Answered step by step

Verified Expert Solution

Question

1 Approved Answer

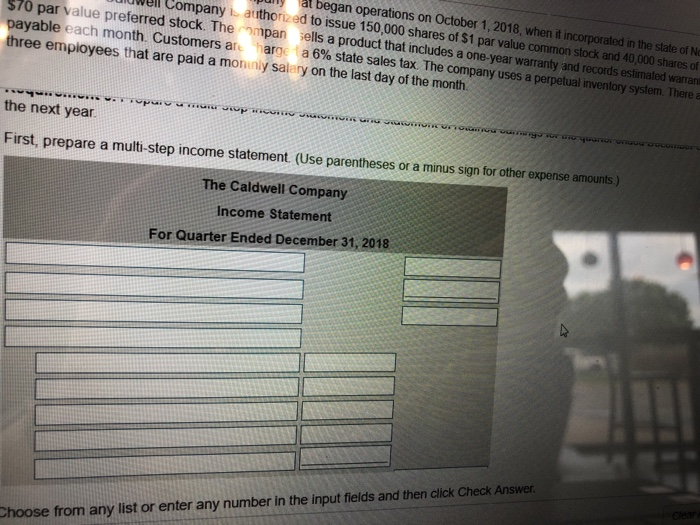

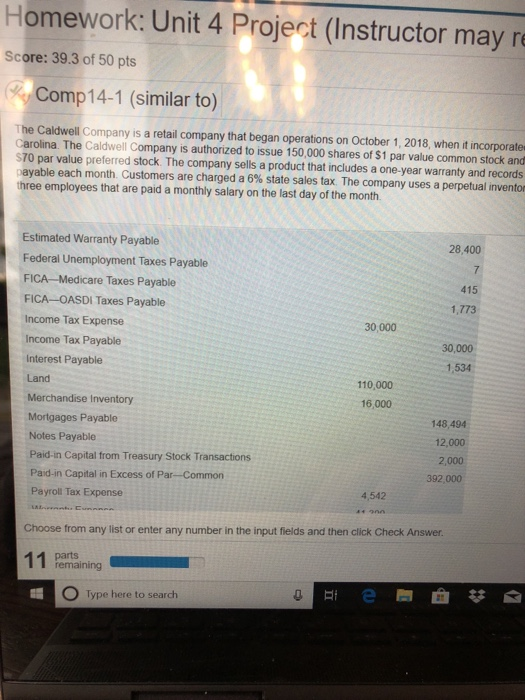

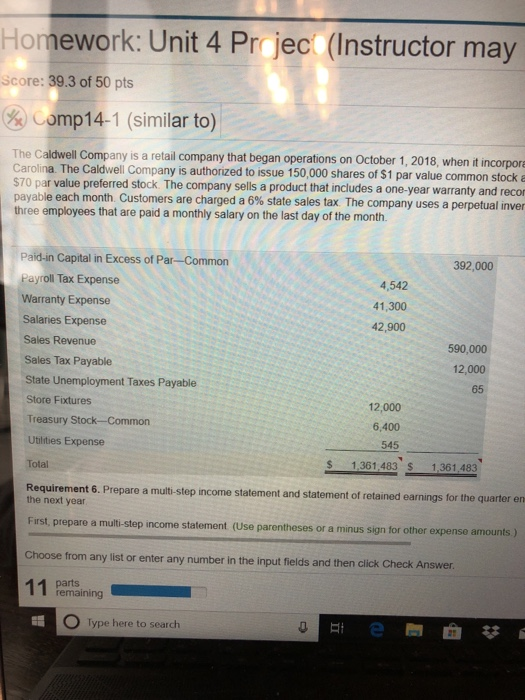

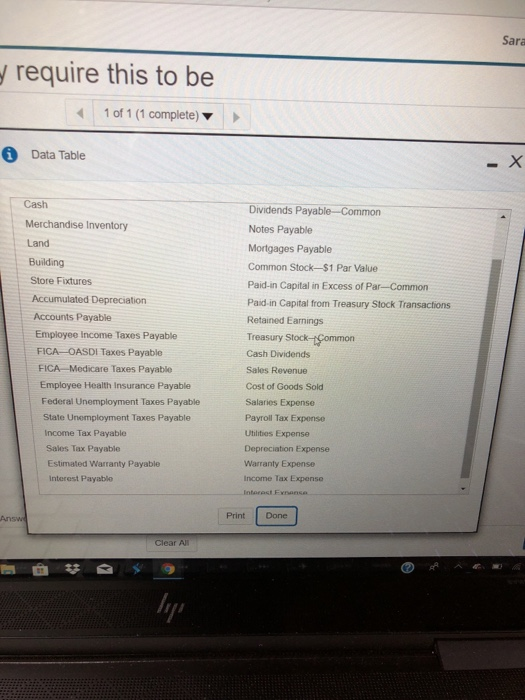

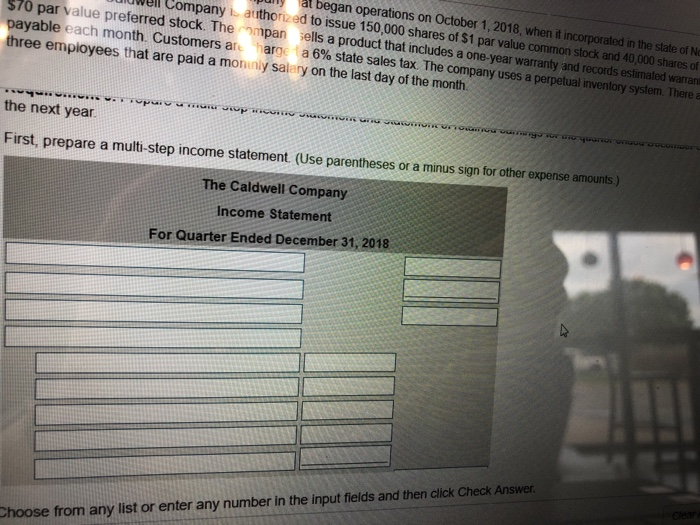

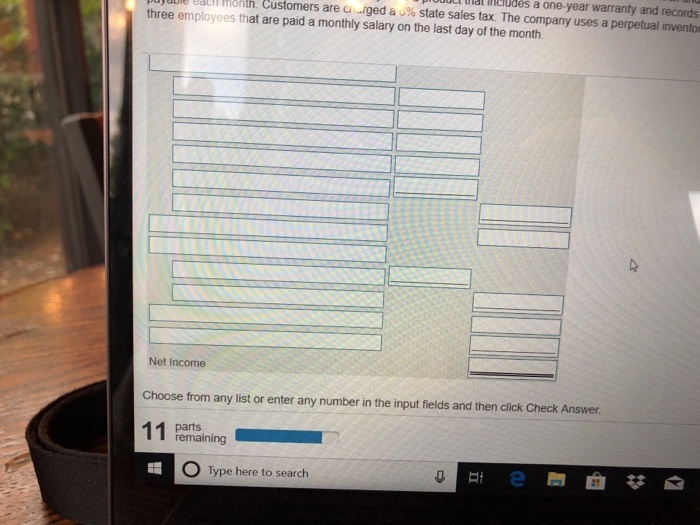

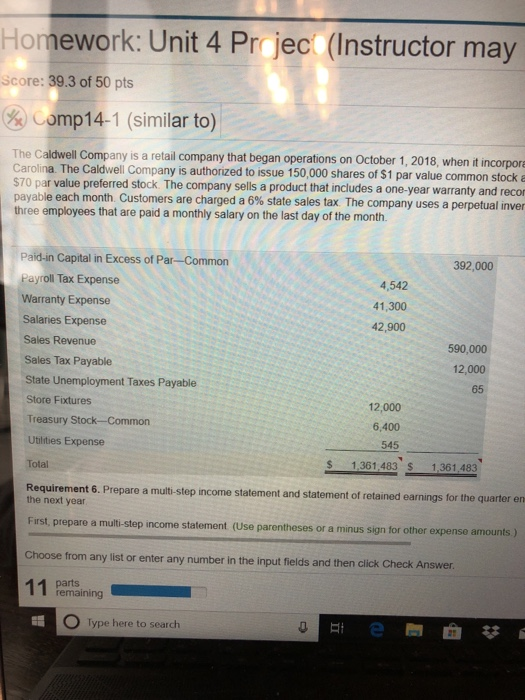

prepare a multi-step income statement and statement of retained earnings for the quarter ended december 31, 2018. prepare a classified balance sheet as of december

prepare a multi-step income statement and statement of retained earnings for the quarter ended december 31, 2018. prepare a classified balance sheet as of december 31,2018. assume that $9,520 of the mortgage payable is due within the next year. if you dont know the number please at least put what goes in the blank (ex: accounts payable, interest expense)

