Prepare a policy position that addresses the issue, "Does it make sense to invest in the productivity improvements offered by the HR module?" Access the Spreadsheet in this weeks Resources titled Activity 3 ROI Analysis.

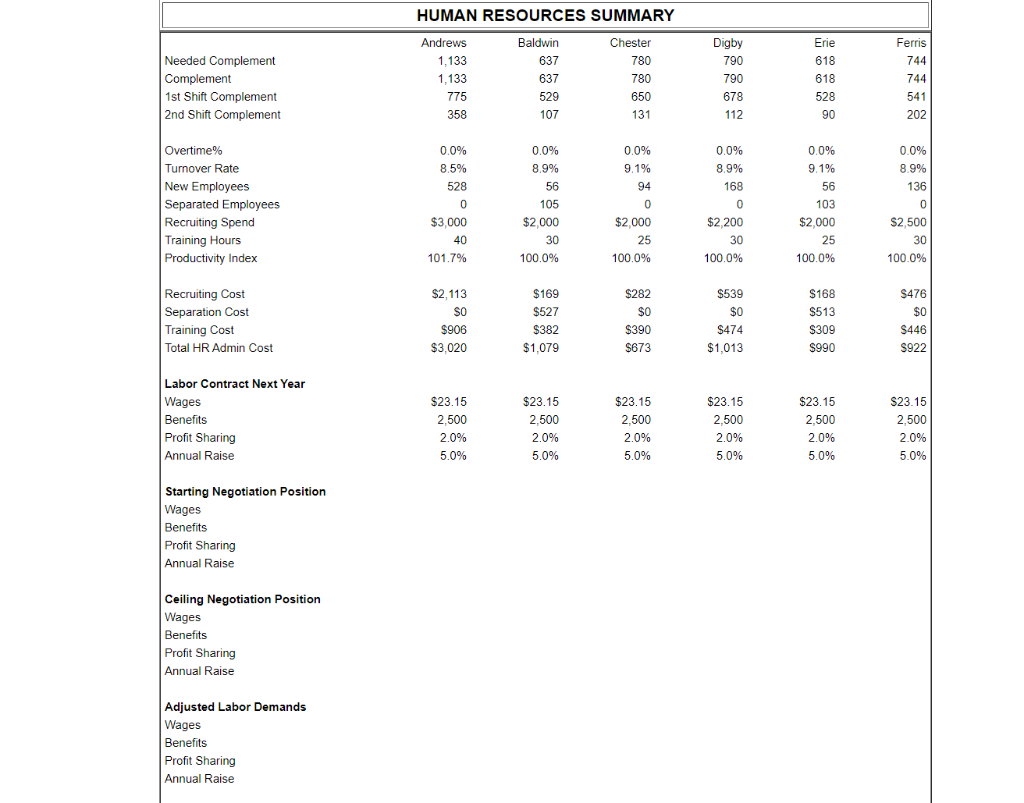

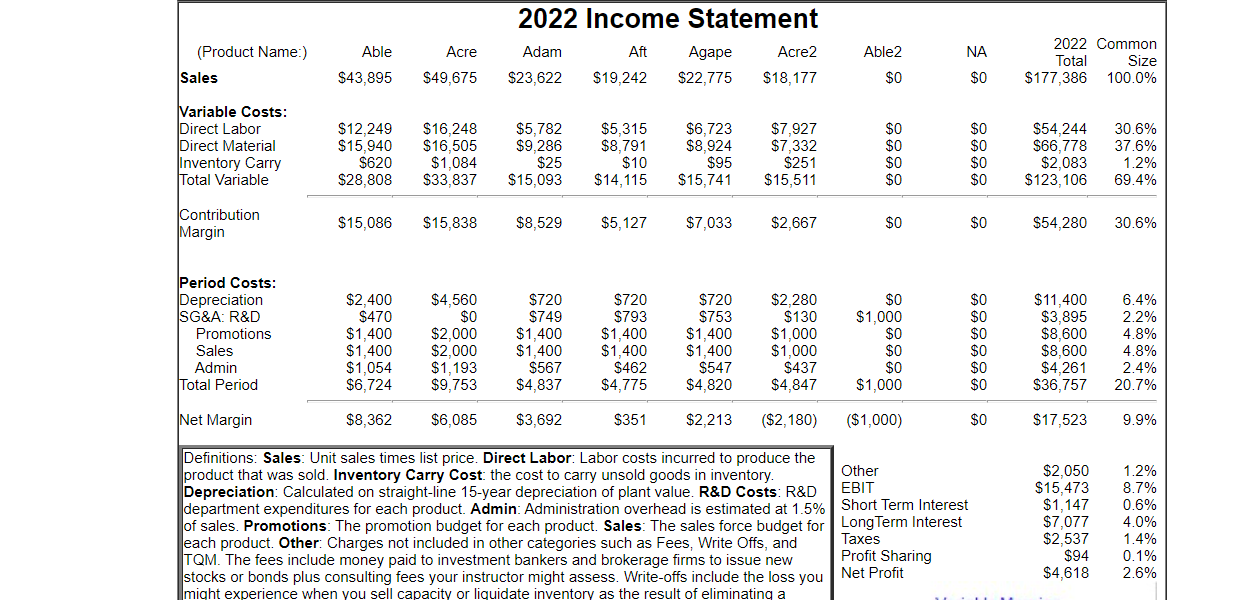

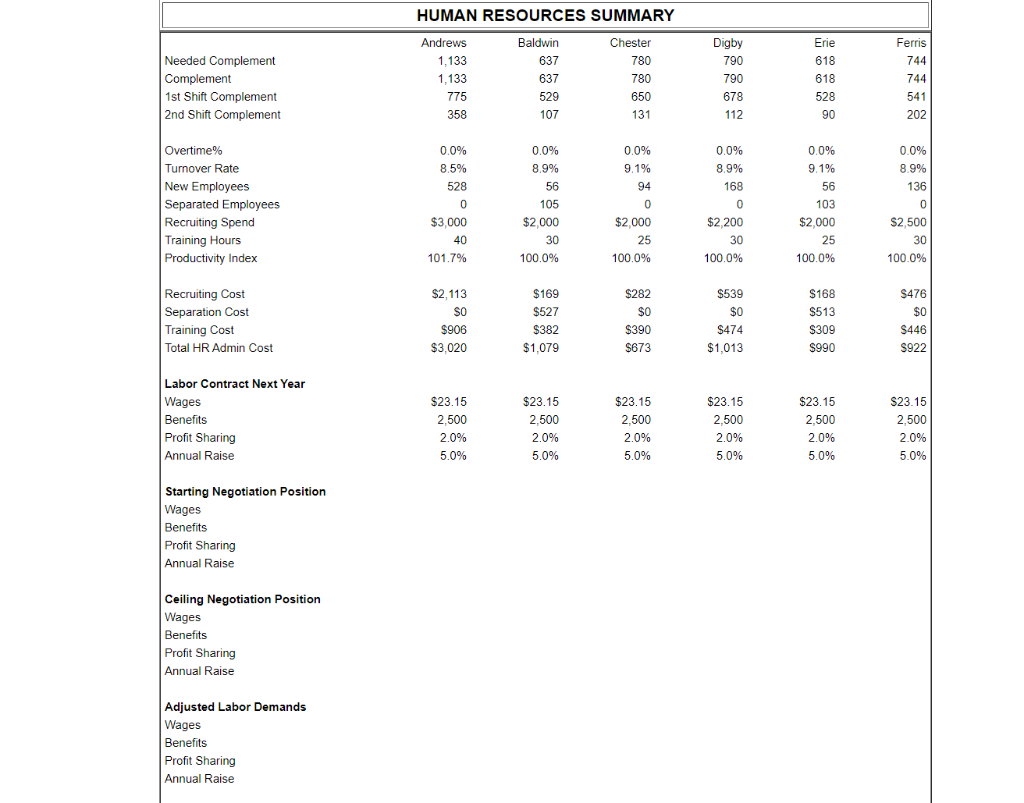

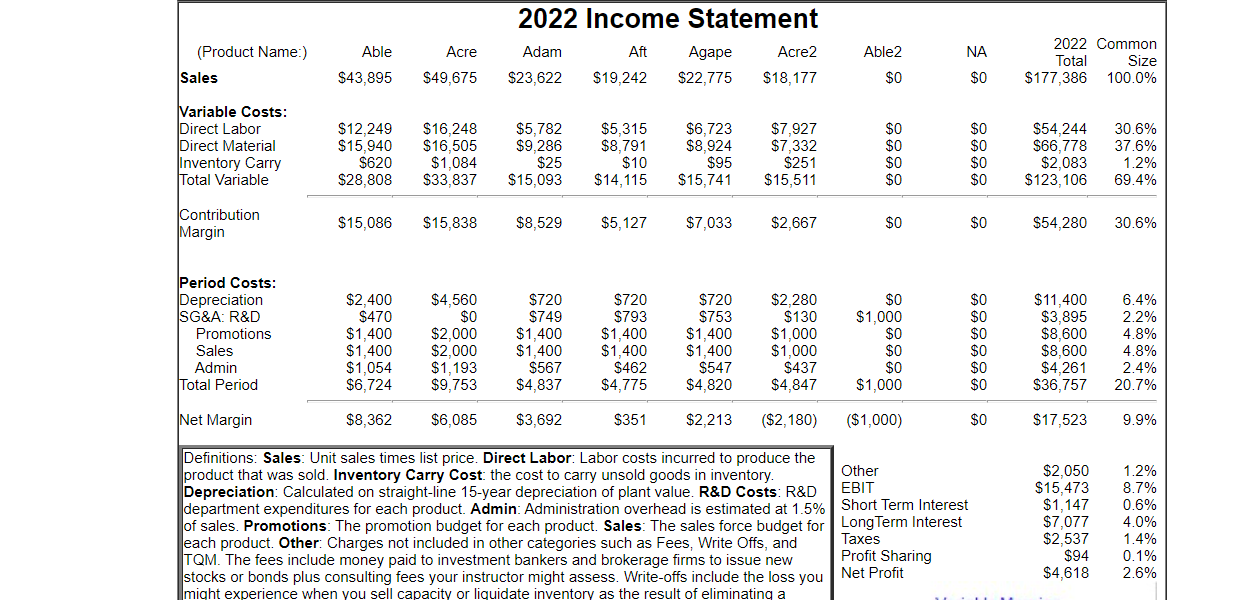

For this exercise, you need the spreadsheet and both the Capstone Courier and Annual Report. Use the Round 2 reports for the analysis. Human Resources statistics like workforce complement and turnover rate are on Courier page 12. Use Annual Report Income Statement's total Labor cost to estimate payroll costs.

Listed below are the assumptions for this exercise:

- These are the maximums for recruiting and training costs:

- Recruiting costs per new worker are $5000.

- Each employee trains 80 hours per year at $20 per training hour.

- Workforce complement increases by 4.2% to cover the 80 hours people are in training.

- Assume the following productivity payoffs:

- Round 2 - 102%

- Round 3 - 105%

- Round 4 - 108%

- Round 5 - 112%

- Round 6 - 115%

- Round 7 - 118%

Therefore, in Round 7 each worker would be 1.18 times as effective as the beginning worker, and your workforce complement would fall to 1/1.18 or 85% of its current level. For a quick evaluation, assume your total labor expenditure from the Annual Report Income Statement will stay flat for the next 6 years. Part 1: Using this weeks course readings and supplemental readings, summarize (1-2 paragraphs) the importance of reviewing ROI for investments in human resources

Part 2: How much of a cost savings might you expect in the seventh year? What are the savings for all 6 years? What are the Recruiting and Training costs? Would the total cost savings justify the necessary expenditures in recruiting and training made over time?

Part 3: Assume your turnover rate doubles and no increase in workforce size. Are the Recruitment and training costs still justified?

