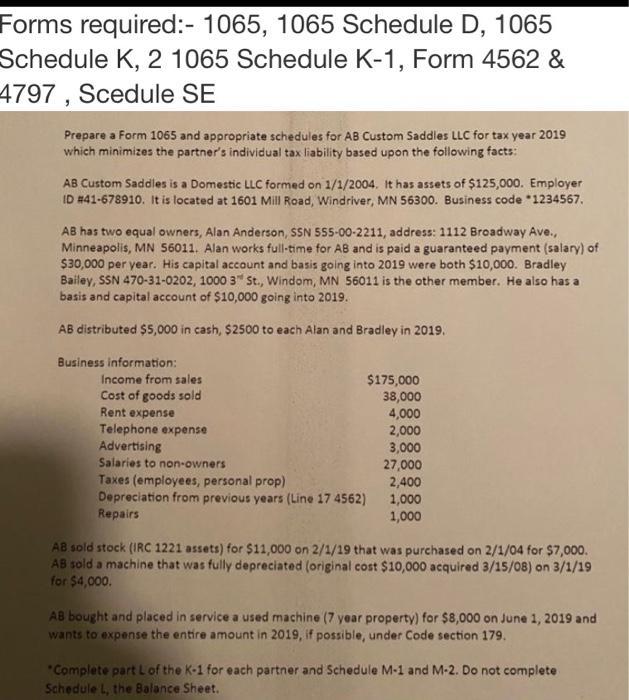

Question: Forms required:- 1065, 1065 Schedule D, 1065 Schedule K, 2 1065 Schedule K-1, Form 4562 & 4797 , Scedule SE Prepare a Form 1065

Forms required:- 1065, 1065 Schedule D, 1065 Schedule K, 2 1065 Schedule K-1, Form 4562 & 4797 , Scedule SE Prepare a Form 1065 and appropriate schedules for AB Custom Saddles LLC for tax year 2019 which minimizes the partner's individual tax liability based upon the following facts: AB Custom Saddies is a Domestic LLC formed on 1/1/2004. It has assets of $125,000. Employer d on: ID #41-678910. It is located at 1601 MilI Road, Windriver, MN 56300. Business code *1234567. AB has two equal owners, Alan Anderson, SSN 555-00-2211, address: 1112 Broadway Ave., Minneapolis, MN 56011. Alan works full-time for AB and is paid a guaranteed payment (salary) of $30,000 per year. His capital account and basis going into 2019 were both $10,000. Bradley Bailey, SSN 470-31-0202, 1000 3 St., Windom, MN 56011 is the other member. He also has a basis and capital account of $10,000 going into 2019. AB distributed $5,000 in cash, $2500 to each Alan and Bradley in 2019. Business information: Income from sales $175,000 38,000 4,000 2,000 3,000 27,000 2,400 1,000 1,000 Cost of goods sold Rent expense Telephone expense Advertising Salaries to non-owners Taxes (employees, personal prop) Depreciation from previous years (Line 17 4562) Repairs AB sold stock (IRC 1221 assets) for $11,000 on 2/1/19 that was purchased on 2/1/04 for $7,000. AB sold a machine that was fully depreciated (original cost $10,000 acquired 3/15/08) on 3/1/19 for $4,000. AB bought and placed in service a used machine (7 year property) for $8,000 on June 1, 2019 and wants to expense the entire amount in 2019, if possible, under Code section 179. "Complete part L of the K-1 for each partner and Schedule M-1 and M-2. Do not complete Schedule L, the Balance Sheet.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Solution Schedule 1605 Name of the Partnership AB Custom Saddles LLC Number of Schedules K1 Attach o... View full answer

Get step-by-step solutions from verified subject matter experts