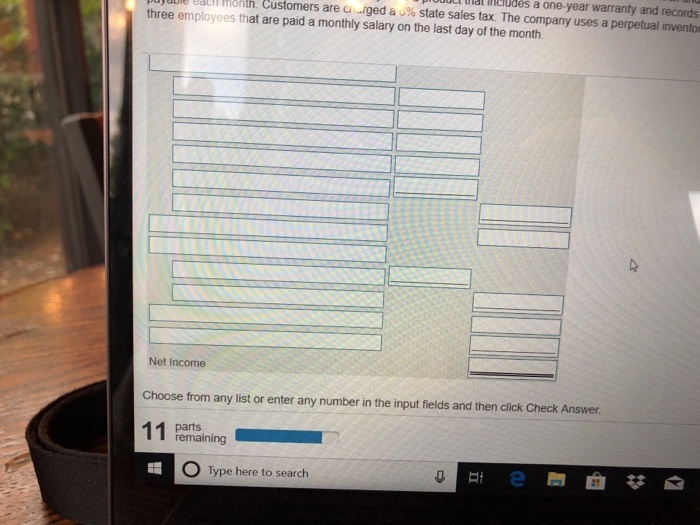

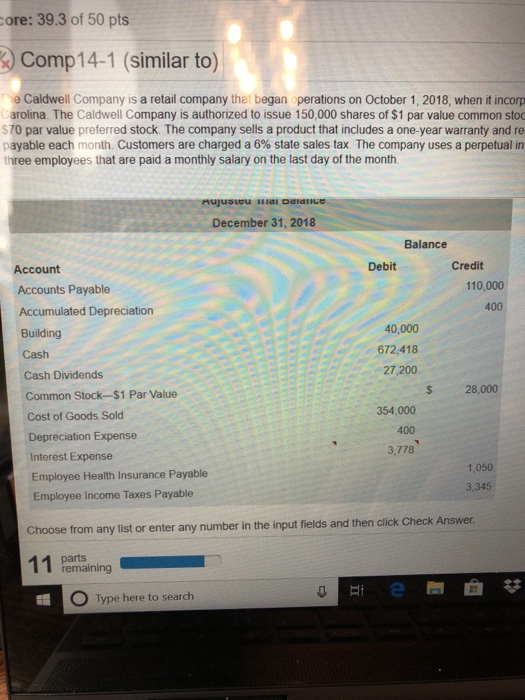

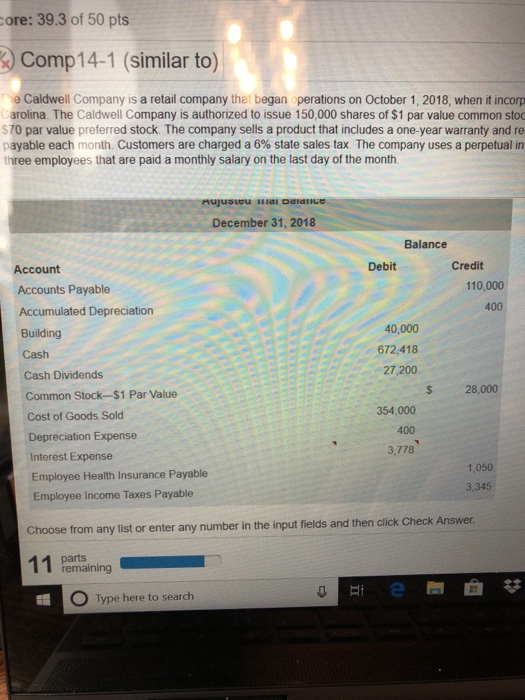

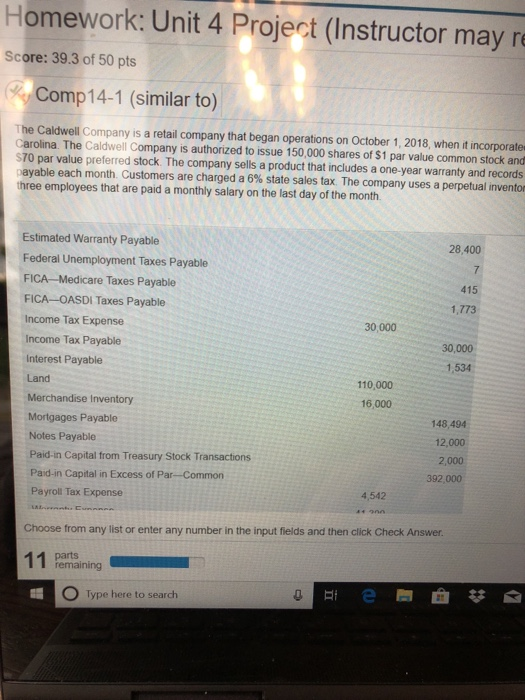

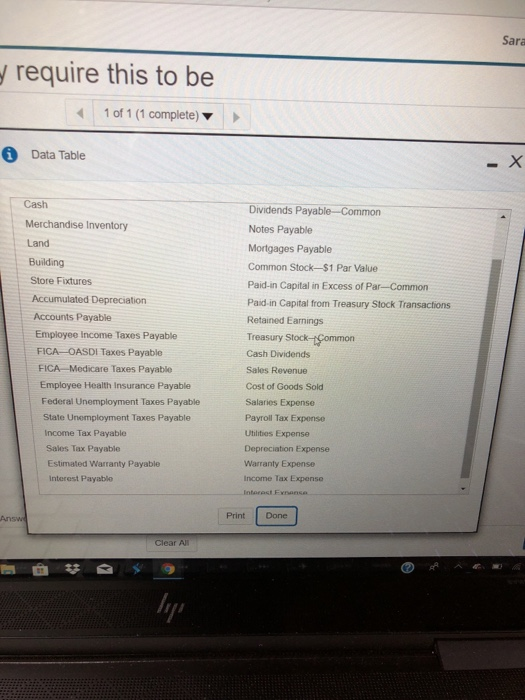

ully at began operations on October 1,2018, when it incorporated in the iuwell Company i authorized to issue 150,000 shares of $1 par value common stock state of N $70 par value preferred stock. Thempan ells a product that includes a one-year warranty payable each month. Customers are haro a 6% state sales tax. The company uses a perpetual three employees that are paid a monunly salary on the last day of the month. and records estimated warran the next year First, prepare a multi-step income statement (Use parentheses or a minus sign for other expense amounts ) The Caldwell Company Income Statement For Quarter Ended December 31, 2018 hoose from any list or enter any number in the input fields and then click Check Answer prUuutt uial ncluds a one-year warranty and records ach month. Customers are a-ged a 5% state sales tax. The company uses a perpetual invento three employees that are paid a monthly salary on the last day of the month. Net Income Choose from any list or enter any number in the input fields and then click Check Answer parts remaining O Type here to search core: 39.3 of 50 pts Comp14-1 (similar to) e Caldwell Company is a retail company that began operations on October 1, 2018, when it incorp arolina. The Caldwell Company is authorized to issue 150,000 shares of $1 par value common stoo $70 par value preferred stock. The company sells a product that includes a one-year warranty and re ayable each month. Customers are charged a 6% state sales tax The company uses a perpetual in three employees that are paid a monthly salary on the last day of the month December 31, 2018 