Answered step by step

Verified Expert Solution

Question

1 Approved Answer

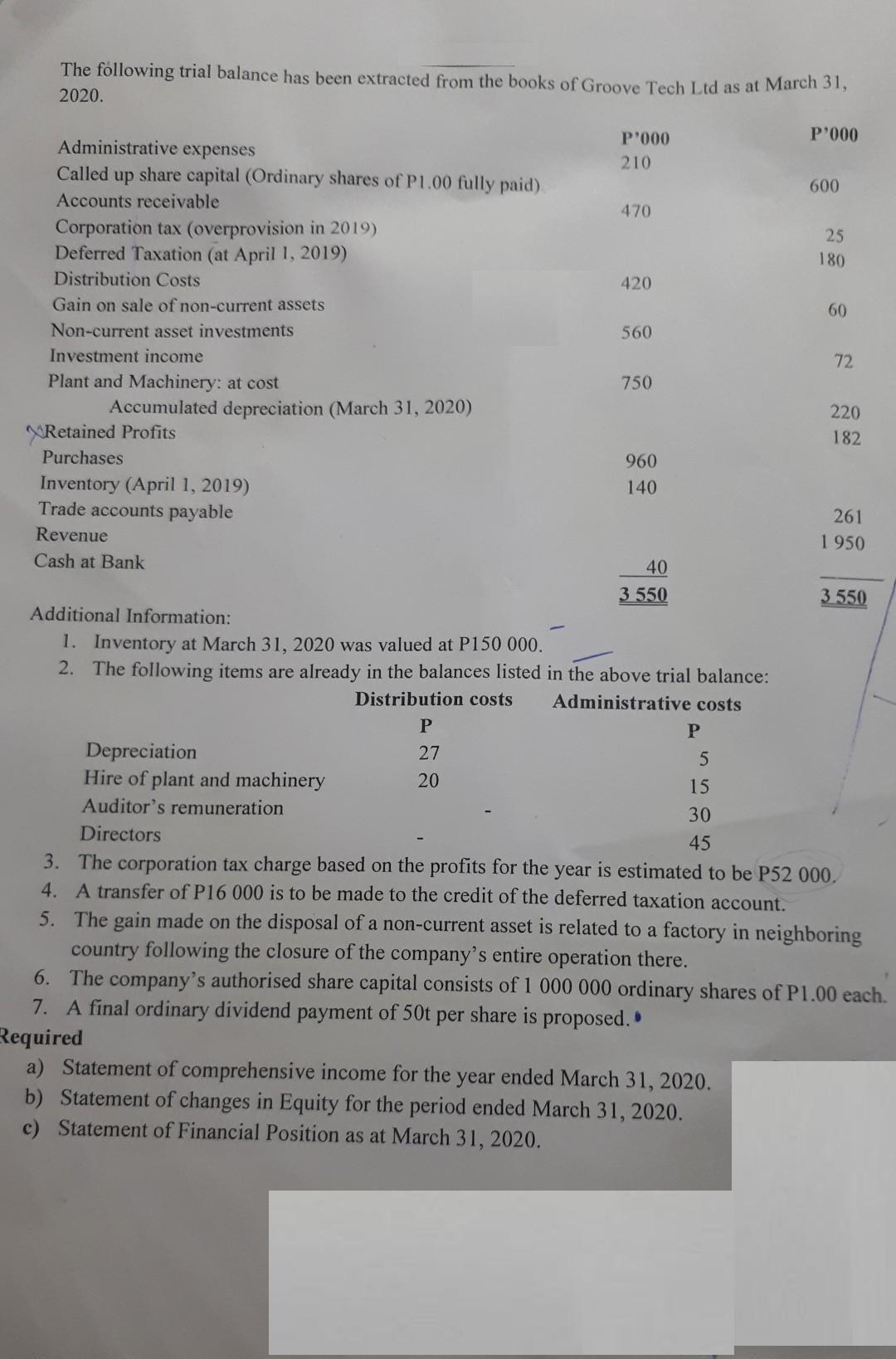

The following trial balance has been extracted from the books of Groove Tech Ltd as at March 31, 2020. Administrative expenses Called up share

The following trial balance has been extracted from the books of Groove Tech Ltd as at March 31, 2020. Administrative expenses Called up share capital (Ordinary shares of P1.00 fully paid) Accounts receivable Corporation tax (overprovision in 2019) Deferred Taxation (at April 1, 2019) Distribution Costs Gain on sale of non-current assets Non-current asset investments Investment income Plant and Machinery: at cost Accumulated depreciation (March 31, 2020) Retained Profits Purchases Inventory (April 1, 2019) Trade accounts payable Revenue Cash at Bank Depreciation Hire of plant and machinery Auditor's remuneration Directors P'000 210 P 27 20 470 420 560 750 960 140 Additional Information: 1. Inventory at March 31, 2020 was valued at P150 000. 2. The following items are already in the balances listed in the above trial balance: Distribution costs Administrative costs 40 3 550 P P'000 600 Required a) Statement of comprehensive income for the year ended March 31, 2020. b) Statement of changes in Equity for the period ended March 31, 2020. c) Statement of Financial Position as at March 31, 2020. 25 180 60 72 220 182 261 1950 3550 5 15 30 45 3. The corporation tax charge based on the profits for the year is estimated to be P52 000. 4. A transfer of P16 000 is to be made to the credit of the deferred taxation account. 5. The gain made on the disposal of a non-current asset is related to a factory in neighboring country following the closure of the company's entire operation there. 6. The company's authorised share capital consists of 1 000 000 ordinary shares of P1.00 each. 7. A final ordinary dividend payment of 50t per share is proposed.

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a b Revenue Less Cost of goods sold Gross income Less Operating expense Distribution expense Depreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started