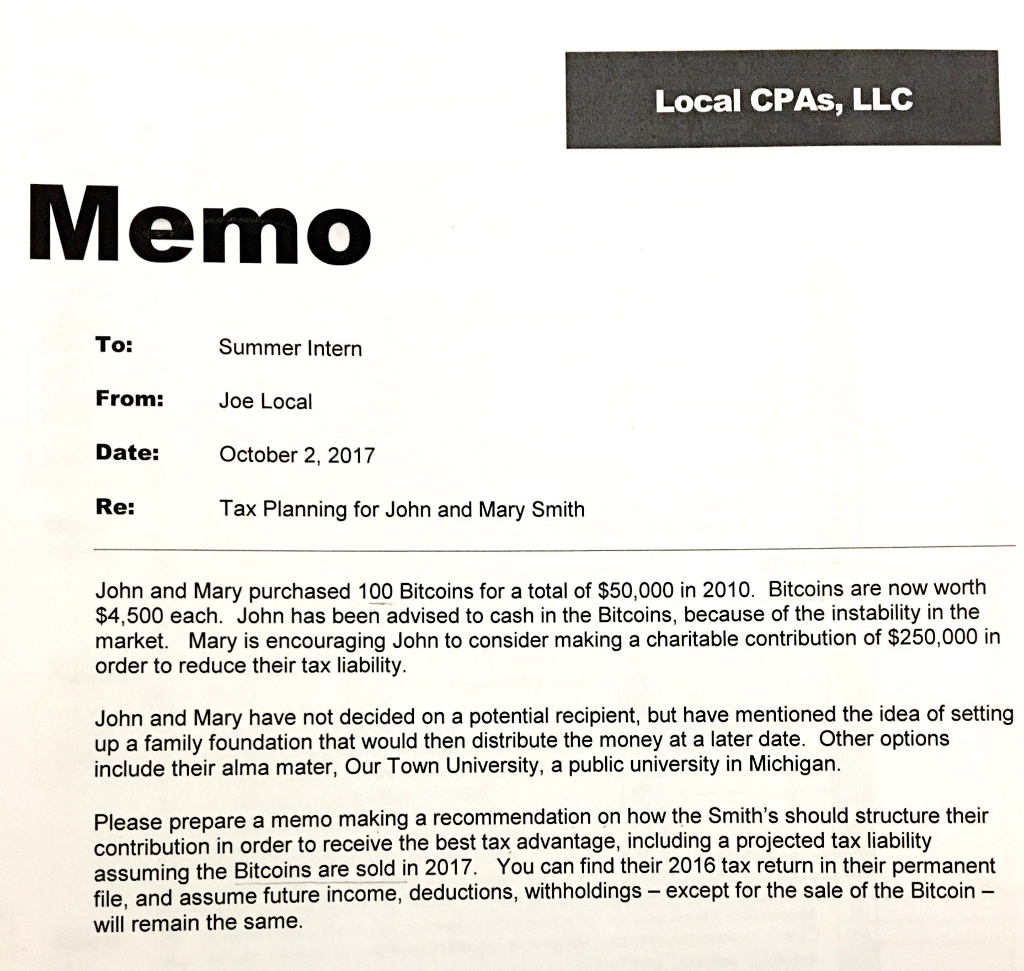

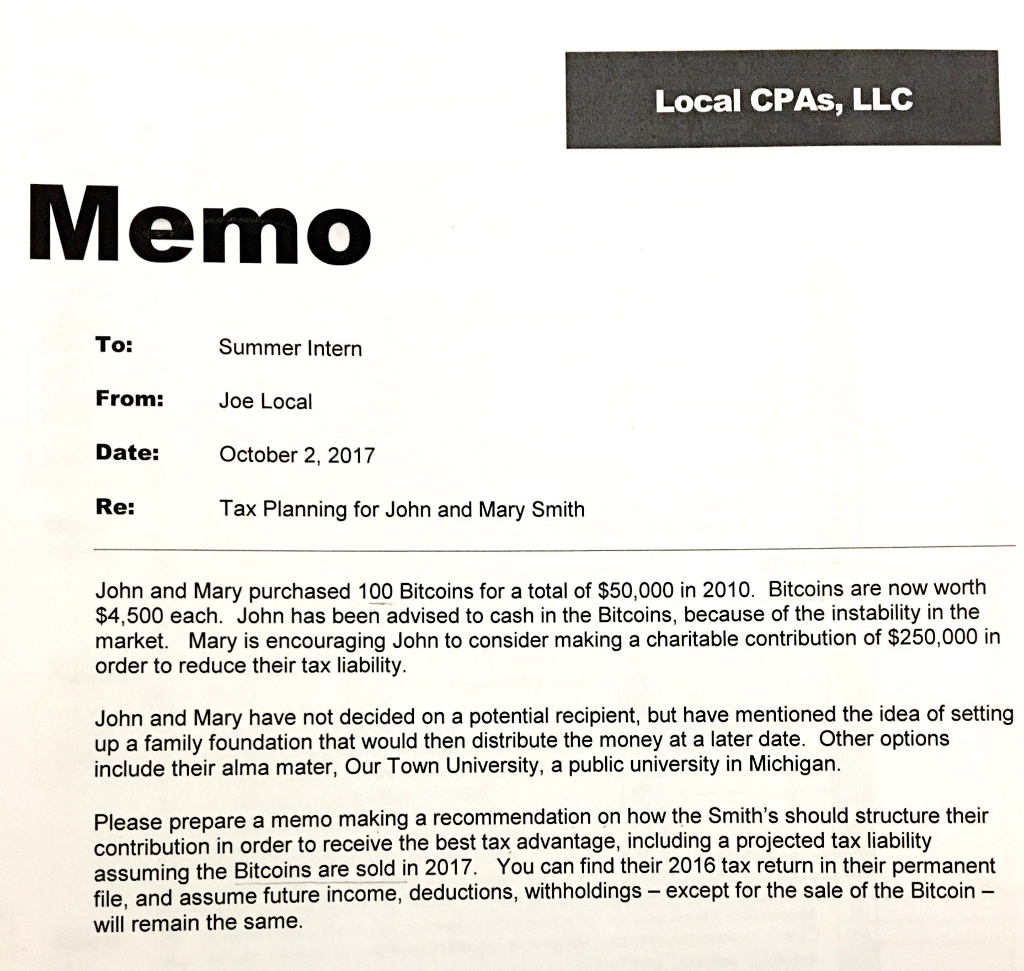

Prepare a memo to Joe Local based on the documents attached.

Prepare a memo to Joe Local based on the documents attached.

Prepare a memo to Joe Local based on the documents attached.

