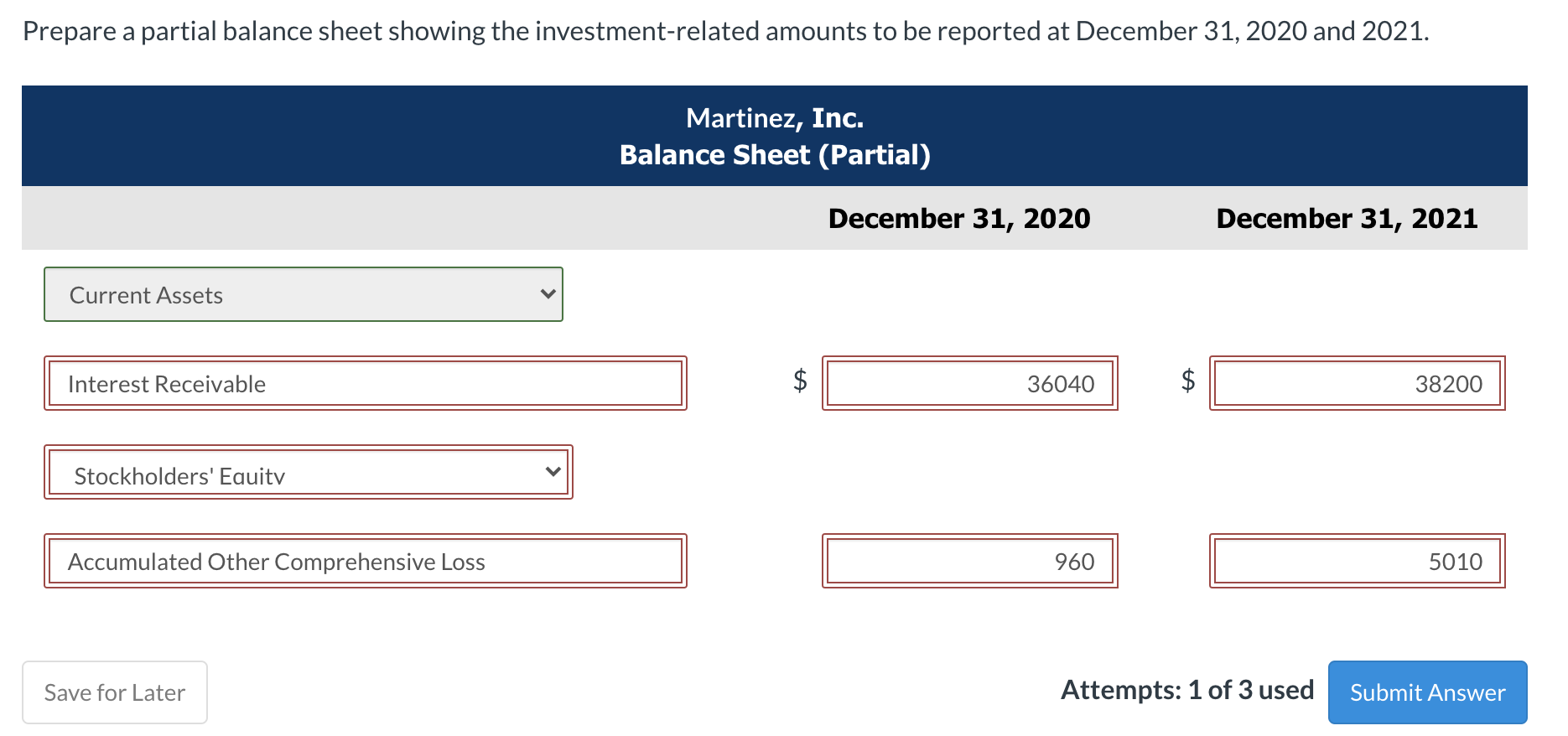

Prepare a partial balance sheet showing the investment-related amounts to be reported at December 31, 2020 and 2021.

