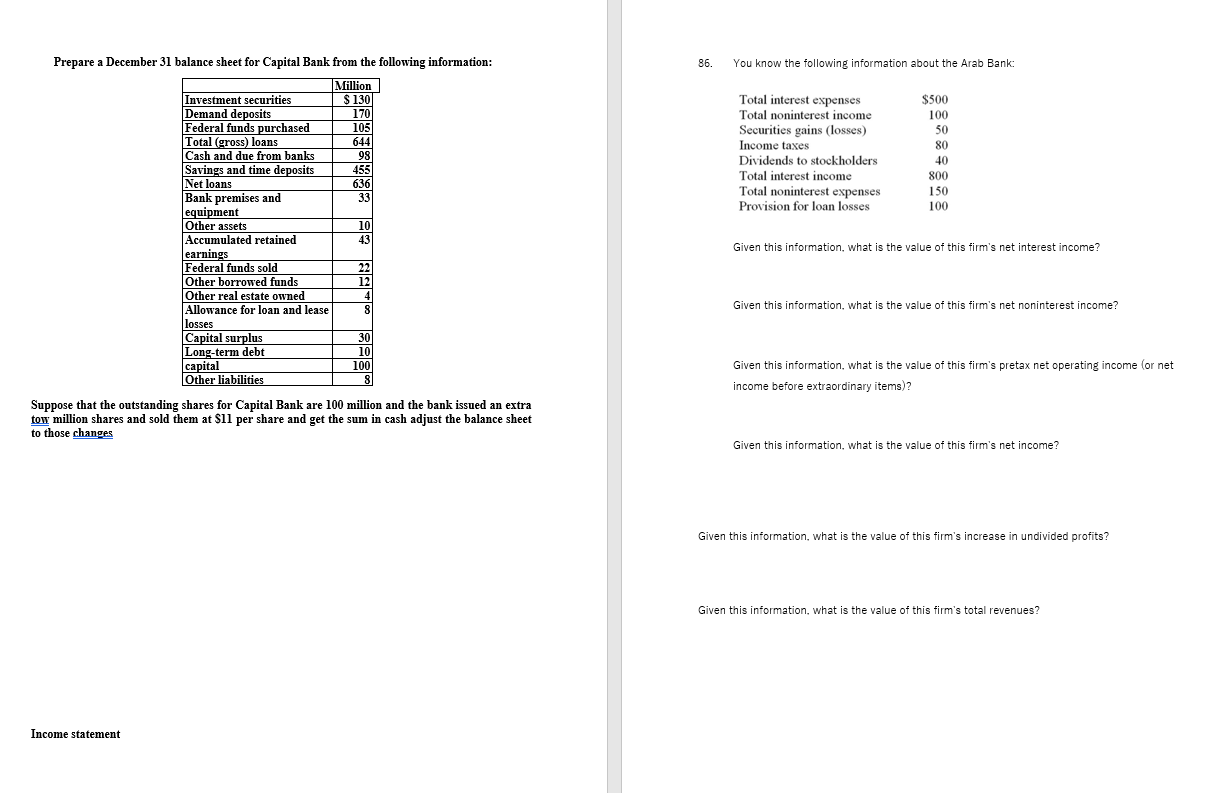

Prepare a December 31 balance sheet for Capital Bank from the following information: 86. You know the following information about the Arab Bank: Million

Prepare a December 31 balance sheet for Capital Bank from the following information: 86. You know the following information about the Arab Bank: Million Investment securities $ 130 Demand deposits 170 Federal funds purchased 105 Total (gross) loans 644 Cash and due from banks 98 Savings and time deposits 455 Net loans 636 Bank premises and 33 equipment Other assets 10 Accumulated retained 43 earnings Federal funds sold 22 Other borrowed funds 12 Other real estate owned 4 Allowance for loan and lease losses 8 Capital surplus 30 Long-term debt 10 capital Other liabilities 100 8 Total interest expenses $500 Total noninterest income 100 Securities gains (losses) 50 Income taxes 80 Dividends to stockholders 40 Total interest income 800 Total noninterest expenses 150 Provision for loan losses 100 Given this information, what is the value of this firm's net interest income? Given this information, what is the value of this firm's net noninterest income? Suppose that the outstanding shares for Capital Bank are 100 million and the bank issued an extra tow million shares and sold them at $11 per share and get the sum in cash adjust the balance sheet to those changes Given this information, what is the value of this firm's pretax net operating income (or net income before extraordinary items)? Given this information, what is the value of this firm's net income? Income statement Given this information, what is the value of this firm's increase in undivided profits? Given this information, what is the value of this firm's total revenues?

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To adjust the balance sheet for the additional four million shares of Capital Bank that were issued ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started