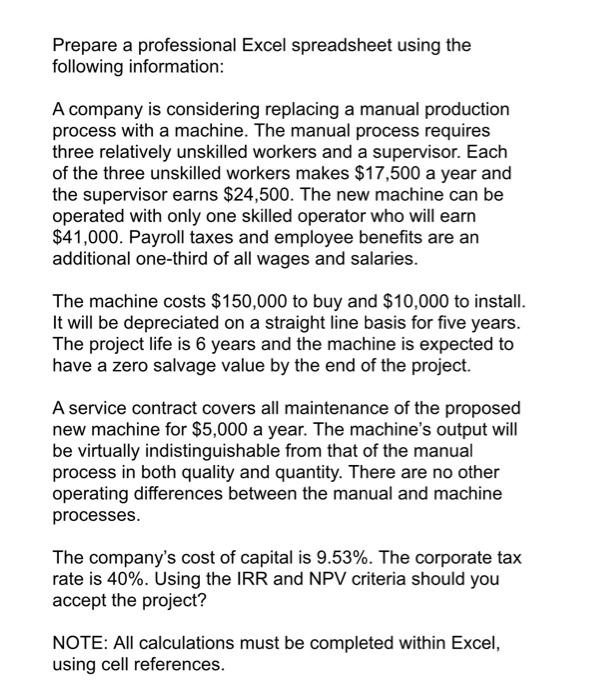

Prepare a professional Excel spreadsheet using the following information: A company is considering replacing a manual production process with a machine. The manual process requires three relatively unskilled workers and a supervisor. Each of the three unskilled workers makes $17,500 a year and the supervisor earns $24,500. The new machine can be operated with only one skilled operator who will earn $41,000. Payroll taxes and employee benefits are an additional one-third of all wages and salaries. The machine costs $150,000 to buy and $10,000 to install. It will be depreciated on a straight line basis for five years. The project life is 6 years and the machine is expected to have a zero salvage value by the end of the project. A service contract covers all maintenance of the proposed new machine for $5,000 a year. The machine's output will be virtually indistinguishable from that of the manual process in both quality and quantity. There are no other operating differences between the manual and machine processes. The company's cost of capital is 9.53%. The corporate tax rate is 40%. Using the IRR and NPV criteria should you accept the project? NOTE: All calculations must be completed within Excel, using cell references. Prepare a professional Excel spreadsheet using the following information: A company is considering replacing a manual production process with a machine. The manual process requires three relatively unskilled workers and a supervisor. Each of the three unskilled workers makes $17,500 a year and the supervisor earns $24,500. The new machine can be operated with only one skilled operator who will earn $41,000. Payroll taxes and employee benefits are an additional one-third of all wages and salaries. The machine costs $150,000 to buy and $10,000 to install. It will be depreciated on a straight line basis for five years. The project life is 6 years and the machine is expected to have a zero salvage value by the end of the project. A service contract covers all maintenance of the proposed new machine for $5,000 a year. The machine's output will be virtually indistinguishable from that of the manual process in both quality and quantity. There are no other operating differences between the manual and machine processes. The company's cost of capital is 9.53%. The corporate tax rate is 40%. Using the IRR and NPV criteria should you accept the project? NOTE: All calculations must be completed within Excel, using cell references