Balance Debit Credit Account 110,000 Accounts Payable 400 Accumulated Depreciation Building Cash Cash Dividends Common Stock-$1 Par Value Cost of Goods Sold Depreciation Expense 40,000 672,418 27,200 $ 28,000 354,000 400 3,778 Interest Expense 1,050 Employee Health Insurance Payable Employee Income Taxes Payable 3.345 Choose from any list or enter any number in the input fields and then click Check Answer parts remaining e 0 O Type here to search rk: Unit 4 Project (Instructor may re Score: 39.3 of 50 pts Comp14-1 (similar to) The Caldwell Company is a retail company that began operations on October 1, 2018, when it incorporate Carolina. The Caldwell Company is authorized to issue 150,000 shares of $1 par value common stock and $70 par value preferred stock. The company sells a product that includes a one-year warranty and records ayable each month. Customers are charged a 6% state sales tax The company uses a perpetual inventor three employees that are paid a monthly salary on the last day of the month. Estimated Warranty Payable Federal Unemployment Taxes Payable FICA-Medicare Taxes Payable FICA-OASDI Taxes Payable Income Tax Expense Income Tax Payable Interest Payable Land Merchandise Inventory Mortgages Payable Notes Payable 28,400 415 1,773 30,000 30,000 1,534 110,000 16,000 148,494 12,000 2,000 392,000 Paid-in Capital from Treasury Stock Transactions Paid-in Capital in Excess of Par-Common Payroll Tax Expense 4,542 Choose from any list or enter any number in the input fields and then click Check Answer. remaining O Type here to search Homework: Unit 4 Pr jec (Instructor may Score: 39.3 of 50 pts Comp14-1 (similar to) The Caldwell Company is a retail company that began operations on October 1, 2018, when it incorpore Carolina. The Caldwell Company is authorized to issue 150,000 shares of $1 par value common stocka $70 par value preferred stock. The company sells a product that includes a one-year warranty payable each month Customers are charged a 6% state sales tax The company uses a perpetual inven three employees that are paid a monthly salary on the last day of the month. and recor Paid-in Capital in Excess of Par-Common 392,000 4,542 1,300 42,900 Payroll Tax Expense Warranty Expense Salaries Expense Sales Revenue Sales Tax Payable State Unemployment Taxes Payable Store Fixtures Treasury StockCommon 590,000 12,000 65 12,000 6,400 545 Utilities Expense S 1.361 483 S 1361483 Total Requirement 6. Prepare a multi step income statement and statement of retained earnings for the quarter en the next year First, prepare a multi-step income statement (Use parentheses or a minus sign for other expense amounts) hoose from any list or enter any number in the input fields and then click Check Answer remaining O Type here to search Sara yrequire this to be 1 of 1 (1 complete) Data Table Cash Merchandise Inventory Land Building Store Fixtures Accumulated Depreciation Dividends Payable Common Notes Payable Mortgages Payable Common Stock-$1 Par Value Paid-in Capital in Excess of Par-Common Paid-in Capital from Treasury Stock Transactions Retained Earnings Treasury Stock-tCommon Cash Dividends Sales Revenue Cost of Goods Sold Salaries Expense Payroll Tax Expense Utilitios Expense Depreciation Expense Warranty Expense income Tax Expense Accounts Payable Employee Income Taxes Payable FCA OASDI Taxes Payable FICA-Medicare Taxes Payable Employee Health Insurance Payable Federal Unemployment Taxes Payable State Unemployment Taxes Payable Income Tax Payable Sales Tax Payable Estimated Warranty Payable interest Payable Print Done Clear A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started