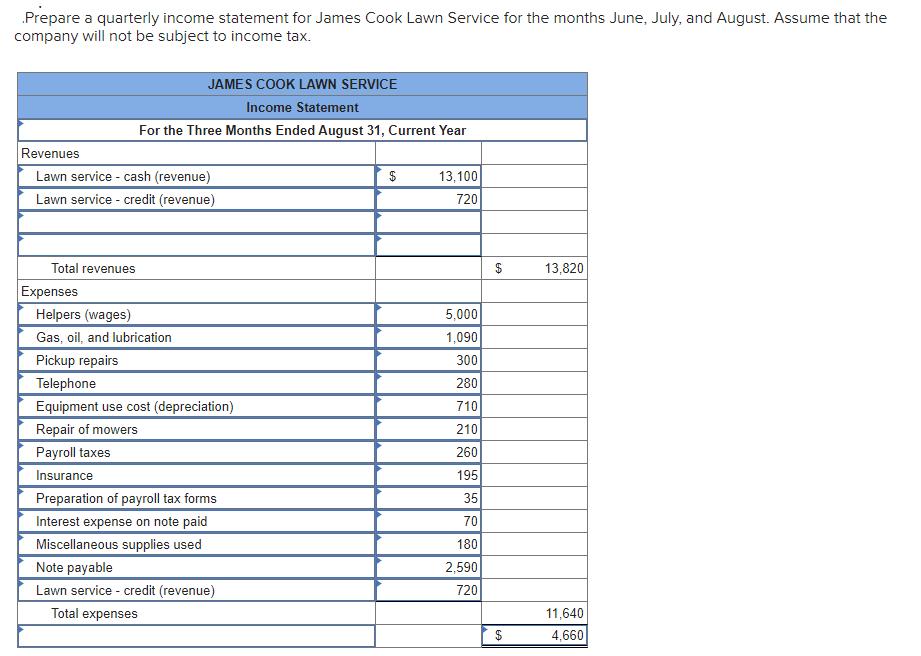

Prepare a quarterly income statement for James Cook Lawn Service for the months June, July, and August. Assume that the company will not be

Prepare a quarterly income statement for James Cook Lawn Service for the months June, July, and August. Assume that the company will not be subject to income tax. Revenues Lawn service - cash (revenue) Lawn service - credit (revenue) Total revenues Expenses JAMES COOK LAWN SERVICE Income Statement For the Three Months Ended August 31, Current Year Helpers (wages) Gas, oil, and lubrication Pickup repairs Telephone Equipment use cost (depreciation) Repair of mowers Payroll taxes Insurance Preparation of payroll tax forms Interest expense on note paid Miscellaneous supplies used Note payable Lawn service - credit (revenue) Total expenses $ 13,100 720 5,000 1,090 300 280 710 210 260 195 35 70 180 2,590 720 $ 69 $ 13,820 11,640 4,660

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started