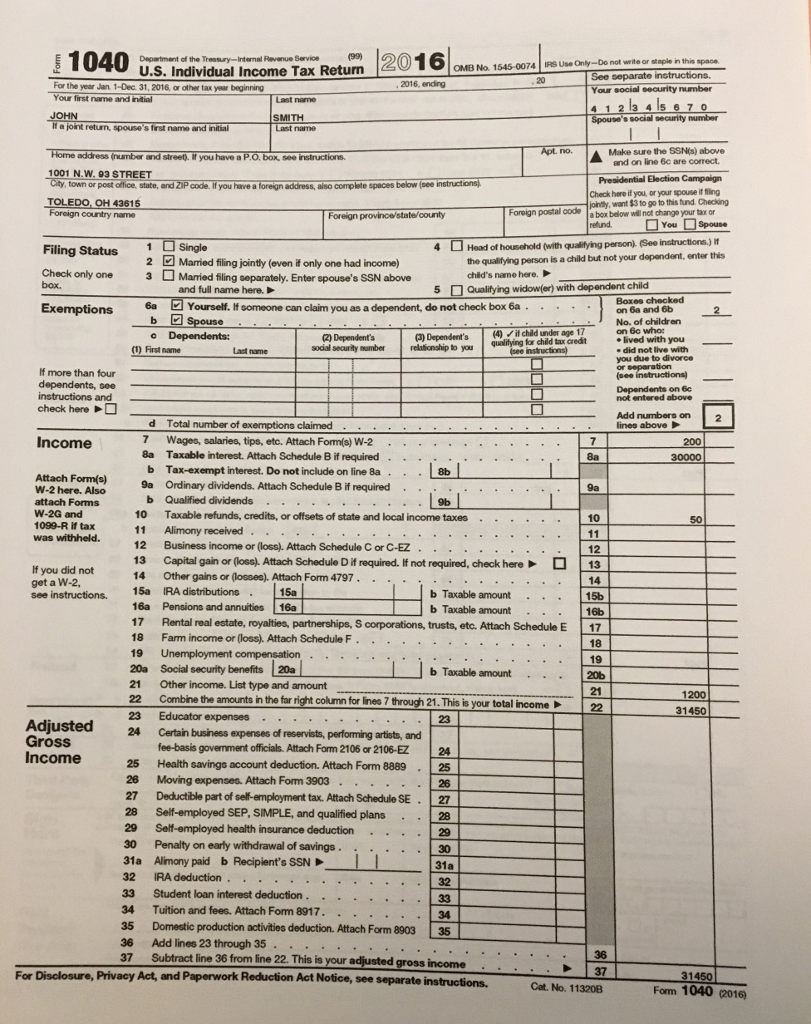

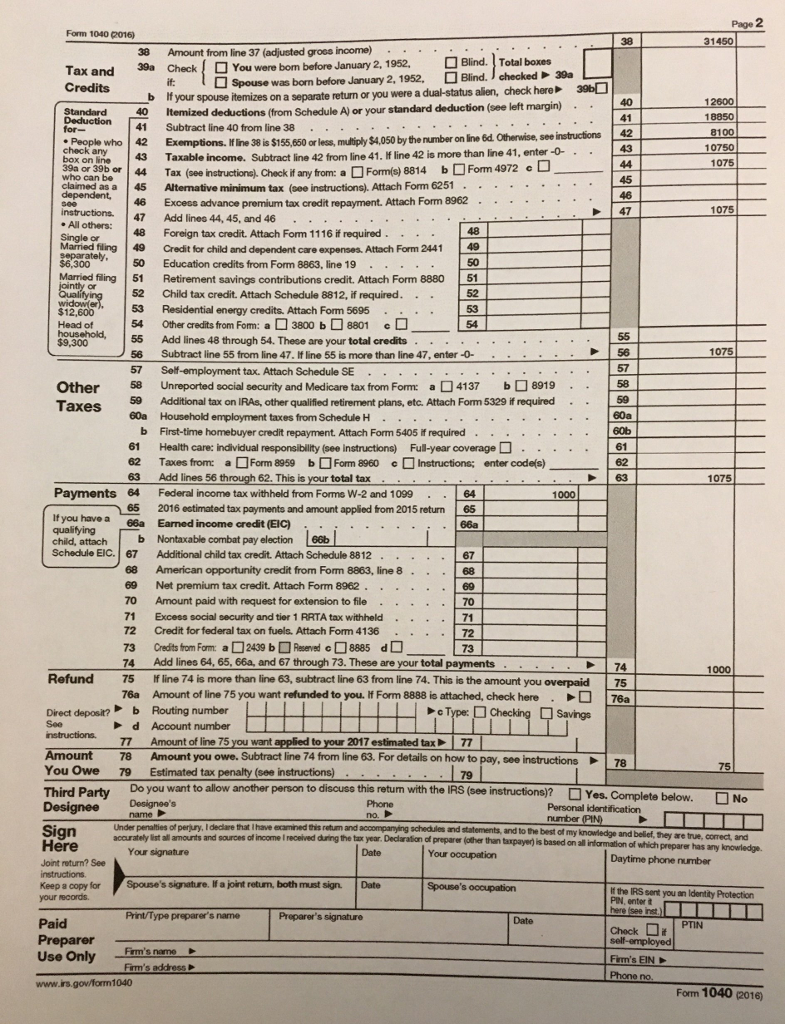

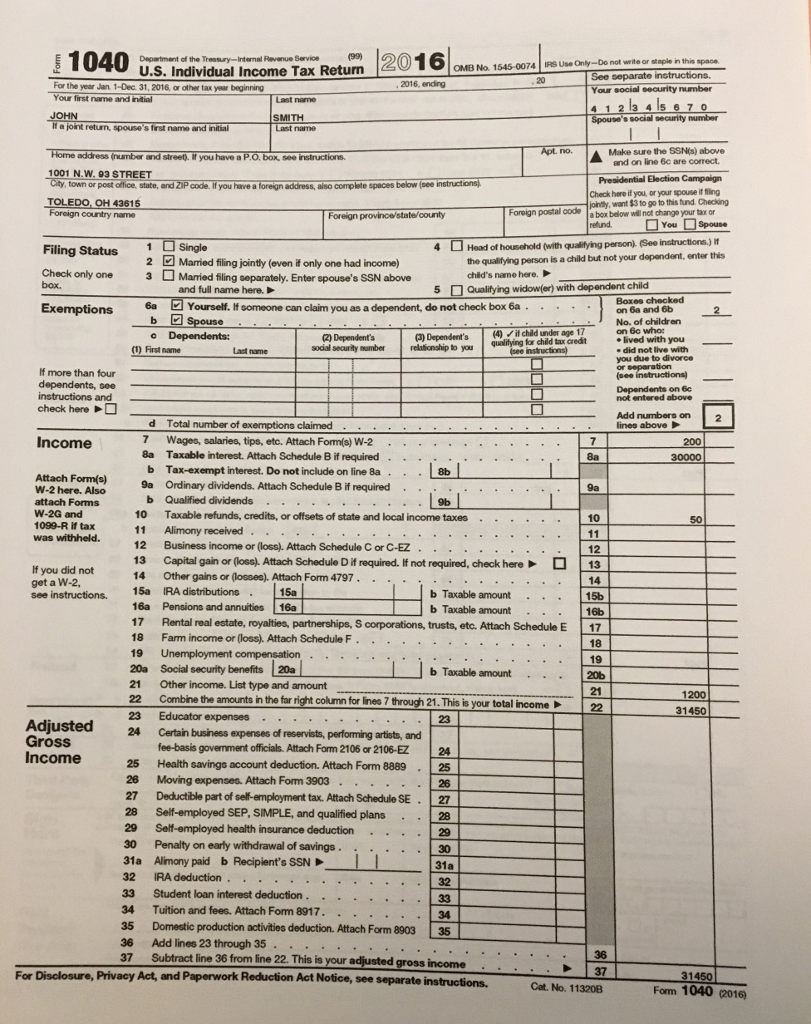

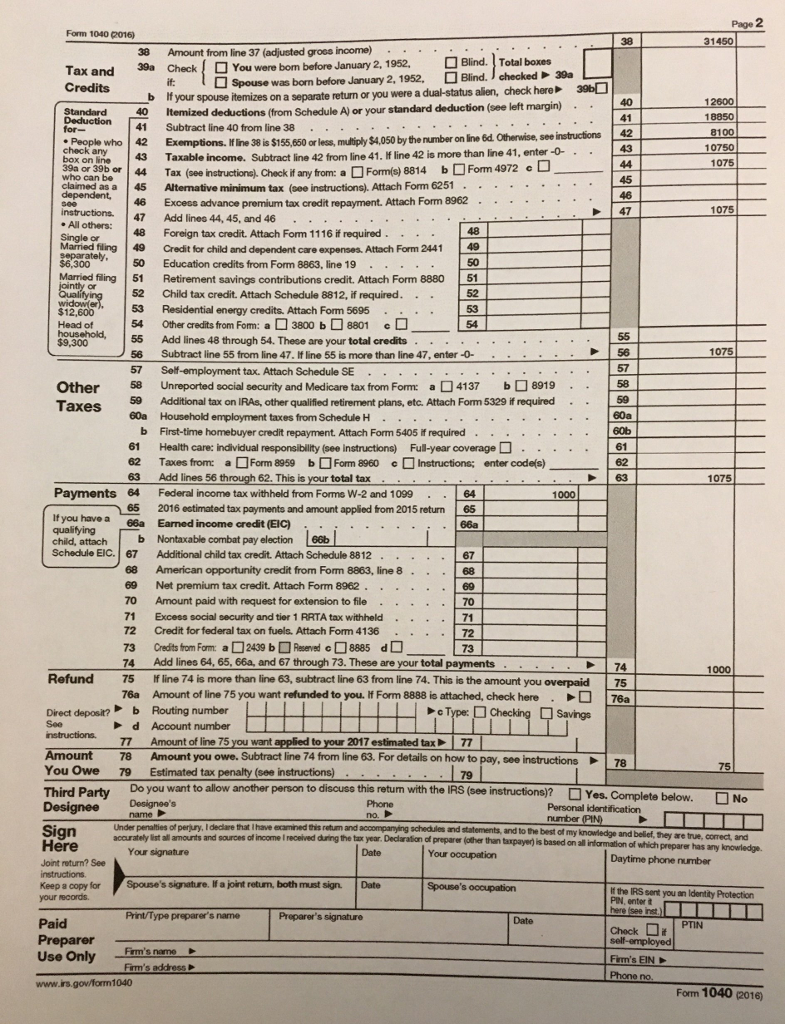

1 040 us IndivIdual Income Tax Return 2016 mu-or-...... tsesooa 001 N w 03 STREET Filing Status 10ing 2 Married fingjon even 'only one had noome) ExemptionsYournelf omeone can claim you as a dependent, de not chock box If more than four dependants, see instructions and check hare Add numbars d Total umber of axemptions claimed Income Wages, salaries, ips,tc. Afttach Fom W2 a Tanable interest, Attach Schedude Breqired. b Ta-xempt interest. De not include on line la Attach Forms wahn. Als9eOdnry dividends. Amach ScheddeBImpind 10 Taxable retunds, credts, or ofoets of state and local inoome taxes wos witaldAlmony received 12 Busness income or loss), Attach Schedule C OrC-EZ 13 Capitgain Attach Schedule Dit reqirenot required, checkhor 14 Other gains er (foes Aach Form 4797 1 If you did not get a W-2 ee instructions 15a IRA distributions bTaxable amount 16a Pensions and annutes 1 17 Rental real estate, yat paripscpraions trsts, et. AtchcheduiE 17 18 Farm income or oss). Atach Schedule F 20a Social security benees 20 21 Other income. List type and amoun 22 Cntr, tie arorts nte lr rigt carn for hes 7 trough 21. This 23 Educator expenses