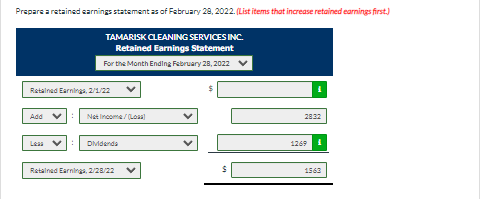

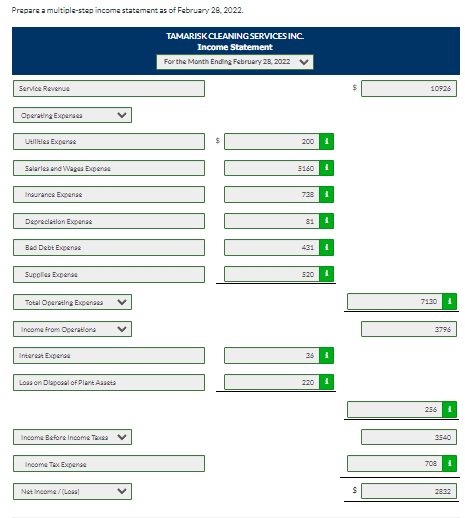

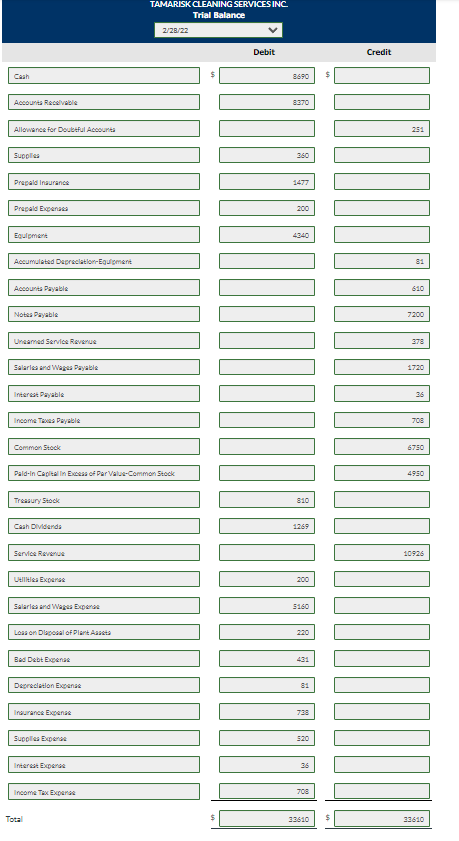

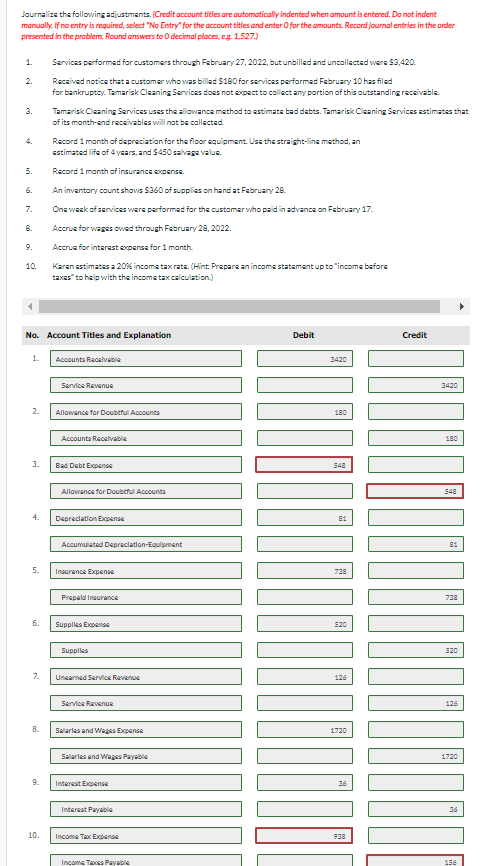

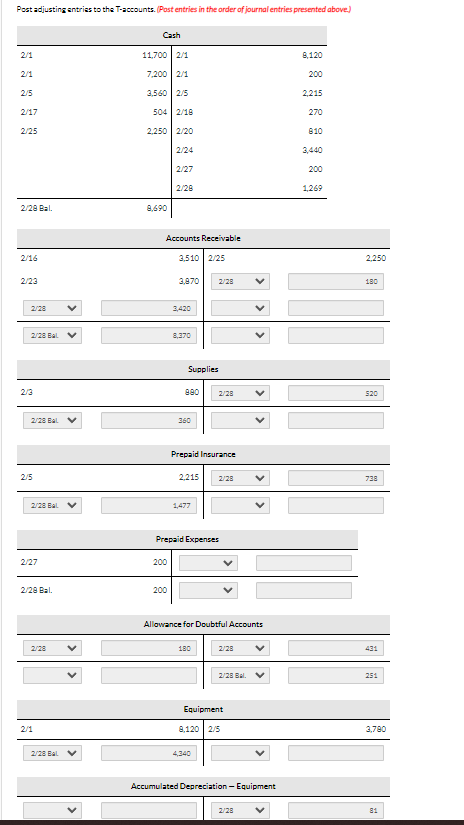

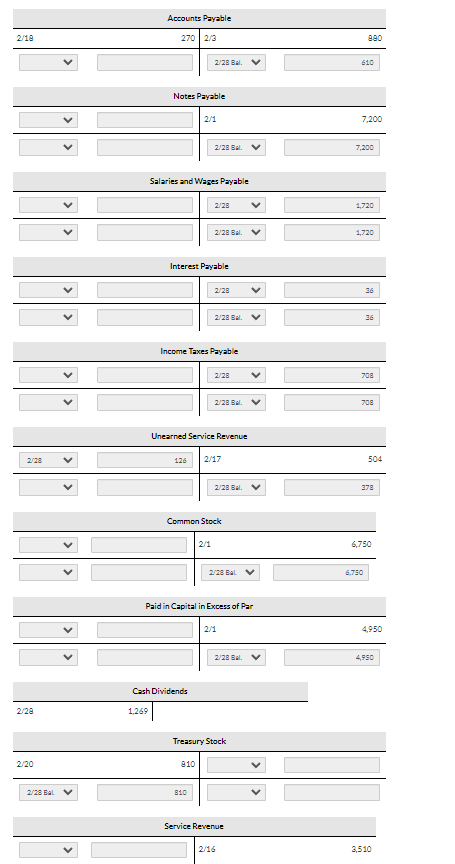

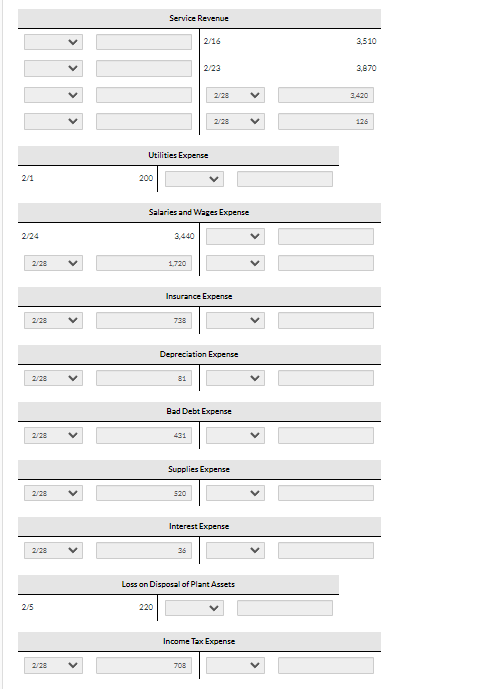

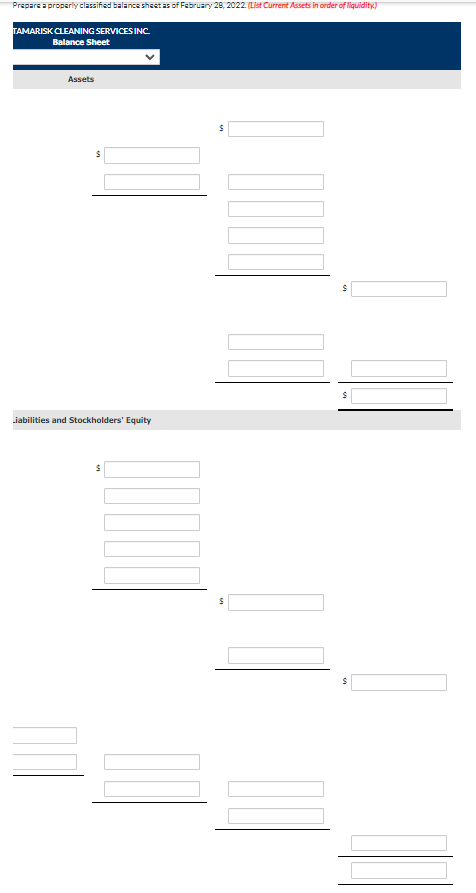

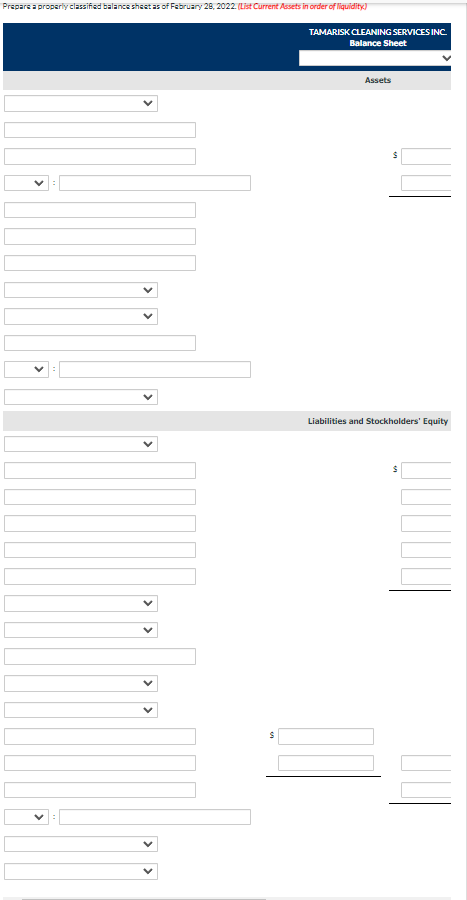

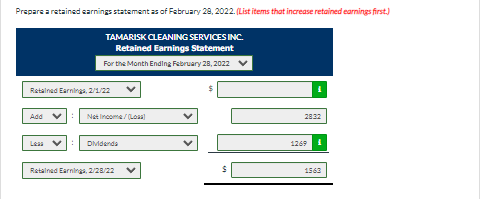

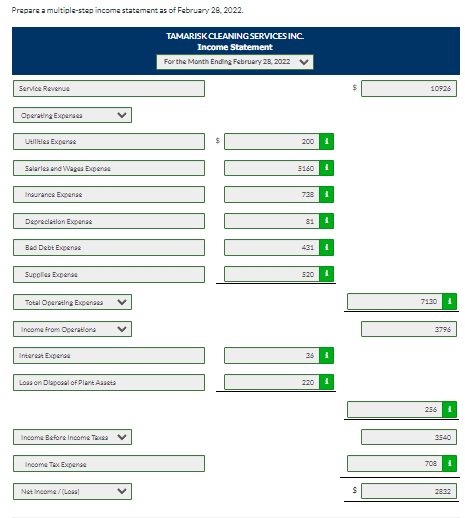

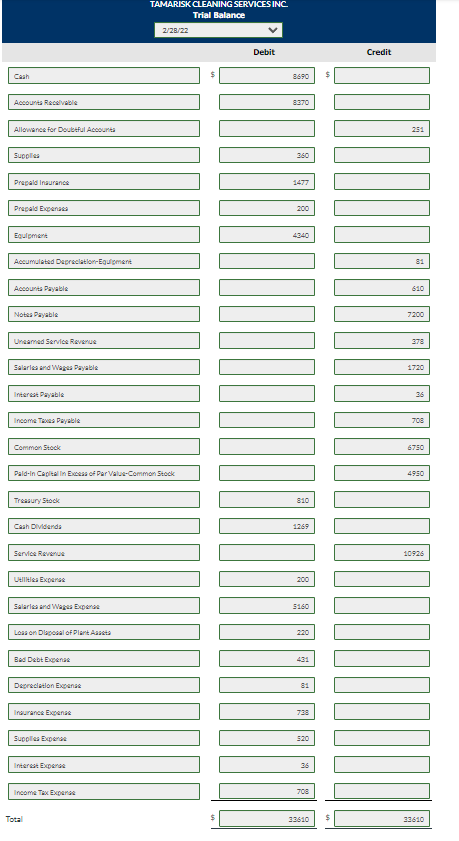

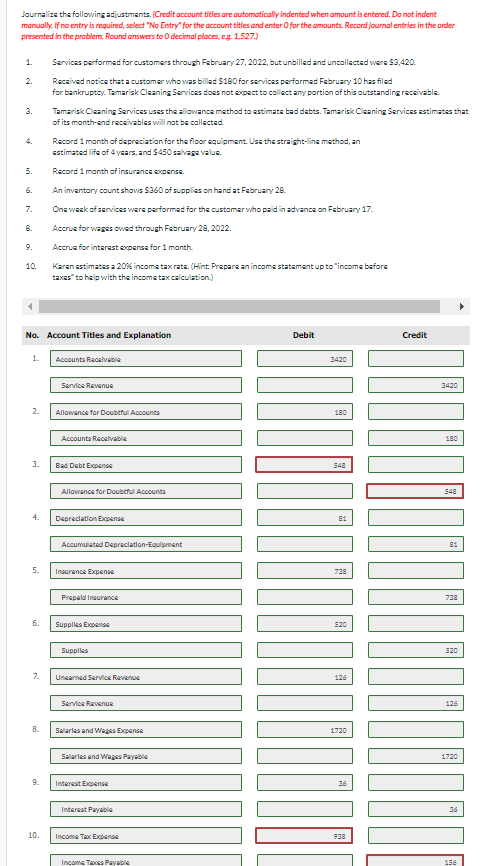

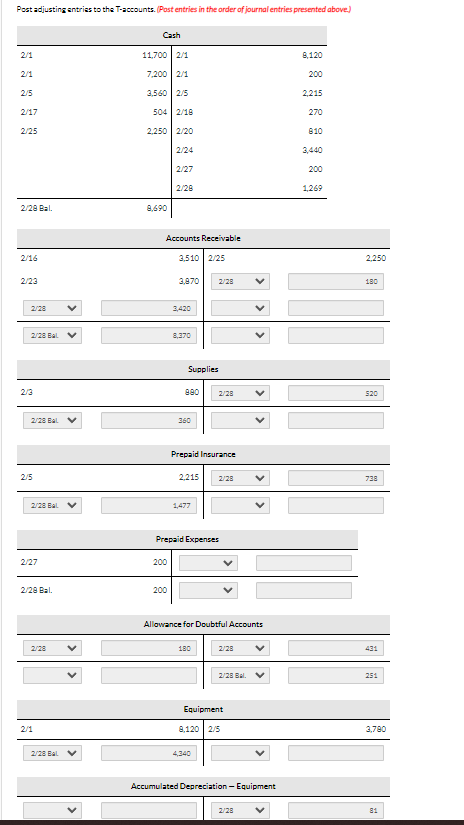

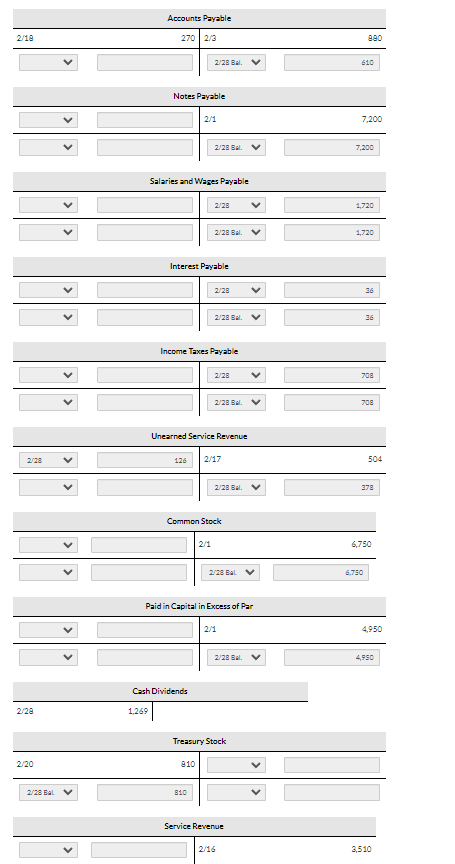

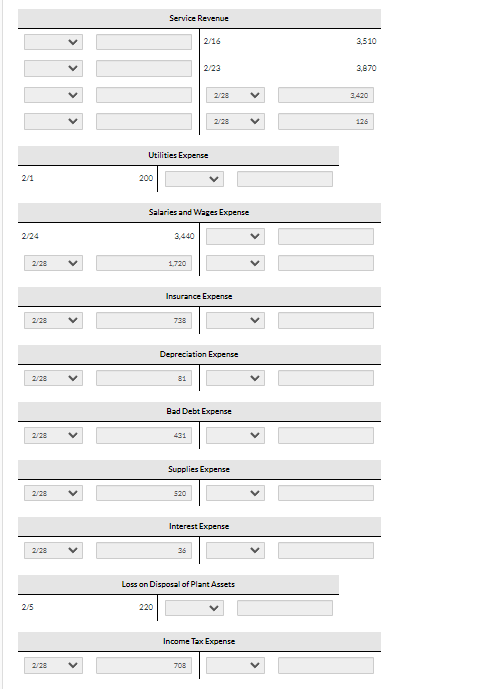

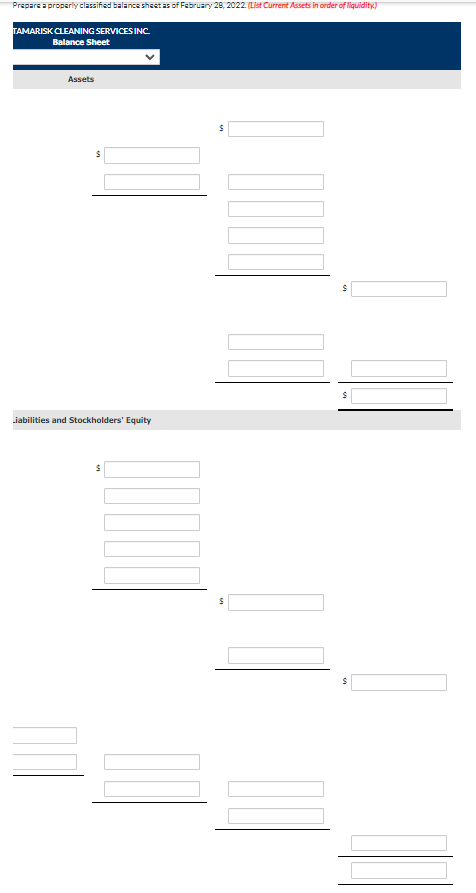

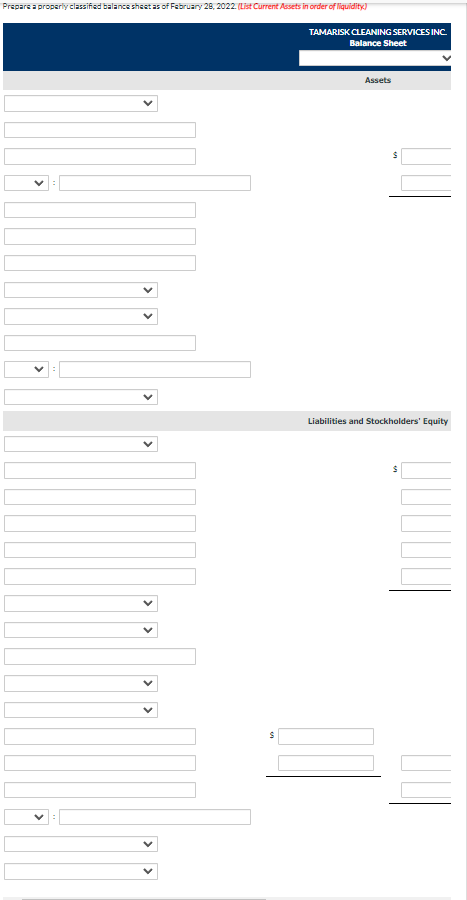