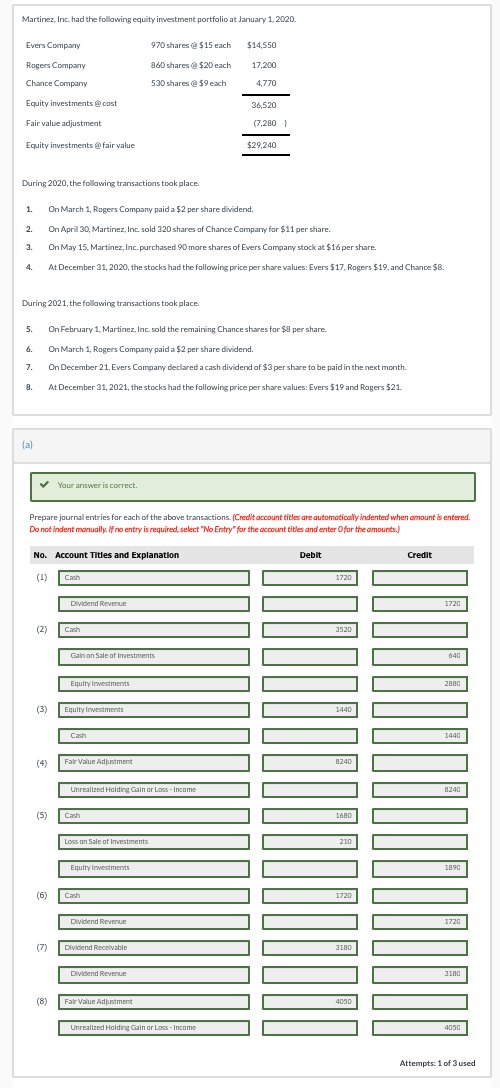

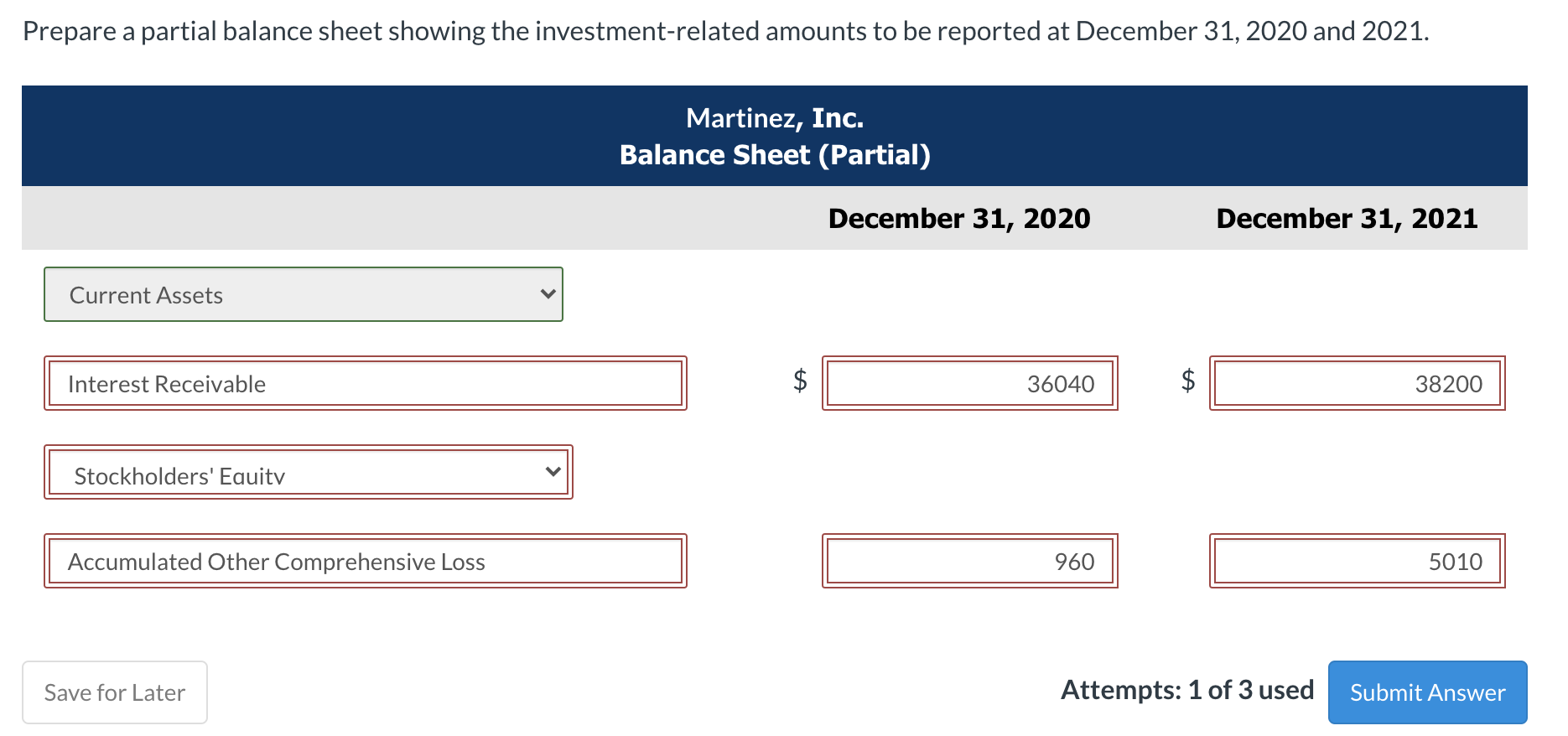

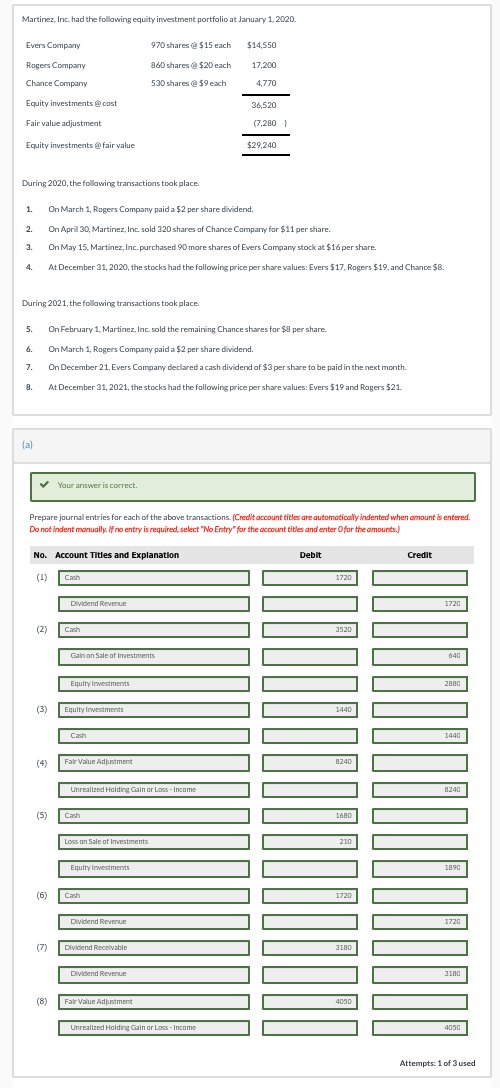

Martinez, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 970 shares @ $15 each $14,550 880 shares @ $20 each 17,200 Rogers Company Chance Company 530 shares @ $9 each 4,770 Equity investments cost 36,520 Fair value adjustment (7.280) Equity investments fair value $29,240 During 2020, the following transactions took place, 1. 2. On March 1, Rogers Company paid a $2 per share dividend. On April 30, Martinez, Inc. sold 320 shares of Chance Company for $11 per share. . On May 15, Martinez, Inc. purchased 90 more shares of Evers Company stock at $16 per share. At December 31, 2020, the stocks had the following price per share values: Evers $17, Rogers $19, and Chance $8. 3. 4. During 2021, the following transactions took place. 5. 6. On February 1, Martinez, Inc. sold the remaining Chance shares for $8 per share. On March 1, Rogers Company paid a $2 per share dividend. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month. . At December 31, 2021, the stocks had the following price per share values: Evers $19 and Rogers $21. 7. 9. (a) Your answer is correct. Prepare journal entries for each of the above transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) No. Account Titles and Explanation Debit Credit (1) Cash 1720 Dividend Revenue 1720 (2) ) Cash 3520 Gain on Sale of Investments 640 Equity Investments 2880 (3) Equity Investments 1440 Cash 1440 (4) Fair Value Adjustment 8240 Unrealized Holding Gain or Loss -Income 8240 (5) Cash 1680 Loss on Sale of Investments 210 Equity Investments 1890 (6) Cash 1720 Dividend Revenue 1720 (7) Dividend Receivable 3180 Dividend Revenue 3180 (8) ( Fair Value Adjustment 4050 Unrealized Holding Gain or Loss -Income 4050 Attempts: 1 of 3 used Prepare a partial balance sheet showing the investment-related amounts to be reported at December 31, 2020 and 2021. Martinez, Inc. Balance Sheet (Partial) December 31, 2020 December 31, 2021 Current Assets Interest Receivable $ 36040 $ ta 38200 Stockholders' Equity Accumulated Other Comprehensive Loss 960 5010 Save for Later Attempts: 1 of 3 used Submit