b Taxable amount20 yo, total home Adjustedih buhes p Gross Income ee-basib govemet oicih Attach Form 2106 ar 2106-E2 Health savingn account deduction Altach Form 08925 26 Moving epenses Attach Fom 3903 27 Deductible part of sel ampkayment tax Allach Schedle SE 28 Sel-employed SEP, SMPLE, and qualifed plan 2 Sellemployed health insurance deduction.. 31a Alimony paid b Recipient's SSN 32 RAdeduction... . 33 Student loan interest deduetion 34 Tution and lees Aach Form 8917.. 36 Add lines 23 through 35... 37 Subtact line 36 from lne 2. This io your edjusted gross income For Disclosure,Privacy Act, and Paperwork Reducon Act Noien,see separate instructions 37 Fom 1040 010 1 040 us IndivIdual Income Tax Return 2016 mu-or-...... tsesooa 001 N w 03 STREET Filing Status 10ing 2 Married fingjon even 'only one had noome) ExemptionsYournelf omeone can claim you as a dependent, de not chock box If more than four dependants, see instructions and check hare Add numbars d Total umber of axemptions claimed Income Wages, salaries, ips,tc. Afttach Fom W2 a Tanable interest, Attach Schedude Breqired. b Ta-xempt interest. De not include on line la Attach Forms wahn. Als9eOdnry dividends. Amach ScheddeBImpind 10 Taxable retunds, credts, or ofoets of state and local inoome taxes wos witaldAlmony received 12 