Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABE plc sells only one product and in 2006, 10 000 units were sold. During 2007, the unit sales increased to 16 000 units

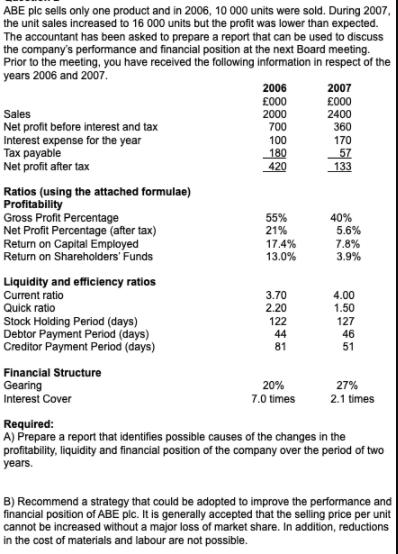

ABE plc sells only one product and in 2006, 10 000 units were sold. During 2007, the unit sales increased to 16 000 units but the profit was lower than expected. The accountant has been asked to prepare a report that can be used to discuss the company's performance and financial position at the next Board meeting. Prior to the meeting, you have received the following information in respect of the years 2006 and 2007. 2006 2007 000 000 2400 Sales 2000 Net profit before interest and tax Interest expense for the year x ayabie Net profit after tax 700 360 100 180 420 170 57 133 Ratios (using the attached formulae) Profitability Gross Profit Percentage Net Profit Percentage (after tax) Return on Capital Employed Return on Shareholders' Funds 55% 21% 17.4% 13.0% 40% 5.6% 7.8% 3.9% Liquidity and efficiency ratios Current ratio 4.00 1.50 3.70 Quick ratio 2.20 Stock Holding Period (days) Debtor Payment Period (days) Creditor Payment Period (days) 122 44 81 127 46 51 Financial Structure Gearing Interest Cover 27% 20% 7.0 times 2.1 times Required: A) Prepare a report that identifies possible causes of the changes in the profitability, liquidity and financial position of the company over the period of two years. B) Recommend a strategy that could be adopted to improve the performance and financial position of ABE plc. It is generally accepted that the selling price per unit cannot be increased without a major loss of market share. In addition, reductions in the cost of materials and labour are not possibie.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation ABE PLS Report on financial analysis for the year 2007 The following are the net results for the year 2007 000 2006000 Sales 2400 2000 Net profit before interest and tax 360 700 Net ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started