Question

Prepare a percentage of sales forecast for 2021. The CEO wants sales to increase in 2021 by 10%. The CEO feels that all expenses down

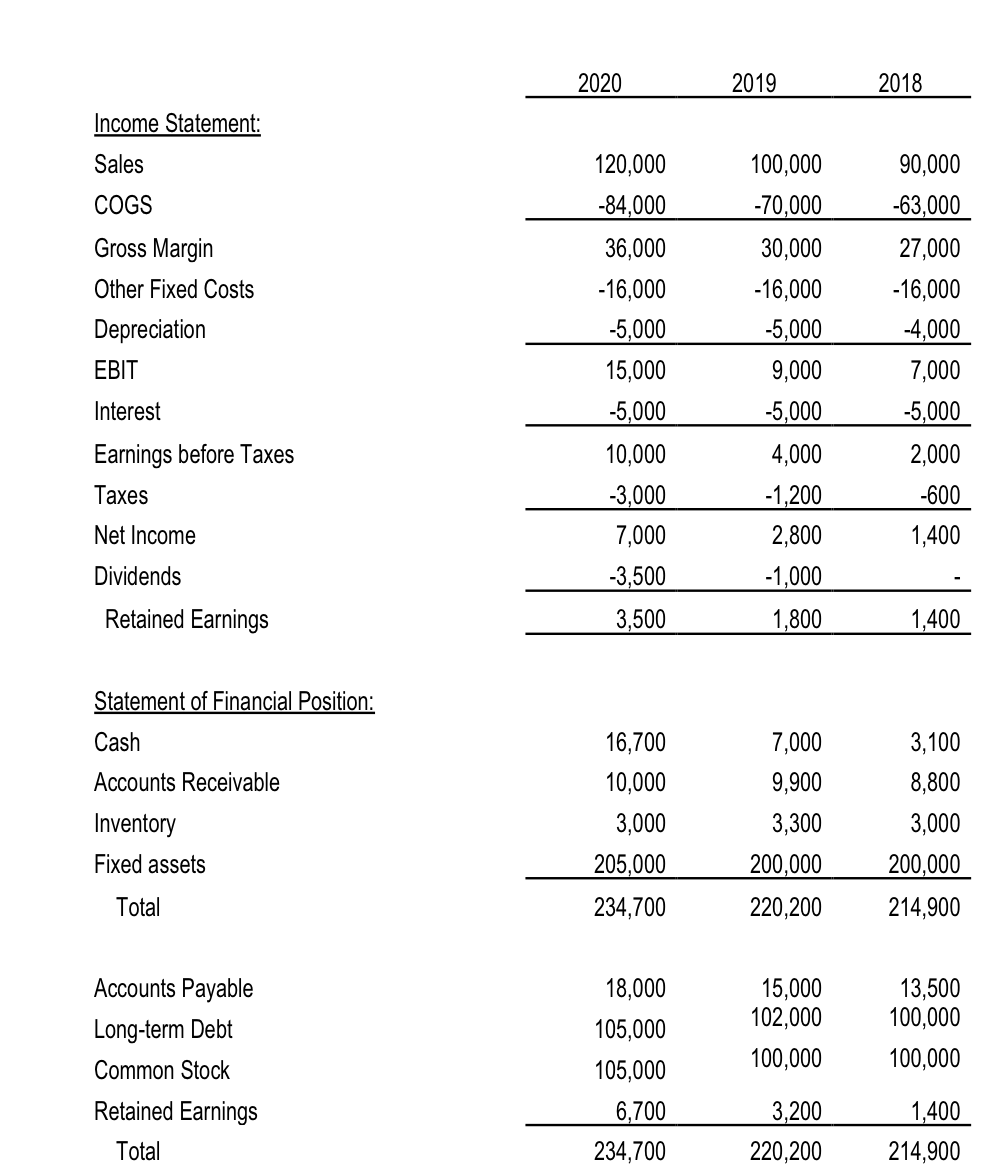

Prepare a percentage of sales forecast for 2021. The CEO wants sales to increase in 2021 by 10%. The CEO feels that all expenses down to Earnings before Taxes will increase using the 2020 percentage of sales. This includes COGS, Other Fixed Costs, Depreciation and Interest. Taxes are 30% of Earnings before Taxes and Dividends will remain 50% of Net Income. Assets and Accounts Payable for 2021 will be based on the 2020 percentages of sales. Common Stock will remain $105,000. The forecast will calculate the level of Long-term Debt and Retained Earnings. a. Will the company be able to finance the growth in 2021?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started