Length: 1 - 2 pages of analysis. Please submit a copy of your spreadsheet as well.

HUMAN RESOURCES SUMMARY Needed Complement Complement 1st Shift Complement 2nd Shift Complement Andrews 1,133 1.133 775 358 Baldwin 637 637 529 107 Chester 780 780 650 131 Digby 790 790 678 112 Erie 618 618 528 90 Ferris 744 744 541 202 Overtime% Turnover Rate New Employees Separated Employees Recruiting Spend Training Hours Productivity Index 0.0% 8.5% 528 0 $3,000 40 101.7% 0.0% 8.9% 56 105 $2,000 30 100.0% 0.0% 9.1% 94 0 $2.000 25 100.0% 0.0% 8.9% 168 0 $2,200 30 100.0% 0.0% 9.1% 56 103 $2.000 25 100.0% 0.0% 8.9% 136 0 $2,500 30 100.0% Recruiting Cost Separation Cost Training Cost Total HR Admin Cost $2,113 so $906 $3.020 $169 $527 $382 $1.079 $282 SO $390 $ $673 $539 $0 $474 $1,013 $168 $513 $309 $ $990 $476 $0 $446 S922 $23.15 Labor Contract Next Year Wages Benefits Profit Sharing Annual Raise $23.15 2.500 2.0% 5.0% $23.15 2.500 2.0% 5.0% $23.15 2,500 2.09 5.0% $23.15 2,500 2.0% 5.0% 2,500 2.0% 5.0% $23.15 2,500 2.0% 5.0% Starting Negotiation Position Wages Benefits Profit Sharing Annual Raise Ceiling Negotiation Position Wages Benefits Profit Sharing Annual Raise Adjusted Labor Demands Wages Benefits Profit Sharing Annual Raise 2022 Income Statement Able Adam Aft Acre2 Able2 NA (Product Name:) Sales Acre $49,675 Agape $22,775 2022 Common Total Size $177,386 100.0% $43,895 $23.622 $19,242 $18,177 $0 $0 Variable Costs: Direct Labor Direct Material Inventory Carry Total Variable $12,249 $15.940 $620 $28,808 $16,248 $16.505 $1,084 $33,837 $5,782 $9.286 $25 $15,093 $5,315 $8,791 $10 $14.115 $6,723 $8,924 $95 $15,741 $7,927 $7.332 $251 $15,511 $0 $0 $0 $0 $54,244 $66.778 $2,083 $123,106 30.6% 37.6% 1.2% 69.4% Contribution Margin $15,086 $15,838 $8,529 $5,127 $7,033 $2,667 $0 $0 $54,280 30.6% Period Costs: Depreciation SG&A: R&D Promotions Sales Admin Total Period $2.400 $470 $1,400 $1,400 $1,054 $6,724 $4,560 $0 $2,000 $2,000 $1,193 $9,753 $720 $749 $1,400 $1,400 $567 $4,837 $720 $793 $1,400 $1,400 $462 $4,775 $720 $753 $1,400 $1,400 $547 $4,820 $2.280 $130 $1,000 $1,000 $437 $4,847 $0 $1,000 $0 $0 $0 $1,000 $0 $0 $0 $0 $0 $0 $11,400 $3,895 $8,600 $8,600 $4,261 $36,757 6.4% 2.2% 4.8% 4.8% 2.4% 20.7% Net Margin $8,362 $6,085 $3,692 $351 $2,213 ($2,180) ($1,000) $0 $17,523 9.9% Definitions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost: the cost to carry unsold goods in inventory. Other Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D EBIT department expenditures for each product. Admin: Administration overhead is estimated at 1.5% Short Term Interest of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for Long Term Interest each product. Other: Charges not included in other categories such as Fees, Write Offs, and Taxes TQM. The fees include money paid to investment bankers and brokerage firms to issue new Profit Sharing stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you Net Profit might experience when you sell capacity or liquidate inventory as the result of eliminating a $2,050 $15,473 $1,147 $7,077 $2,537 $94 $4,618 1.2% 8.7% 0.6% 4.0% 1.4% 0.1% 2.6% HUMAN RESOURCES SUMMARY Needed Complement Complement 1st Shift Complement 2nd Shift Complement Andrews 1,133 1.133 775 358 Baldwin 637 637 529 107 Chester 780 780 650 131 Digby 790 790 678 112 Erie 618 618 528 90 Ferris 744 744 541 202 Overtime% Turnover Rate New Employees Separated Employees Recruiting Spend Training Hours Productivity Index 0.0% 8.5% 528 0 $3,000 40 101.7% 0.0% 8.9% 56 105 $2,000 30 100.0% 0.0% 9.1% 94 0 $2.000 25 100.0% 0.0% 8.9% 168 0 $2,200 30 100.0% 0.0% 9.1% 56 103 $2.000 25 100.0% 0.0% 8.9% 136 0 $2,500 30 100.0% Recruiting Cost Separation Cost Training Cost Total HR Admin Cost $2,113 so $906 $3.020 $169 $527 $382 $1.079 $282 SO $390 $ $673 $539 $0 $474 $1,013 $168 $513 $309 $ $990 $476 $0 $446 S922 $23.15 Labor Contract Next Year Wages Benefits Profit Sharing Annual Raise $23.15 2.500 2.0% 5.0% $23.15 2.500 2.0% 5.0% $23.15 2,500 2.09 5.0% $23.15 2,500 2.0% 5.0% 2,500 2.0% 5.0% $23.15 2,500 2.0% 5.0% Starting Negotiation Position Wages Benefits Profit Sharing Annual Raise Ceiling Negotiation Position Wages Benefits Profit Sharing Annual Raise Adjusted Labor Demands Wages Benefits Profit Sharing Annual Raise 2022 Income Statement Able Adam Aft Acre2 Able2 NA (Product Name:) Sales Acre $49,675 Agape $22,775 2022 Common Total Size $177,386 100.0% $43,895 $23.622 $19,242 $18,177 $0 $0 Variable Costs: Direct Labor Direct Material Inventory Carry Total Variable $12,249 $15.940 $620 $28,808 $16,248 $16.505 $1,084 $33,837 $5,782 $9.286 $25 $15,093 $5,315 $8,791 $10 $14.115 $6,723 $8,924 $95 $15,741 $7,927 $7.332 $251 $15,511 $0 $0 $0 $0 $54,244 $66.778 $2,083 $123,106 30.6% 37.6% 1.2% 69.4% Contribution Margin $15,086 $15,838 $8,529 $5,127 $7,033 $2,667 $0 $0 $54,280 30.6% Period Costs: Depreciation SG&A: R&D Promotions Sales Admin Total Period $2.400 $470 $1,400 $1,400 $1,054 $6,724 $4,560 $0 $2,000 $2,000 $1,193 $9,753 $720 $749 $1,400 $1,400 $567 $4,837 $720 $793 $1,400 $1,400 $462 $4,775 $720 $753 $1,400 $1,400 $547 $4,820 $2.280 $130 $1,000 $1,000 $437 $4,847 $0 $1,000 $0 $0 $0 $1,000 $0 $0 $0 $0 $0 $0 $11,400 $3,895 $8,600 $8,600 $4,261 $36,757 6.4% 2.2% 4.8% 4.8% 2.4% 20.7% Net Margin $8,362 $6,085 $3,692 $351 $2,213 ($2,180) ($1,000) $0 $17,523 9.9% Definitions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost: the cost to carry unsold goods in inventory. Other Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D EBIT department expenditures for each product. Admin: Administration overhead is estimated at 1.5% Short Term Interest of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for Long Term Interest each product. Other: Charges not included in other categories such as Fees, Write Offs, and Taxes TQM. The fees include money paid to investment bankers and brokerage firms to issue new Profit Sharing stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you Net Profit might experience when you sell capacity or liquidate inventory as the result of eliminating a $2,050 $15,473 $1,147 $7,077 $2,537 $94 $4,618 1.2% 8.7% 0.6% 4.0% 1.4% 0.1% 2.6%