Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a financial analysis of this company and comment on its status and performance. ACCT 335 Show all of your work. Assets Quiz #3

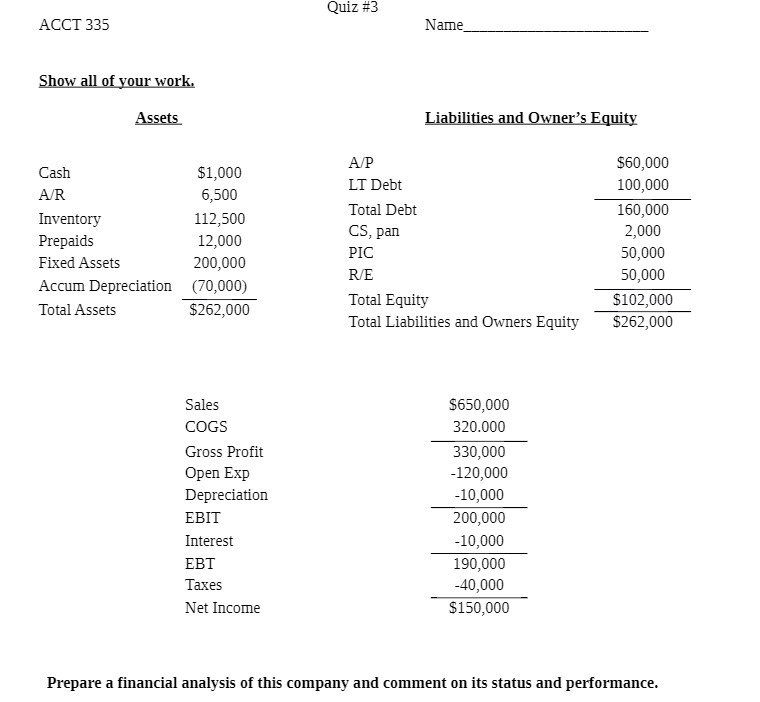

Prepare a financial analysis of this company and comment on its status and performance. ACCT 335 Show all of your work. Assets Quiz #3 Name Liabilities and Owner's Equity A/P $60,000 Cash A/R $1,000 6,500 LT Debt 100,000 Total Debt 160,000 Inventory 112,500 CS, pan 2,000 Prepaids 12,000 PIC 50,000 Fixed Assets 200,000 R/E 50,000 Accum Depreciation (70,000) Total Equity $102,000 Total Assets $262,000 Total Liabilities and Owners Equity $262,000 Sales COGS $650,000 320.000 Gross Profit Open Exp 330,000 -120,000 Depreciation -10,000 EBIT 200,000 Interest -10,000 EBT 190,000 Taxes -40,000 Net Income $150,000 Prepare a financial analysis of this company and comment on its status and performance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To conduct a financial analysis of the company we will calculate several key financial ratios to assess its liquidity profitability solvency and effic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started