Prepare a retained earnings statements of February 20, 2022. List items that increase retained earnings first) TAMARISK CLEANING SERVICES INC. Retained Earnings Statement For the Month Ending February 28, 2022 V Retained Earnings, 2/1/22 Net Income /( Las 2832 Las V DMdende 1269 Retained Earnings, 2/28/22 1963 Prepare a multiple-step income statement as of February 28, 2022. TAMARISK CLEANING SERVICES INC Income Statement For the Month Ending February 28, 2022 Service Revenue 10926 Operating Expenses V Ulla Expanse 200 1 Salarland Wages En 5160 Insurance Expense 738 1 Deprecation Expanse 81 Bed Debt Expens 431 Supplies Expen 520 Total Operating Expenses 7130 1 Income from Operatione 3796 Interest Expand 36 Loss on Deposal of Plant Aasta 256 Income Before Income TV 3540 Income Tax Expre 01 708 Netcom /(Loaa TAMARISK CLEANING SERVICES INC Trial Balance 2/28/22 Debit Credit Cash 8690 $ Accounts Receivable 8370 Allowance for Doubtful Account 25: Supplies 360 Prepaid Insurancs Prepaid Expenses 200 Egulament 4340 Accumulated Depreciation Equipment 81 no Account Payable 610 Notas Payable 7200 Uneamed Service Revenue 378 Selaic and Wages Payable 1720 Interest Payable 36 Income Taxes Payable 708 Common Stock 6750 Pald-in Capital in Excess of Per Value-Common Stock 4950 Treasury Stock 810 Cash Dividends 1269 Service Revenue Ulla Expande 200 Salario and Wages Expense 5160 Leason Davosal of Plent Arts COM DICIODATA02 Bed Debt Expens 431 Deprecation Expanse 81 Insurance Expense 738 Supplies Expense 520 Interest Expende 36 Income Tax Expand 708 Total 33610 Journalize the following adjustments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Record journal entries in the order presented in the problem. Round answers to decimal places, eg 1.527.) 1. 2. 