Answered step by step

Verified Expert Solution

Question

1 Approved Answer

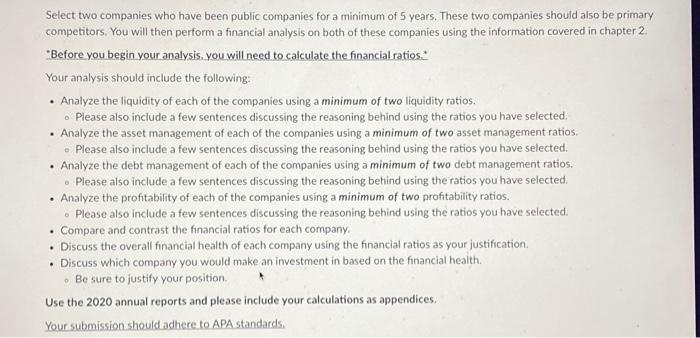

Select two companies who have been public companies for a minimum of 5 years. These two companies should also be primary competitors. You will

Select two companies who have been public companies for a minimum of 5 years. These two companies should also be primary competitors. You will then perform a financial analysis on both of these companies using the information covered in chapter 2. "Before you begin your analysis, you will need to calculate the financial ratios. Your analysis should include the following: Analyze the liquidity of each of the companies using a minimum of two liquidity ratios. Please also include a few sentences discussing the reasoning behind using the ratios you have selected. Analyze the asset management of each of the companies using a minimum of two asset management ratios. . Please also include a few sentences discussing the reasoning behind using the ratios you have selected. . Analyze the debt management of each of the companies using a minimum of two debt management ratios. . Please also include a few sentences discussing the reasoning behind using the ratios you have selected. Analyze the profitability of each of the companies using a minimum of two profitability ratios. . Please also include a few sentences discussing the reasoning behind using the ratios you have selected. Compare and contrast the financial ratios for each company. Discuss the overall financial health of each company using the financial ratios as your justification. Discuss which company you would make an investment in based on the financial health.. Be sure to justify your position. Use the 2020 annual reports and please include your calculations as appendices. Your submission should adhere to APA standards.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

We will be foraying into the FMCG Personal care segment of the Indian National Stock Exchange NSE Th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635de113399b0_179641.pdf

180 KBs PDF File

635de113399b0_179641.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started