Prepare a Journal Entry for this

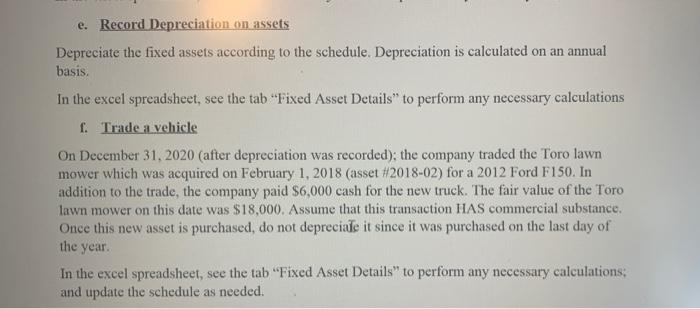

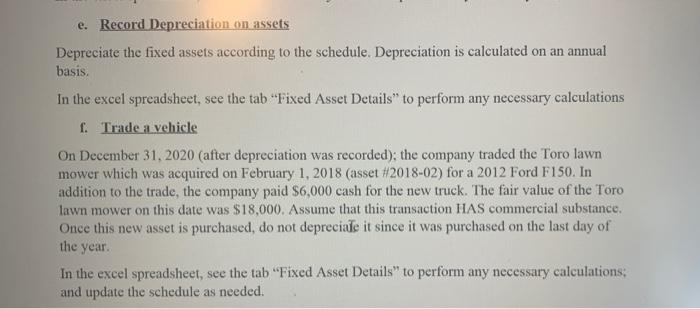

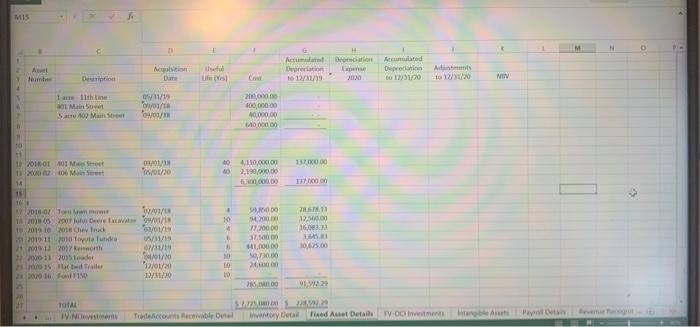

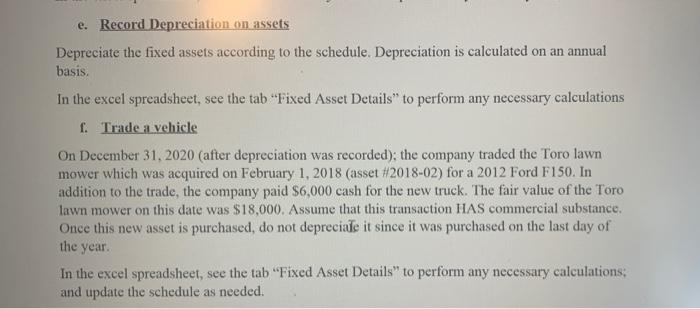

e. Record Depreciation on assets Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis. In the excel spreadsheet, see the tab "Fixed Asset Details to perform any necessary calculations f. Trade a vehicle On December 31, 2020 (after depreciation was recorded); the company traded the Toro lawn mower which was acquired on February 1, 2018 (asset #2018-02) for a 2012 Ford F150. In addition to the trade, the company paid $6,000 cash for the new truck. The fair value of the Toro lawn mower on this date was $18,000. Assume that this transaction HAS commercial substance. Once this new asset is purchased, do not depreciate it since it was purchased on the last day of the year. In the excel spreadsheet, see the tab "Fixed Asset Details" to perform any necessary calculations: and update the schedule as needed. MIS M O G H ht Deco Depreciation 10 12/11/19 2020 Art Fame Mapo Du Acumulated Depreciation to 12/31/20 Am 10 12/11/20 CA Diption 6 NIN Tanellthine A Main Street W11/19 O/01/18 09/01/18 2000 100,000.00 0.000.00 GAO D000 I COVAS 10 L/100 OR 11.700.00 1 2018 01 401 Mar 0006 Maio 06./07/30 110.000 2.190.000 100.000 YL 117.000.00 2/01/18 VO TEMESTRE 10 000 12,500.00 16,00 15 TO 2011 Tor 180185 700 New 102019-10 20 Cher 2010-11 2010 Toyunda 2110191) 2017 Resort 10 11 2015 01 Trailer 20/0 1 0 09/01/19 01/31/18 7/11/19 01/01/20 17/01/ 12/11/30 5 10 77,200.00 32.00 411,000.00 73000 20.000 0.00 01 10 25 DOO OL 2 WIDE SO Inventory Detai IV NintentsTodaci Fixed Ast Details IV. Au Part Cover Sheet Trial Balance and Worksheet Journal Entries Cash & Equival Financial Statements Accumulated Depreciation Depreciation Expense Cou to 12/31/19 2020 Asset Category Number Action Date Uslu Life Yrs) Accumulated Depreciation to 12/31/20 Adjustments to 12/31/30 NDY Land Description I acre 11th Line 401 Main Street Sacre 402 Main Street 0531/19 0901/18 0901/18 200,000.00 400.000,00 40,000.00 140.000.00 0.00 0.00 100 000 Building 137.000.00 2018.01 401 Main Street 2020-02406 Main Street 09.01 OS 01/20 40 40 4110,000.00 2.100.00 60.000 13700000 4 10 4 Ten 2018-02 2011-05 2019-10 2010-11 2019-12 202013 2030-15 2020-16 Toro lawn mower 2007 John Deere Excavator 2018 Chew Track 2010 Toyota Tundra 2017 Kenneth 2015 Loader bed Trailer Ford F150 0201/18 0901/18 01/01/19 05:31/19 07/31/19 OR 01:20 1201720 12/31/20 39,850,00 2000 77,200.00 37.500.00 441,000.00 50,730.00 24,000.00 0.00 11.00.00 26713 12.500.00 1, MM) 10.625.00 6 10 10 10 000 9159229 TOTAL 572225.000 522.59229