3. Services performed for customers through February 27, 2022, but unbilled and uncollected were $3,420. Received notice that a customer who was billed $180 for services performed February 10 has filed for bankruptcy. Tamarisk Cleaning Services does not expect to collect any portion of this outstanding receivable Tamarisk Cleaning Services uses the allowance method to estimate bad debts. Tamarisk Cleaning Services estimates that of its month and receivables will not be collected Record 1 month of depreciation for the floor equipment Use the straight-line method, an estimated life of 4 years, and $450 salvage value. Record 1 month of insurance expense. An inventory count shows S260 of supplies on hand at February 28, 5. 7. B. One week of services were performed for the customer who paid in advance on February 17. Accrus for wages owed through February 28, 2022. Accrue for interest expense for month 10 Karan estimates a 20% income tax rats. (Hint: Prepare an income statement up to income before taxes to help with the income tax calculation) No. Account Titles and Explanation Debit Credit 1. Accounts Receivable 3420 Service Revenue 3420 2. Allowance for Doubtful Accounts 180 Accounts Receivable 190 3. Bed Debt Expense 548 Allowance for Doubtful Accounts 548 4. Depreciation Ense doodlo dod Accumulated Depreciation Equipment 81 5. Insurance Expense 738 Prepeld Insurance 738 6. Supplies Expense 520 Supplies 520 7. Unearned Service Revenue 126 Service Revenue 126 B Salaries and Weges Expense 1720 Selaries and Weges Payable 1720 9. Interest Expense Interest Payable 36 10. Income Tax Expen 938 Income Tees Payable 156 Post adjusting entries to the accounts. (Post entries in the order of journal entries presented