Prepare a statement of cash flow using the indirect method

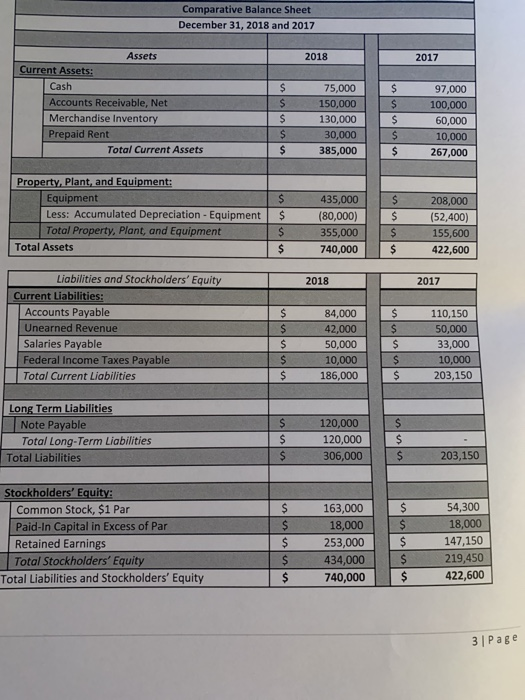

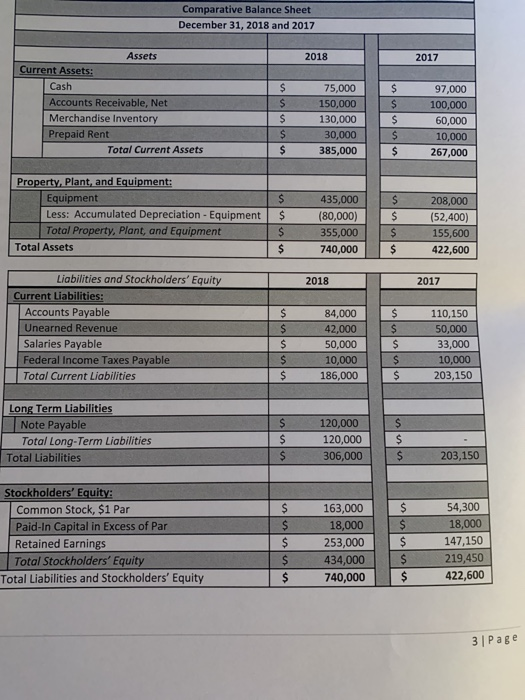

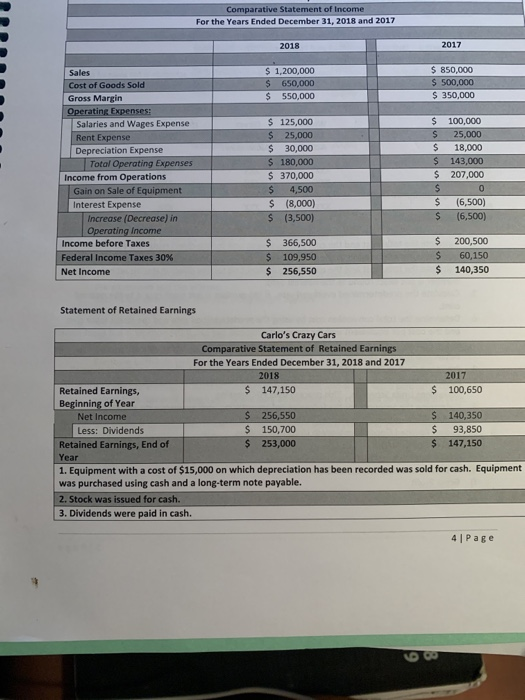

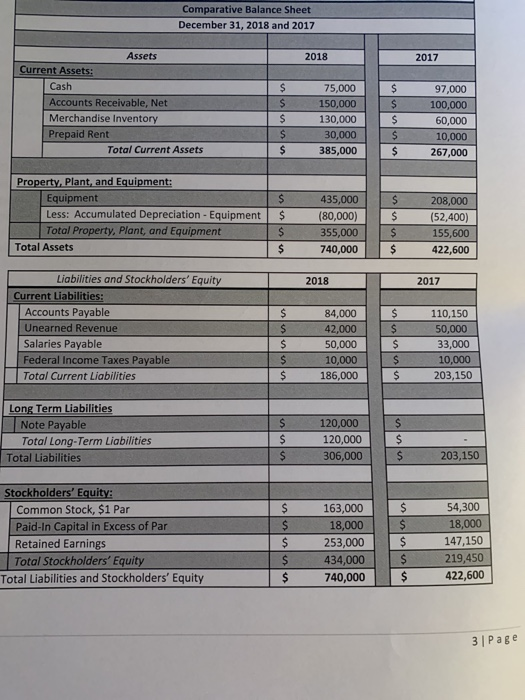

Comparative Balance Sheet December 31, 2018 and 2017 Assets 2018 2017 Current Assets: Cash 75,000 $ 97,000 Accounts Receivable, Net 150,000 100,000 Merchandise Inventory 130,000 60,000 Prepaid Rent 30,000 10,000 Total Current Assets 385,000 267,000 Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation - Equipment S 435,000 208,000 (80,000) $ (52,400) Total Property, Plant, and Equipment 355,000 155,600 Total Assets 740,000 422,600 Liabilities and Stockholders' Equity 2018 2017 Current Liabilities: Accounts Payable 84,000 110,150 Unearned Revenue 42,000 50,000 Salaries Payable 50,000 33,000 Federal Income Taxes Payable S 10,000 10,000 Total Current Liabilities 186,000 203,150 Long Term Liabilities 120,000 Note Payable $ 120,000 Total Long-Term Liabilities 306,000 $ 203,150 Total Liabilities Stockholders' Equity: Common Stock, $1 Par $ 54,300 163,000 $ 18,000 Paid-In Capital in Excess of Par 18,000 $ 147,150 253,000 Retained Earnings 219,450 434,000 Total Stockholders' Equity $ 422,600 740,000 Total Liabilities and Stockholders' Equity 3 | Page Comparative Statement of Income For the Years Ended December 31, 2018 and 2017 2017 2018 $850,000 $1,200,000 650,000 $ 550,000 Sales $ 500,000 Cost of Goods Sold S350,000 Gross Margin Operating Expenses: 100,000 125,000 Salaries and Wages Expense 25,000 25,000 Rent Expense 18,000 Depreciation Expense Total Operating Expenses Income from Operations 30,000 $ 180,000 S 143,000 $ 207,000 $370,000 4,500 Gain on Sale of Equipment (8,000) (6,500) Interest Expense $ (3,500) (6,500) Increase (Decrease) in Operating Income 200,500 S 366,500 Income before Taxes S 60.150 109,950 Federal Income Taxes 30 % 140,350 256,550 Net Income Statement of Retained Earnings Carlo's Crazy Cars Comparative Statement of Retained Earnings For the Years Ended December 31, 2018 and 2017 2018 2017 $ Retained Earnings, 147,150 100,650 Beginning of Year $ 256,550 140.350 Net Income 93,850 150,700 Less: Dividends 253,000 Retained Earnings, End of 147,150 Year 1. Equipment with a cost of $15,000 on which depreciation has been recorded was sold for cash. Equipment was purchased using cash and a long-term note payable. 2. Stock was issued for cash. 3. Dividends were paid in cash. 4 Page