Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a flowchart for MACRS depreciation/cost recovery of fixed assets. You may limit your flowchart to tangible personal property falling into the 5 and

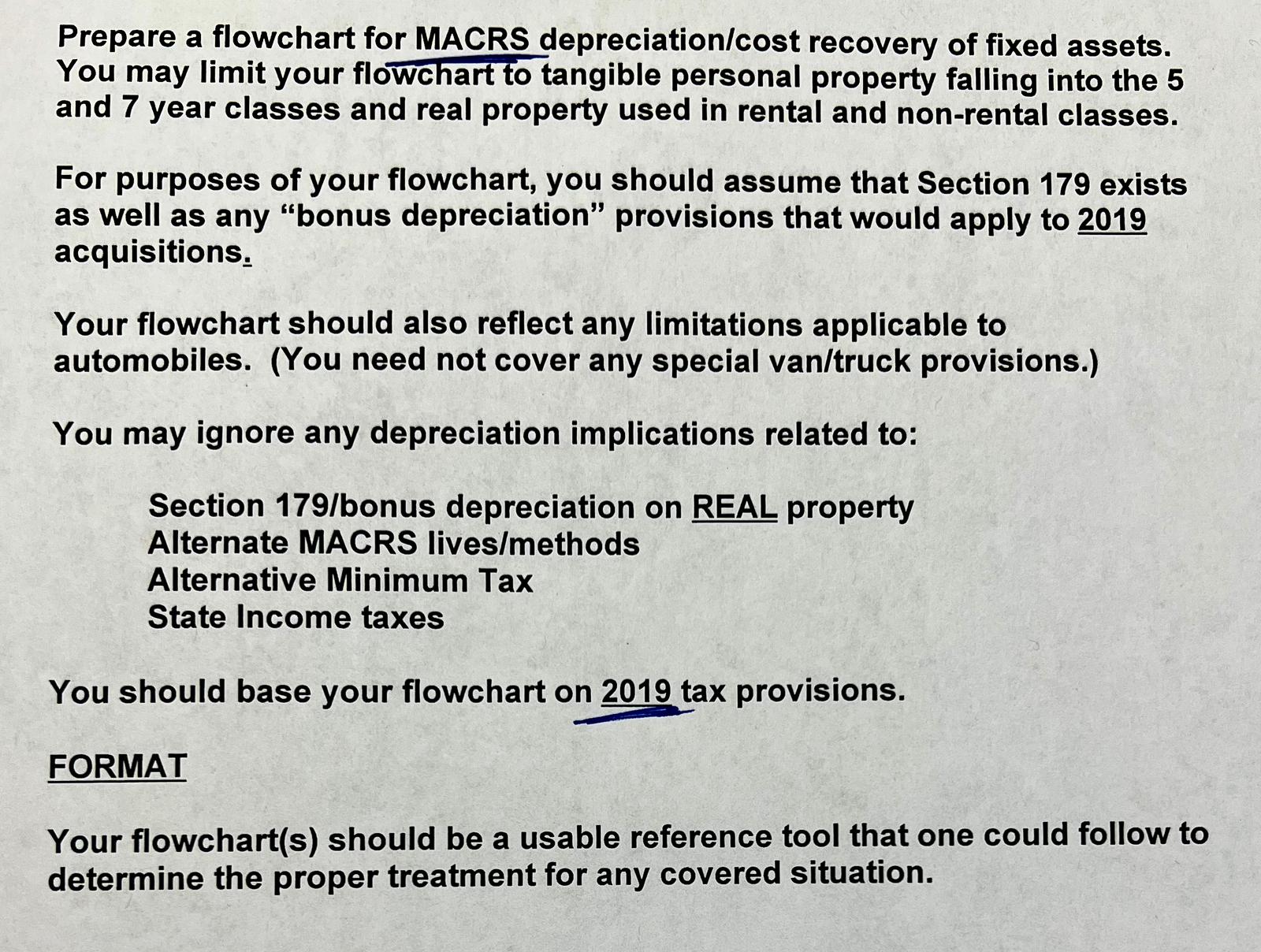

Prepare a flowchart for MACRS depreciation/cost recovery of fixed assets. You may limit your flowchart to tangible personal property falling into the 5 and 7 year classes and real property used in rental and non-rental classes. For purposes of your flowchart, you should assume that Section 179 exists as well as any "bonus depreciation" provisions that would apply to 2019 acquisitions. Your flowchart should also reflect any limitations applicable to automobiles. (You need not cover any special van/truck provisions.) You may ignore any depreciation implications related to: Section 179/bonus depreciation on REAL property Alternate MACRS lives/methods Alternative Minimum Tax State Income taxes You should base your flowchart on 2019 tax provisions. FORMAT Your flowchart(s) should be a usable reference tool that one could follow to determine the proper treatment for any covered situation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

MACRS Depreciation Flowchart for Tangible Personal Property and Real Property Start Is the property ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started