Question

Prepare a policy position that addresses the issue, Does it make sense to invest in the productivity improvements offered by the HR module? Suppose that

Prepare a policy position that addresses the issue, "Does it make sense to invest in the productivity improvements offered by the HR module?" Suppose that you apply the maximums to recruiting and training. Here are the costs: Recruiting costs per new worker are $5000. Each employee trains 80 hours per year at $20 per training hour Workforce complement increases by 4.2% to cover the 80 hours people are in training.

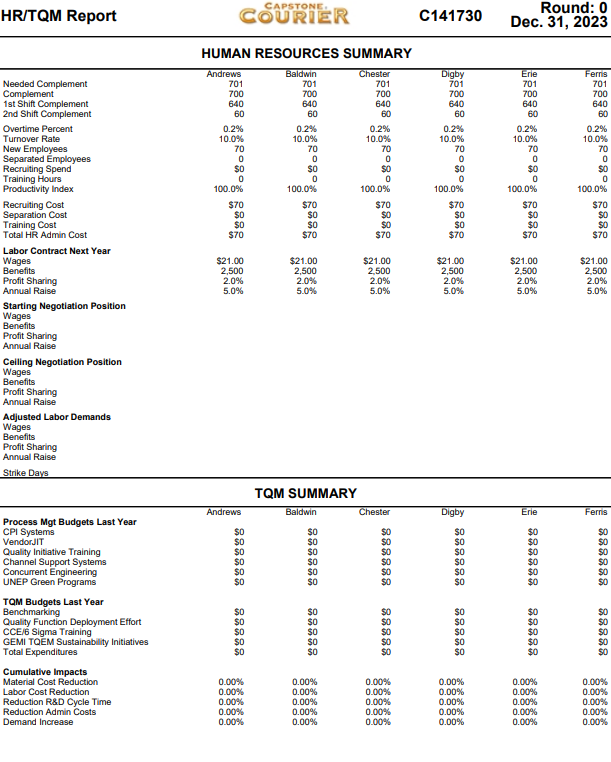

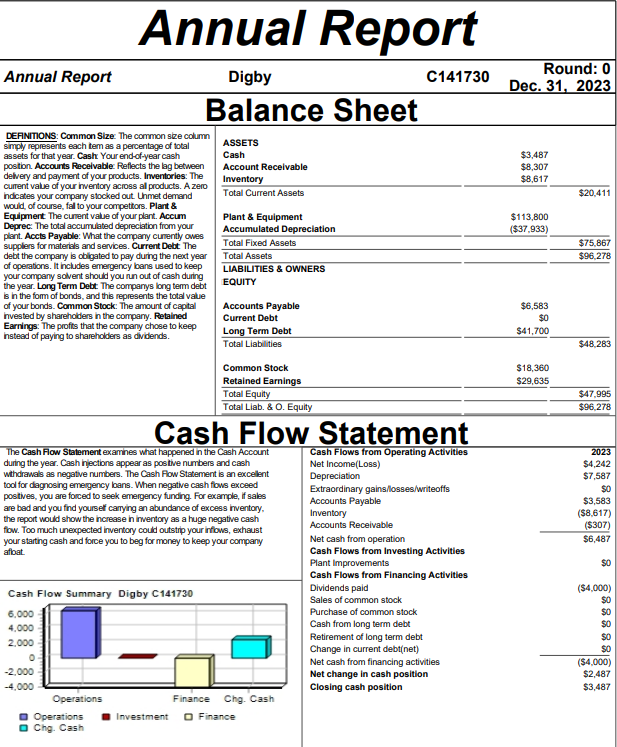

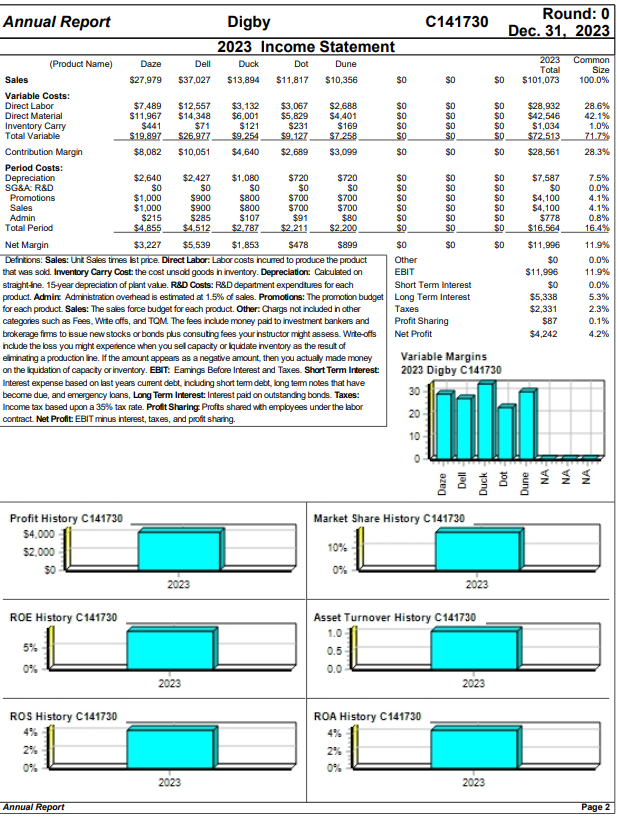

For this exercise you need a spreadsheet and both the Capstone Courier and Annual Report. Use the Round 0 reports for the analysis. Human Resources statistics like workforce complement and turnover are on Courier page 12.

Use Annual Report Income Statement's total Labor cost to estimate payroll costs. Assume the following productivity payoffs:

Round 1 - 102%

Round 2 - 105%

Round 3 - 108%

Round 4 - 112%

Round 5 - 115%

Round 6 - 118%

Therefore, in Round 6 each worker would be 1.18 times as effective as the beginning worker, and your workforce complement would fall to 1/1.18 or 85% of its current level.

For a quick evaluation, assume your total labor expenditure from the Annual Report Income Statement will stay flat for the next six years.

1. How much of a cost savings might you expect in the sixth year? For example, if the total labor costs on the Income Statement says $29M, and costs stay the same for six years, then in the last year your costs would fall to $29/1.18 M.

2. Apply the same approach to years one through five to get a total savings over time.

3. Would this justify the necessary expenditures in recruiting and training made over time? Assume a turnover of 10% and no increase in workforce size. Since you are sending workers to training for 80 hours or two weeks each year, you also need to expand the workforce enough to cover the workers that are in training. We are looking for a ballpark answer, not a precise answer, so that you can decide whether or not a payoff in HR productivity justifies the expense.

4. So far we have assumed our workforce and labor contracts are constant. In practice the market is growing at about 14%, and your labor contract has a 5% wage escalator. How does this affect the numbers?

5. At what level, if any, would you recommend that your company invest in recruiting and training? Are there any factors beyond the simple numbers that should be considered?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started