Answered step by step

Verified Expert Solution

Question

1 Approved Answer

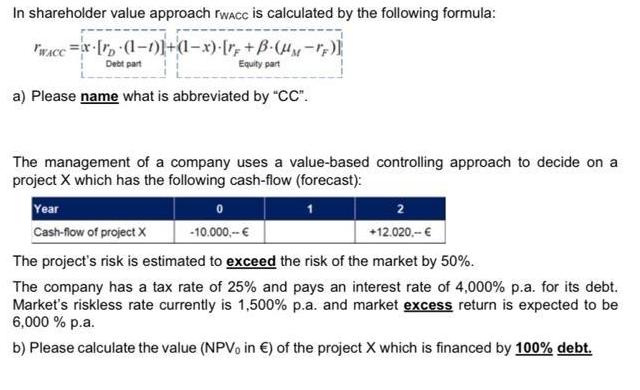

In shareholder value approach rwAcc is calculated by the following formula: TWACC=x[D (1-1)]+(1-x)-[r +B-( F)] Equity part Debt part a) Please name what is

![As the (net present) value of project X is negative in case of lit. c) the state introduces an subsidy S [€] on which payment](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/63295acd762a6_1663654585143.jpg)

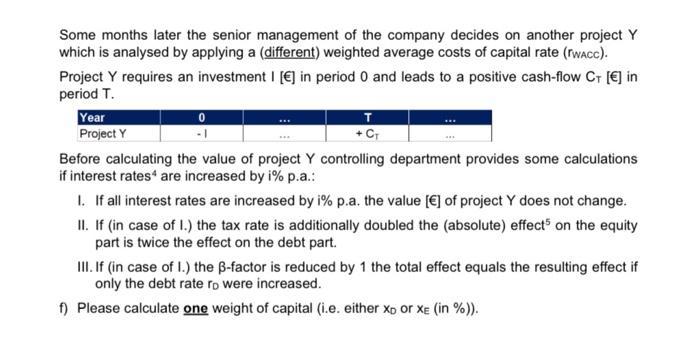

In shareholder value approach rwAcc is calculated by the following formula: TWACC=x[D (1-1)]+(1-x)-[r +B-( "F)] Equity part Debt part a) Please name what is abbreviated by "CC". The management of a company uses a value-based controlling approach to decide on a project X which has the following cash-flow (forecast): Year Cash-flow of project X 0 -10.000,-- 2 +12.020,-- The project's risk is estimated to exceed the risk of the market by 50%. The company has a tax rate of 25% and pays an interest rate of 4,000% p.a. for its debt. Market's riskless rate currently is 1,500% p.a. and market excess return is expected to be 6,000 % p.a. b) Please calculate the value (NPV, in ) of the project X which is financed by 100% debt. As the (net present) value of project X is negative in case of lit. c) the state introduces an subsidy S [] on which payments in the years 1, 2, and 3 are based. Once the subsidy S is paid. In one of the years only 75% of the subsidy S, in another year even 125% of the subsidy S is paid. Year Cash-flow of project X (of lit. d)) -10.000,-- 2 +12.020,-- d) Please amend the provided cash-flow by adding three subsidy S-based payments [] into the provided table so that the value of the project X is maximised. e) Please calculate one of the three subsidy payments []3 which lead to the (maximised) value of 180,-- of the project X. It is financed by 100% equity. Some months later the senior management of the company decides on another project Y which is analysed by applying a (different) weighted average costs of capital rate (WACC). Project Y requires an investment I [] in period 0 and leads to a positive cash-flow C+ [] in period T. Year Project Y T + CT Before calculating the value of project Y controlling department provides some calculations if interest rates are increased by i% p.a.: 1. If all interest rates are increased by i% p.a. the value [] of project Y does not change. II. If (in case of 1.) the tax rate is additionally doubled the (absolute) effects on the equity part is twice the effect on the debt part. III. If (in case of I.) the B-factor is reduced by 1 the total effect equals the resulting effect if only the debt rate ro were increased. f) Please calculate one weight of capital (i.e. either xp or X (in %)).

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a In the formula CC stands for Cost of Capital b To calculate the net present value NPV of the proje...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started