Answered step by step

Verified Expert Solution

Question

1 Approved Answer

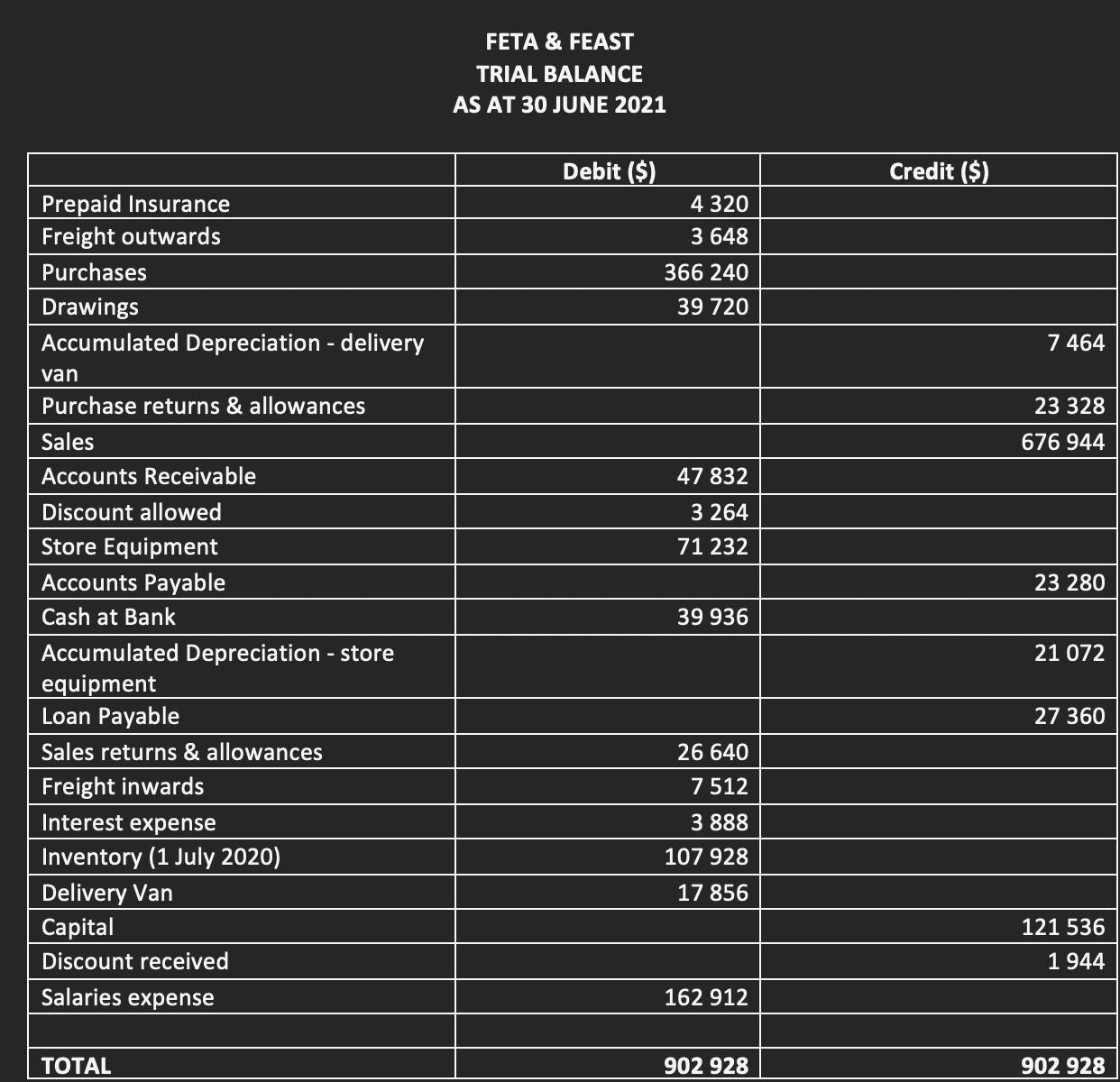

Prepare a fully classified Income Statement, a Statement of Changes in Equity and a fully classified Balance Sheet using the Trial Balance. Additional Information: The

Prepare a fully classified Income Statement, a Statement of Changes in Equity and a fully classified Balance Sheet using the Trial Balance.

Additional Information:

Additional Information:

The salaries expense represents $78 624 for sales staff and $84 288 for office staff.

The inventory stocktake revealed a closing stock balance at 30 June 2021 as $87 432.

25% of the loan is due on the 1 February 2022 and the remainder due in subsequent financial years.

Prepaid Insurance Freight outwards Purchases Drawings Accumulated Depreciation - delivery van Purchase returns & allowances Sales Accounts Receivable Discount allowed Store Equipment Accounts Payable Cash at Bank Accumulated Depreciation - store equipment Loan Payable Sales returns & allowances Freight inwards Interest expense Inventory (1 July 2020) Delivery Van Capital Discount received Salaries expense TOTAL FETA & FEAST TRIAL BALANCE AS AT 30 JUNE 2021 Debit ($) 4 320 3 648 366 240 39 720 47 832 3 264 71 232 39 936 26 640 7512 3 888 107 928 17 856 162 912 902 928 Credit ($) 7 464 23 328 676 944 23 280 21 072 27 360 121 536 1944 902 928

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Income Statement Revenue Sales 676944 Less Sales returns allowances 26640 Net Sales 650304 Expense...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started