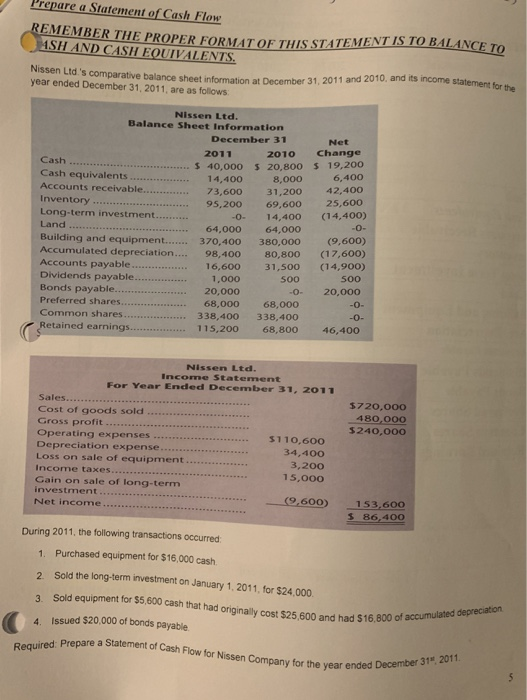

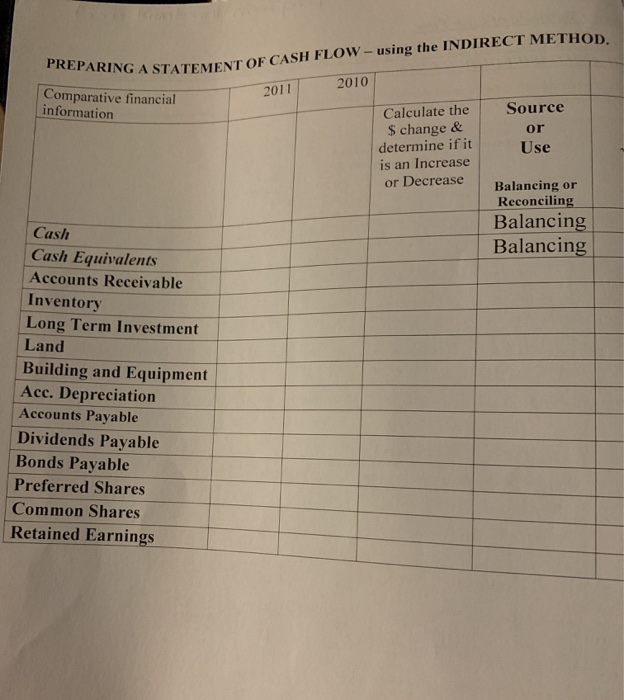

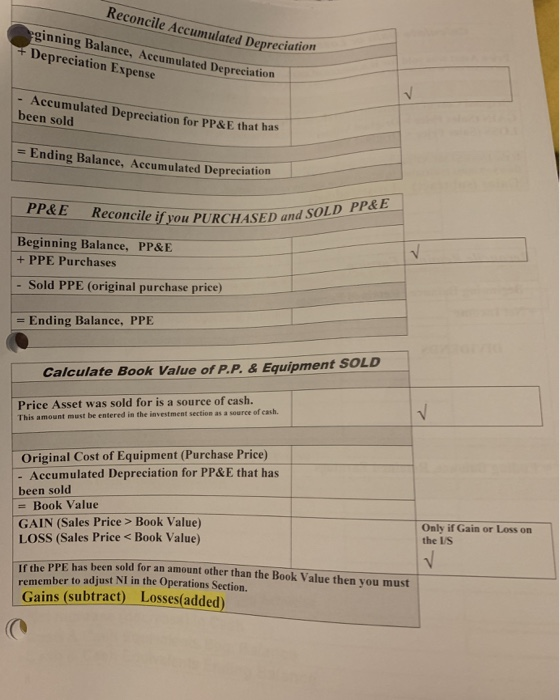

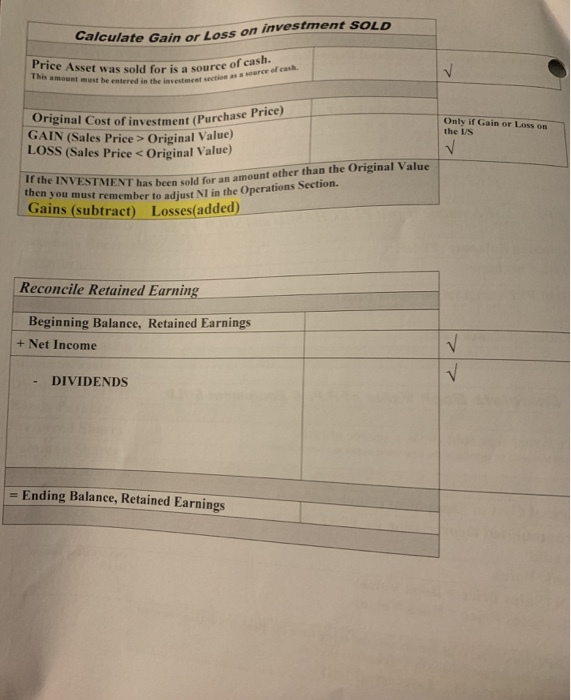

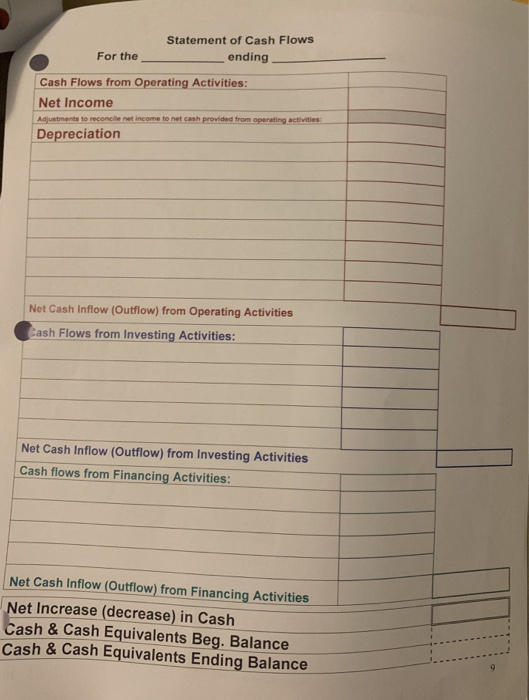

Prepare a Statement of Cash Flow REMEMBER THE PROPER FORMAT OE THIS STATEMENT IS TO BALANCE TO ASH AND CASH EQUIVALENTS. Nissen Ltd's comparative balance sheet information at December 31, 2011 and 2010. and is mcome stlatement for the year ended December 31, 2011, are as folows Nissen Ltd. Balance Sheet Information December 31 Net 2011 Change 2010 Cash $ 40,000 S 20,800 S 19,200 14,400 Cash equivalents Accounts receivable.. Inventory 6,400 8,000 31,200 69,600 42,400 73,600 25,600 95,200 Long-term investment.. Land .. (14,400) -0- 14,400 64,000 370,400 -0- 64,000 380,000 Building and equipment.... Accumulated depreciation... Accounts payable Dividends payable (9,600) (17,600) 98,400 80,800 16,600 (14,900) 31,500 1,000 500 Bonds payable.. Preferred shares. 20,000 68,000 338,400 20,000 -0- 68,000 338,400 -0- Common shares -0- Retained earnings. 115,200 68,800 46,400 Nissen Ltd. Income Statement For Year Ended December 31, 2011 Sales... $720,000 Cost of goods sold Gross profit Operating expenses Depreciation expense Loss on sale of equipment Income taxes... Gain on sale of long-term investment 480,000 $240,000 $110,600 34,400 3,200 15,000 Net income (9,600) 153,600 S 86,400 During 2011, the following transactions occurred Purchased equipment for $16,000 cash 1. Sold the long-term investment on January 1, 2011, for $24,000. 