Busness income or loss), Attach Schedule C OrC-EZ 13 Capitgain Attach Schedule Dit reqirenot required, checkhor 14 Other gains er (foes Aach Form 4797 1 If you did not get a W-2 ee instructions 15a IRA distributions bTaxable amount 16a Pensions and annutes 1 17 Rental real estate, yat paripscpraions trsts, et. AtchcheduiE 17 18 Farm income or oss). Atach Schedule F 20a Social security benees 20 21 Other income. List type and amoun 22 Cntr, tie arorts nte lr rigt carn for hes 7 trough 21. This 23 Educator expenses b Taxable amount20 yo, total home Adjustedih buhes p Gross Income ee-basib govemet oicih Attach Form 2106 ar 2106-E2 Health savingn account deduction Altach Form 08925 26 Moving epenses Attach Fom 3903 27 Deductible part of sel ampkayment tax Allach Schedle SE 28 Sel-employed SEP, SMPLE, and qualifed plan 2 Sellemployed health insurance deduction.. 31a Alimony paid b Recipient's SSN 32 RAdeduction... . 33 Student loan interest deduetion 34 Tution and lees Aach Form 8917.. 36 Add lines 23 through 35... 37 Subtact line 36 from lne 2. This io your edjusted gross income For Disclosure,Privacy Act, and Paperwork Reducon Act Noien,see separate instructions 37 Fom 1040 010

Prepare a memo to Joe Local based on the documents attached.

Prepare a memo to Joe Local based on the documents attached.