above) Cash 2/1 11.700 2/1 8,120 2/1 7,2002/1 200 2/5 3.560 2/5 2.215 2/17 270 5042/18 2.250 2/20 2/25 810 2/24 3,440 2/27 200 2/28 1,269 2/28 Bal. 2,690 Accounts Receivable 2/16 3,510 2/25 2.250 2/23 3.970 2/28 V 180 2/28 3,420 2/28 BAL 8,370 Supplies 2/3 990 2/28 520 2/28 BAL 360 Prepaid Insurance 2,5 2.215 2/28 738 2/28 BAL 1,477 Prepaid Expenses 2/27 200 2/20 Bal 200 Allowance for Doubtful Accounts 2/28 180 2/28 431 2/28 Bu 251 Equipment 2/1 2,120 2/5 3.790 2/28 BAL 4.340 Accumulated Depreciation - Equipment 2/28 81 Accounts Payable 2/18 270 2/3 990 2/28 Bal. 610 Notes Payable 2/1 7,200 2/28 Bel. 7,200 Salaries and Wages Payable 2/28 1,720 2/28 B 1,720 Interest Payable 2/28 Bu Income Taxes Payable 2/28 708 2/28 Bal. 708 Unearned Service Revenue 2/28 126 2/17 504 2/28 Bel. 378 Common Stock 2/1 6,750 2/28 BAL 6.750 Paid in Capital in Excess of Par 2/1 4,950 2/28 Bu 4950 Cash Dividends 2/28 Treasury Stock 2/20 910 2/28 BAL 810 Service Revenue 2/16 3.510 Service Revenue 2/16 3,510 2/23 3,670 2/28 3.420 2/28 126 Utilities Expense 2/1 200 Salaries and Wages Expense 2/24 3,440 2/28 1.720 Insurance Expense 2/28 739 Depreciation Expense Bad Debt Expense 2/28 431 Supplies Expense 2/28 520 Interest Expense 2/28 Loss on Disposal of Plant Assets 2/5 220 Income Tax Expense 2/28 708 Prepare a properly classified balance sheet as of February 28, 2022. List Current Assets in order of liquidity) TAMARISK CLEANING SERVICES INC Balance Sheet Assets $ S Liabilities and Stockholders' Equity s Prepare a properly classified balance sheet as of February 28, 2022. List Current Assets in order of liquidity) TAMARISK CLEANING SERVICES INC Balance Sheet Assets Liabilities and Stockholders' Equity V S