2. Sold equipment for $5,600 cash that had originally cost $25,600 and had $16,800 of accumulated depreciation 3. Issued $20.000 of bonds payable 4. Required: Prepare a Statement of Cash Flow for Nissen Company for the year ended December 31", 2011. PREPARING A STATEMENT OF CASH FLOW using the INDIRECT METHOD, 2010 2011 Comparative financial information Calculate the $ change & determine if it is an Increase or Decrease Source or Use Balancing or Reconciling Balancing Balancing Cash Cash Equivalents Accounts Receivable Inventory Long Term Investment Land Building and Equipment Acc. Depreciation Accounts Payable Dividends Payable Bonds Payable Preferred Shares Common Shares Retained Earnings Reconcile Accumulated Depreciation eginning Balance, Accumulated Depreciation + Depreciation Expense Accumulated Depreciation for PP&E that has been sold Ending Balance, Accumulated Depreciation PP&E Reconcile if you PURCHASED and SOLD PP&E Beginning Balance, PP&E + PPE Purchases Sold PPE (original purchase price) Ending Balance, PPE Calculate Book Value of P.P. & Equipment SOLD Price Asset was sold for is a source of cash. This amount must be entered in the investment section as a source of cash. Original Cost of Equipment (Purchase Price) Accumulated Depreciation for PP&E that has been sold = Book Value GAIN (Sales Price > Book Value) LOSS (Sales Price Original Value) LOSS (Sales Price