Question

Prepare a Form 1065 and its schedules with the given information for a Partnership. This should include Form 1125A, Schedule B-1, Schedule D, Schedule K-1

Prepare a Form 1065 and its schedules with the given information for a Partnership. This should include Form 1125A, Schedule B-1, Schedule D, Schedule K-1 Form 4562, Form 4797, and Form 8949.

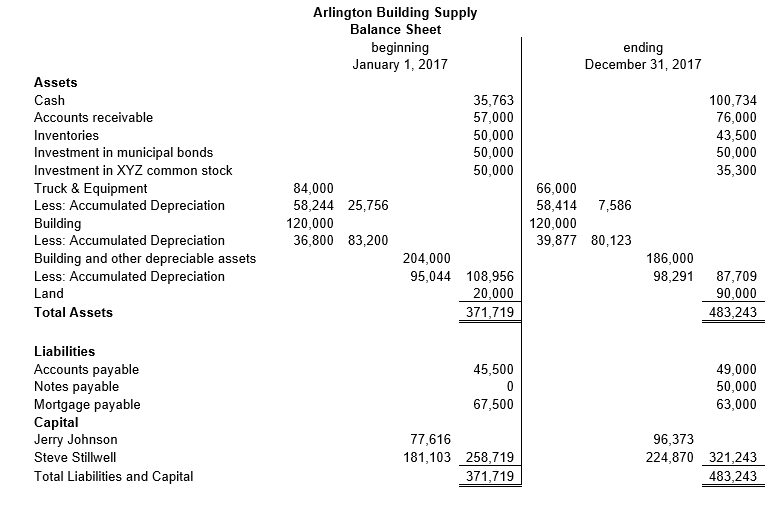

On January 1, 2005, Jerry and Steve formed a general partnership under the name Company X.On January 1, 2005, Jerry and Steve formed a general partnership under the name Company X.

The partnership maintains its books according to the 704(b) regulations. Under this method of accounting, all book and tax numbers are the same except life insurance premiums and tax-exempt interest.

The partners percentage ownership of original capital is 30 percent for Jerry and 70 percent for Steve. They agree that profits and losses will be shared according to this same ratio. Any additional capital contributions and withdrawals must be made in these same ratios.

Johnson is expected to devote all of his time to the business, while Stillwell will devote approximately 75 percent of his. For their services to the company, the partners will receive the following annual guaranteed payments:

Jerry, $28,000

Steve, $21,000

Information on the depreciable assets and land is provided in the table below. The partnership intends to immediately expense the new equipment purchase under 179.

| Asset Schedule | ||||||

| description | cost | date acquired | prior depreciation | life | date sold | selling price |

| Truck | 20,000 | April 1, 2014 | 14,240 | 5 | April 1, 2017 | 10,000 |

| Equipment A | 30,000 | June 1, 2013 | 20,626 | 7 | September 1, 2017 | 7,500 |

| Equipment B | 34,000 | May 1, 2013 | 23,378 | 7 | ||

| Equipment C | 32,000 | September 1, 2017 | 7 | |||

| Building | 120,000 | January 15, 2005 | 36,800 | 39 | ||

| Land A | 20,000 | January 15, 2005 | ||||

| Land B | 70,000 | September 30, 2017 | ||||

The partnership uses currently allowable tax depreciation methods for both regular tax and book purposes and has adopted a policy of electing not to claim bonus depreciation. Assume alternative minimum tax depreciation equals regular tax depreciation.

The partners decided to invest in a small tract of land (Land B) with the intention of selling it about a year later at a substantial profit. On September 30, 2017, they executed a $50,000 note with the bank to obtain the $70,000 cash purchase price. Interest on the note is payable quarterly, and the principal is due in one year. The first interest payment of $1,000 was made on December 30, 2017.

The notes payable to the bank as well as the accounts payable are treated by the partnership as recourse debt and will be allocated using the profit sharing ratios.

The partnership has a mortgage on the land and building. The annual principal payment of $4,500 is paid each Dec. 31, along with 8 percent interest on the outstanding balance. The mortgage is a qualified nonrecourse debt secured by the land and the building. It will be allocated using the profit sharing ratios.

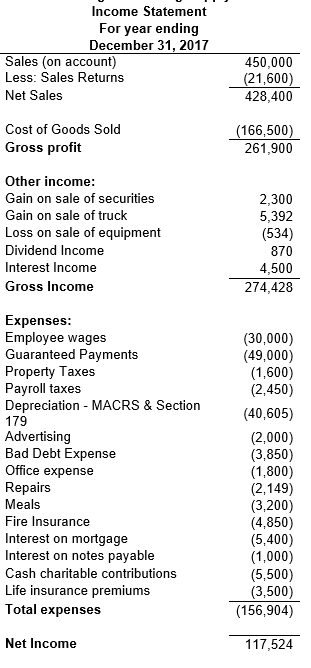

Company X's inventory-related purchases during 2017 were $160,000. The partnership values its inventory at lower of cost or market and uses FIFO inventory method. Assume the rules of 263A do not apply.

On February 8, 2017, the partnership bought 400 shares of ABC, Ltd. for $20 per share. All shares were sold for $22 per share on April 2, 2017.

On September 13, 2017, 300 shares of XYZ Corporation were sold for $54 per share. The stock was purchased on December 1, 2011 for $49 per share.

The following dividends were received:

| Dividend Income | |

| XYZ (qualified) | 520 |

| ABC (not qualified) | 350 |

| Total Dividends | 870 |

Interest income comes from the following sources:

| Interest Income | |

| Interest on Illinois municipal bonds | 3,100 |

| Interest on savings | 1,400 |

| Total Interest | 4,500 |

The partnership donated $5,500 cash to the Red Cross.

Life insurance policies are maintained on the lives of Jerry and Steve. The partnership pays the premiums, $3,500, and is the beneficiary of the policy.

Total distributions were $55,000 and each partner withdrew the following amounts (in addition to their guaranteed payments):

| Jerry | $16,500 |

| Steve | $38,500 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started