Question

Prepare a report for Diane. For simplicity, ignore any financial reporting issues related to the (bifurication) splitting up/division of the debt and equity components of

Prepare a report for Diane. For simplicity, ignore any financial reporting issues related to the (bifurication) splitting up/division of the debt and equity components of the convertible bond. Specifically, your report should include

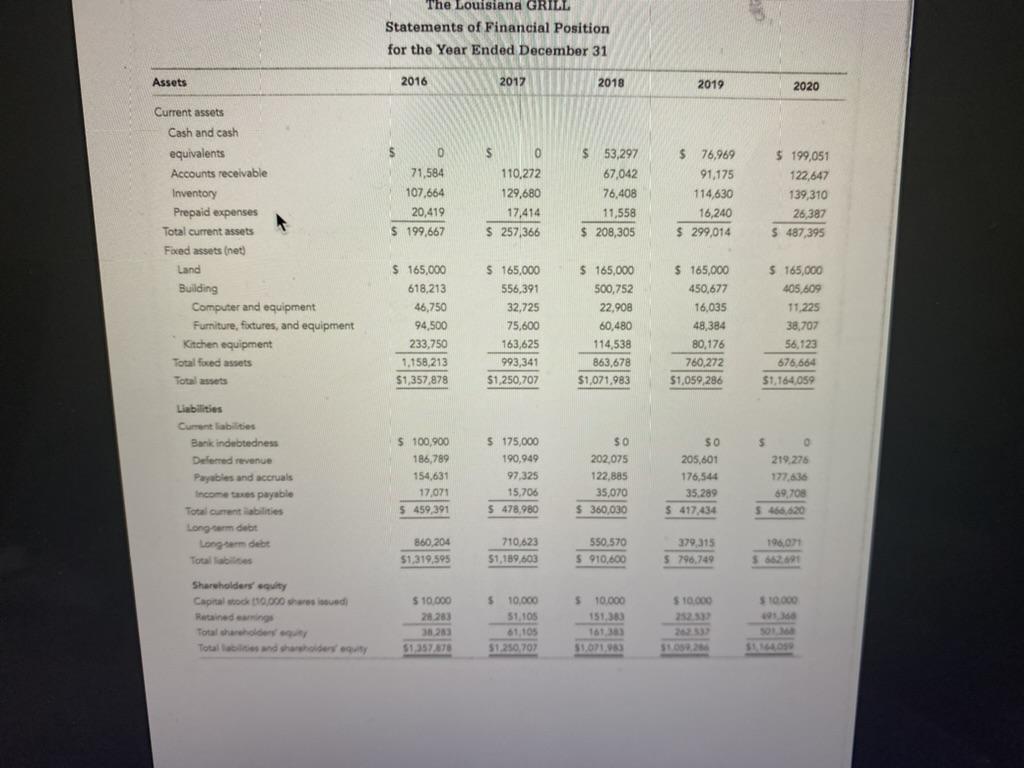

Preparation and analysis of the statement of cash flows;

Compute and interpret component percentages; Compute and interpret profitability, liquidity, and solvency ratios;

Using the financial statements and the results of your work in points 1 to 3 above conclude if strategic plans for Louisiana Grill are consistent with your analysis of the financial statements. Are the plans feasible (why or why not)?

The Louisiana Grill The Louisiana Grill (TLG) is a restaurant in Toronto. TLG is a regional restaurant created and operated by Alex Ven- tresca, a former football player from New Orleans. The company was established in 2016 and has experienced steady revenue growth since inception. The restaurant's success can be attributed to its variety of dishes. Currently, there is only one restaurant, which is located in downtown Toronto. Alex is looking to expand the busi- ness by opening another restaurant in Mississauga. Ontario. Alex estimates that it will cost upward of $1 million to open a new location. Alex has approached Diane Drapeau, a managing partner at a venture capital firm, about the potential opportunity. Alex has proposed two alternatives to finance the new restaurant: 1. Extend credit to the business: Lend TLG $1 million in debt financing. The bond would be secured by the building and equipment purchased with the funds. Alex would like the interest to accrue at 5% per annum. with the loan repayable with blended monthly payments over a five-year term. In exchange for the low interest rate, the bond will be convertible in common shares at the rate of nine common shares per $1,000. 2. Purchase an ownership interest: Purchase 10,000 shares in the business (50% interest). The funds will be used to start up the new location. Depending on the purchase price, any deficiency in the funds required will be obtained through traditional bank financing. Of course, Alex is aware of the fact that Diane can choose neither of the options and walk away from the opportunity. In order to help make a decision, Alex has provided Diane with TLG's historical income statements and statements of financial position since inception (Exhibit I). In addition, Diane had a long discussion with Alex. (Notes from the meeting are in Exhibit II.) Diane has asked you, a newly hired junior analyst, to prepare a preliminary report that provides a recommended course of action. Your report should be based on a thorough analysis of TLG's historical financial performance. As it is one of your first assignments, Diane reminds you that a well-prepared report of this nature should include, at minimum, the following: The preparation and analysis of the statement of cash flows for the five-year period . An analysis of financial ratios and common-sized financial statements . A preliminary valuation of the common shares (note that a common share earnings multiple for similar franchise restaurants ranges from 4 to 6 times normalized net income) . Based on the estimated share value, the value of the conversion feature over the life of the bond A comparison of the rate of return on the equity versus debt investment. Required Prepare the report for Diane. For simplicity, ignore any financial reporting issues related to the bifurcation of the debt and equity components of the convertible bond.

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 The statements of cash flows for the fiveyear period show that Louisiana Grill has had positive cash flows from operating activities in each year ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started