Question

Prepare a statement of cash flows for Wonder Inc. for the year ending December 31, 2021, using the indirect method . Wonder has adopted the

Prepare a statement of cash flows for Wonder Inc. for the year ending December 31, 2021, using the indirect method. Wonder has adopted the policy of classifying interest paid as operating and dividends paid as financing activities.

1. Prepare the operating activities section of the statement of cash flows (6 marks)

| Net earnings (loss) | |

| Net cash provided by (used in) operating activities |

2. Prepare the investing activities section of the statement of cash flows. (3 marks)

| Net cash provided by (used in) investing activities |

3. Prepare the financing activities section of the statement of cash flows. (5 marks)

| Net cash provided (used in) financing activities |

4. Using the direct method, prepare below the cash flow from operating activities section only for Wonder Company for the year ended December 31, 202 (6 marks)

Operating activities section of the statement of cash flows-Direct Method

5. Wonder Company has adopted the policy of classifying interest paid as operating and dividends paid as financing activities. Under IFRS, Wonder Company has other alternatives for classifying interest and dividend amounts paid. Fill in the blank following the statements below.(2 marks)

Interest paid can also be classified on the SCF as_________________________________________________________________

Dividends paid can also be classified on the SCF as____________________________________________________________________________

6. Assume that you are a shareholder of Wonder company, what do you think of the dividend payout ratio that is highlighted in the statement of cash flows for the year ended December 31,2021? Compute the dividend payout ratio and briefly discuss whether this is a positive sign. The average dividend payout for the industry is 20%. (2 marks)

______________________________________________________________________________

______________________________________________________________________________

Additional information:

- There were 20,000 common shares issued and outstanding at December 31, 2020.

- In June 2021 the company issued a 10% stock dividend, valued at market price per share of $12.

- The company sold equipment that had an original cost of $292,000 and a net book value of $123,800. Other equipment was purchased for cash. Patent amortization was $4,000.

- Long-term debt with a face value of $400,000 was repaid during the year and other long-term debt was issued at a lower interest rate.

- The company issued shares for land during the period. Other common shares retired (bought back and cancelled) at book value

- All sales during the year were made on the account. All merchandise was purchased on account, making up the total accounts payable account.

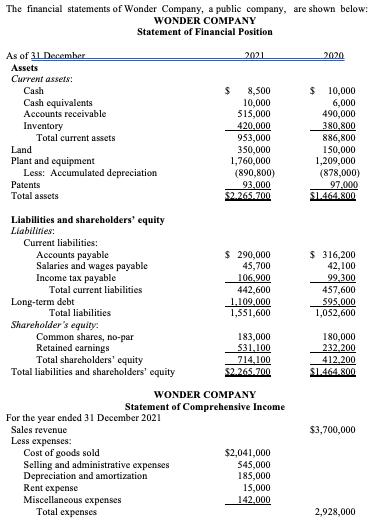

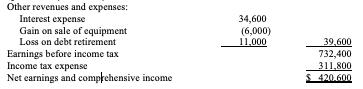

The financial statements of Wonder Company, a public company, are shown below: WONDER COMPANY Statement of Financial Position As of 31 December Assets Current assets: Cash Cash equivalents Accounts receivable Inventory Total current assets Land Plant and equipment Less: Accumulated depreciation Patents Total assets Liabilities and shareholders' equity Liabilities: Current liabilities: Accounts payable Salaries and wages payable Income tax payable Total current liabilities Long-term debt Total liabilities Shareholder's equity: Common shares, no-par Retained earnings Total shareholders' equity Total liabilities and shareholders' equity For the year ended 31 December 2021 Sales revenue Less expenses: $ Cost of goods sold Selling and administrative expenses Depreciation and amortization Rent expense Miscellaneous expenses Total expenses 2021 8,500 10,000 515,000 420,000 953,000 350,000 1,760,000 (890,800) 93,000 $2.265.700 $ 290,000 45,700 106,900 442,600 1,109,000 1,551,600 WONDER COMPANY Statement of Comprehensive Income 183,000 531,100 714,100 $2.265.700 $2,041,000 545,000 185,000 15,000 142,000 2020 $ 10,000 6,000 490,000 380,800 886,800 150,000 1,209,000 (878,000) 97,000 $1.464.800 $ 316,200 42,100 99,300 457,600 595,000 1,052,600 180,000 232,200 412,200 $1.464.800 $3,700,000 2,928,000

Step by Step Solution

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Operating activities section Net earnings per income statement Sales revenue 3700000 Less Expenses 2928000 Net earnings 772000 Adjustments Add back ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started