MZE Manufacturing Company has a normal plant capacity of 37,500 units per month. Because of an extra-large quantity of inventory on hand, it expects

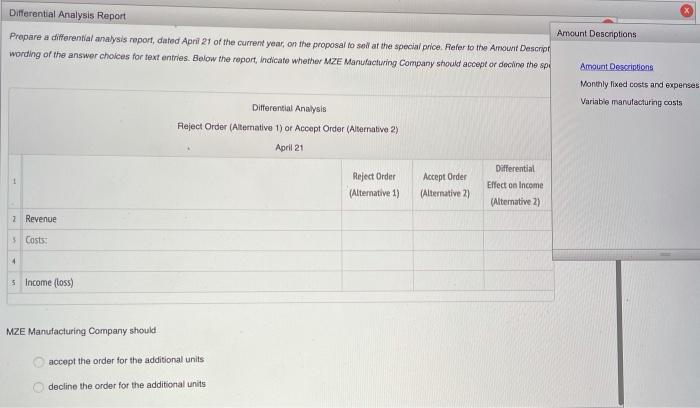

MZE Manufacturing Company has a normal plant capacity of 37,500 units per month. Because of an extra-large quantity of inventory on hand, it expects to produce only 30,000 units in May. Monthly fixed costs and expenses are $112,500 ($3 per unit at normal plant capacity) and variable costs and expenses are $8.25 per unt. The present seling price is $13.50 per unit. The company has an opportunity to sell 7,.500 additional units at $0.90 per unit to an exporter who plans to market the product under its own brand name in a foreign market. The additional business is therefore not expected to affect the reguiar seling price or quantity of sales of MZE Manutacturing Company Required: Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sell at the special price. Refer to the Amount Descriptions for the exact wording of the answer choices for text enitries. Below the report, indicate whether MZE Manutactuning Company should accept or decine the special order. Differential Analysis Report Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sel at the special price. Refer to the AIOunt Descript Amount Descriptions wording of the answer choices for text entries. Below the report, indicate whether MZE Manufacturing Company should accept or decline the spi Amount Descriptions Monthly fixed costs and expenses Variable manufacturing costs Diferential Analysis Reject Order (Alternative 1) or Accept Order (Alternative 2) April 21 Differential Reject Order Accept Order Effect on Income (Alternative 1) (Alternative 2) (Alternative 2) 2 Revenue 3 Costs: 5 Income (loss) MZE Manufacturing Company should accept the order for the additional units decline the order for the additional units MZE Manufacturing Company has a normal plant capacity of 37,500 units per month. Because of an extra-large quantity of inventory on hand, it expects to produce only 30,000 units in May. Monthly fixed costs and expenses are $112,500 ($3 per unit at normal plant capacity) and variable costs and expenses are $8.25 per unt. The present seling price is $13.50 per unit. The company has an opportunity to sell 7,.500 additional units at $0.90 per unit to an exporter who plans to market the product under its own brand name in a foreign market. The additional business is therefore not expected to affect the reguiar seling price or quantity of sales of MZE Manutacturing Company Required: Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sell at the special price. Refer to the Amount Descriptions for the exact wording of the answer choices for text enitries. Below the report, indicate whether MZE Manutactuning Company should accept or decine the special order. Differential Analysis Report Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sel at the special price. Refer to the AIOunt Descript Amount Descriptions wording of the answer choices for text entries. Below the report, indicate whether MZE Manufacturing Company should accept or decline the spi Amount Descriptions Monthly fixed costs and expenses Variable manufacturing costs Diferential Analysis Reject Order (Alternative 1) or Accept Order (Alternative 2) April 21 Differential Reject Order Accept Order Effect on Income (Alternative 1) (Alternative 2) (Alternative 2) 2 Revenue 3 Costs: 5 Income (loss) MZE Manufacturing Company should accept the order for the additional units decline the order for the additional units MZE Manufacturing Company has a normal plant capacity of 37,500 units per month. Because of an extra-large quantity of inventory on hand, it expects to produce only 30,000 units in May. Monthly fixed costs and expenses are $112,500 ($3 per unit at normal plant capacity) and variable costs and expenses are $8.25 per unt. The present seling price is $13.50 per unit. The company has an opportunity to sell 7,.500 additional units at $0.90 per unit to an exporter who plans to market the product under its own brand name in a foreign market. The additional business is therefore not expected to affect the reguiar seling price or quantity of sales of MZE Manutacturing Company Required: Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sell at the special price. Refer to the Amount Descriptions for the exact wording of the answer choices for text enitries. Below the report, indicate whether MZE Manutactuning Company should accept or decine the special order. Differential Analysis Report Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sel at the special price. Refer to the AIOunt Descript Amount Descriptions wording of the answer choices for text entries. Below the report, indicate whether MZE Manufacturing Company should accept or decline the spi Amount Descriptions Monthly fixed costs and expenses Variable manufacturing costs Diferential Analysis Reject Order (Alternative 1) or Accept Order (Alternative 2) April 21 Differential Reject Order Accept Order Effect on Income (Alternative 1) (Alternative 2) (Alternative 2) 2 Revenue 3 Costs: 5 Income (loss) MZE Manufacturing Company should accept the order for the additional units decline the order for the additional units

Step by Step Solution

3.33 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The fixed cost is sunk cost since it will have to be incurred w...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started