Answered step by step

Verified Expert Solution

Question

1 Approved Answer

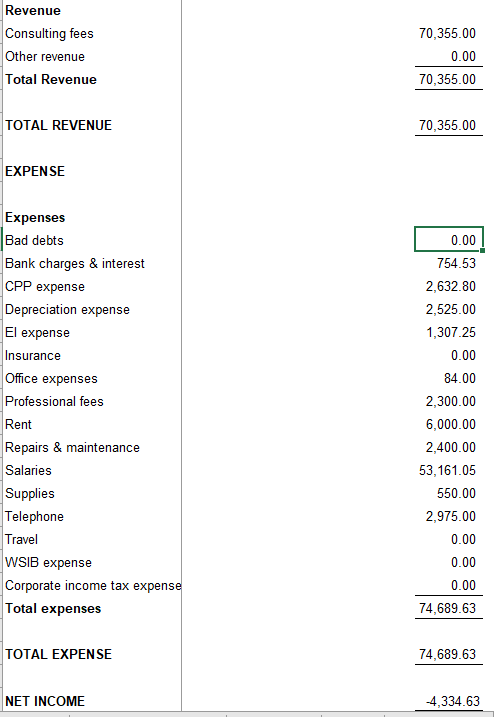

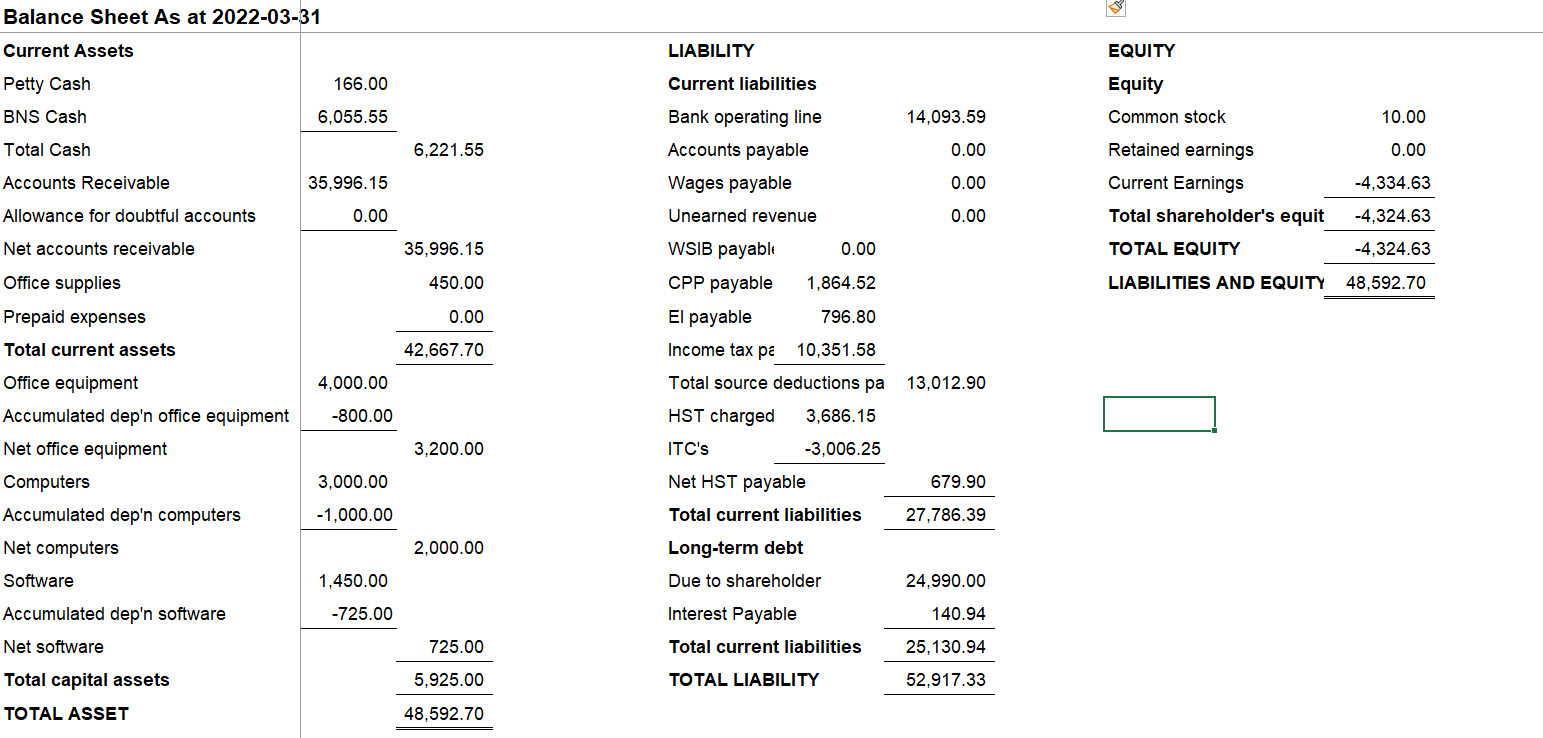

Prepare a Pro-forma income statement, and balance sheet and cash budget statement , for your company, on a monthly bases for the 2 nd quarter,

- Prepare a Pro-forma income statement, and balance sheet and cash budget statement , for your company, on a monthly bases for the 2nd quarter, and a total column for the quarter, based on the following assumptions:

- Sales will increase by 50% over Q1 and are equally spread out over the 3 months. All sales are on credit. The collection pattern is 20% in the month of sale, 50% in the month following sale and the balance in the 2nd month following sale.

- All of the A/R outstanding at March 31st will be received in the 2nd quarter as follows; 80% in April and the balance in May.

- The employees will be the four employees who worked on the March 31st payroll (in Assignment 2). Their wages and source deductions remain the same. Source deductions must be paid on the 15th of the following month.

- Rent will be the same; telephone expense which will be $800 per month (+HST).

- The business will buy computer equipment on April 1 for $1,000 plus HST.

- HST is paid on the 15th of the month following the end of the quarter.

- Accrued interest will be paid on April 1st and interest will have to be accrued monthly. It will be paid on July 2nd. Bank charges paid to the bank are $200 per month.

- Office expenses will be $100 per month, plus HST.

- Depreciation expense will have to be calculated monthly.

- Supplies of $200 (plus HST) per month will be purchased as they are used.

- The prepaid airline ticket will be used in May.

- Monthly maintenance is $800 per month + HST

- There are no professional fees incurred in this quarter.

- Ignore WSIB expense and income tax expense

- When preparing your cash budget, there is no minimum cash balance required.

-

Must complete a budgeted income statement, cash budget and proforma balance sheet for all 3 months plus a total column for the quarter. You do not need a total column for the Balance Sheet.

You MUST have a separate data sheet that includes all your calculations. You must use formulae wherever possible.

Must complete a budgeted income statement, cash budget and proforma balance sheet for all 3 months plus a total column for the quarter. You do not need a total column for the Balance Sheet.

You MUST have a separate data sheet that includes all your calculations. You must use formulae wherever possible.

Remember that you have to keep track of HST charged on sales and HST paid on purchases.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started