Question

Prepare a flexible budget using estimated annual unit sales = 3,100. Enter volume in the Budget and Variance Analysis tab, column H, row 4. Enter

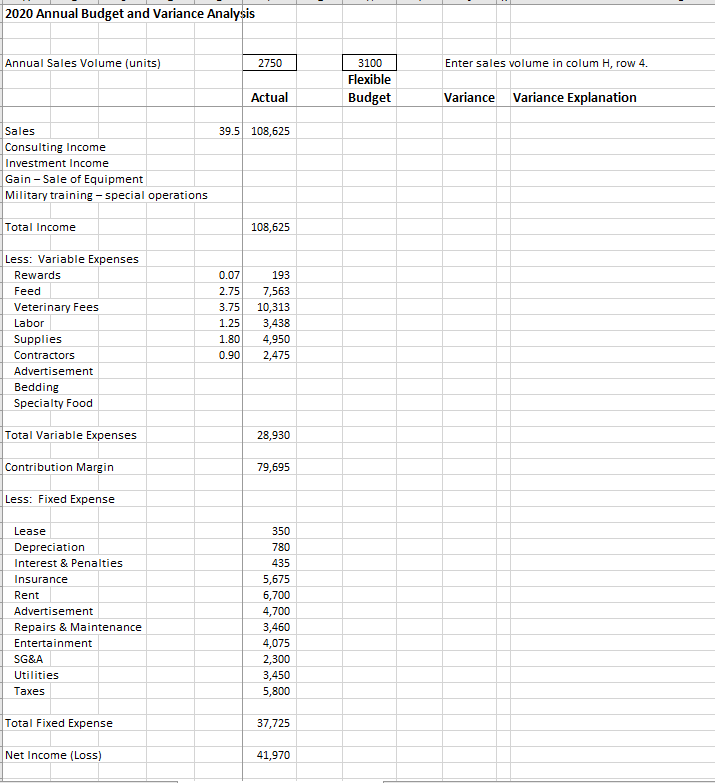

Prepare a flexible budget using estimated annual unit sales = 3,100. Enter volume in the Budget and Variance Analysis tab, column H, row 4. Enter all other data and calculations in the appropriate cells (column H). The company adopted the accrual method of accounting in 2017. Increase the average animal fee by 2.75% for the first five months and 3.50% for the remaining seven months of the year. The owner is working with regional competitors on COVID-19 planning and small business loan approvals. Estimated fees for the company is estimated to be 50 clients at an average fee equal to $750 each. Excess cash was invested in an S&P 500 Index fund with estimated annual capital gain and dividend income equal to $13,000. The company sold grooming equipment for a $500 dollar gain. However, the equipment is not expected to be delivered to the buyer nor will the owner receive payment. The company is diversifying into animal training and recorded unearned income in 2018 equal to $250,000 for cash advances from the U.S. government. The company expects to train several animals for special operation forces in 2020. Earned income is expected to be $25,000. Increase the variable cost per unit (animal) by 3.15%. This applies to all variable cost categories (excluding advertising, bedding, and specialty food). The driver for bedding and specialty food is the number of non-traditional animals. The company expect 275 animals per year at an average cost of $1.35 per animal for bedding and $1.09 per animal for specialty food. The company plans to relocate the business. This may increase rent by $1000. The company uses a dated advertising program including the yellow pages and billboard signs. The company plans to reduce costs and increase effectiveness by investing in an online campaign. The cost structure changes to a mixed cost and includes $900 fixed plus variable costs. The variable cost is equal to .02 per online view plus $3.00 for appointments scheduled online. The company expects 1,250 views and 185 scheduled appointments. Use the skills you learned from the week five project. Compute the break even point in units and dollars. Compute the margin of safety. Enter the information in the Budget and Variance Analysis tab, rows 50-56. Use formulas to compute variances and explain why the variances are positive or negative. Enter formulas in the Budget and Variance Analysis tab column J. Write your explanations in column L.

2020 Annual Budget and Variance Analysis Annual Sales Volume (units) 2750 Enter sales volume in colum H, row 4. 3100 Flexible Budget Actual Variance Variance Explanation 39.5 108,625 Sales Consulting Income Investment Income Gain-Sale of Equipment Military training - special operations Total Income 108,625 Less: Variable Expenses Rewards Feed Veterinary Fees Labor Supplies Contractors Advertisement Bedding Specialty Food 0.07 2.75 3.75 1.25 1.80 0.90 193 7,563 10,313 3,438 4,950 2,475 Total Variable Expenses 28,930 Contribution Margin 79,695 Less: Fixed Expense Lease Depreciation Interest & Penalties Insurance Rent Advertisement Repairs & Maintenance Entertainment SG&A Utilities Taxes 350 780 435 5,675 6,700 4,700 3,460 4,075 2,300 3,450 5,800 Total Fixed Expense 37,725 Net Income (Loss) 41,970 Total Fixed Expense 37,725 Net Income (Loss) 41,970 Break Even (Units) Break Even (Dollars) Margin of Safety (Dollars) 2020 Annual Budget and Variance Analysis Annual Sales Volume (units) 2750 Enter sales volume in colum H, row 4. 3100 Flexible Budget Actual Variance Variance Explanation 39.5 108,625 Sales Consulting Income Investment Income Gain-Sale of Equipment Military training - special operations Total Income 108,625 Less: Variable Expenses Rewards Feed Veterinary Fees Labor Supplies Contractors Advertisement Bedding Specialty Food 0.07 2.75 3.75 1.25 1.80 0.90 193 7,563 10,313 3,438 4,950 2,475 Total Variable Expenses 28,930 Contribution Margin 79,695 Less: Fixed Expense Lease Depreciation Interest & Penalties Insurance Rent Advertisement Repairs & Maintenance Entertainment SG&A Utilities Taxes 350 780 435 5,675 6,700 4,700 3,460 4,075 2,300 3,450 5,800 Total Fixed Expense 37,725 Net Income (Loss) 41,970 Total Fixed Expense 37,725 Net Income (Loss) 41,970 Break Even (Units) Break Even (Dollars) Margin of Safety (Dollars)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started