Prepare a Statement of Cash Flows using the direct method. Use the following information:

The following information is available for 2017.

- Equipment (cost $10,000 and accumulated depreciation $4,000) was sold for $7,000. All other changes in Property, Plant and Equipment accounts relate to purchases and depreciation expense, respectively.

- Intangible Assets costing $10,000 were purchased during 2017.

- There were $25,000 in payments on the Bonds Payable during 2017

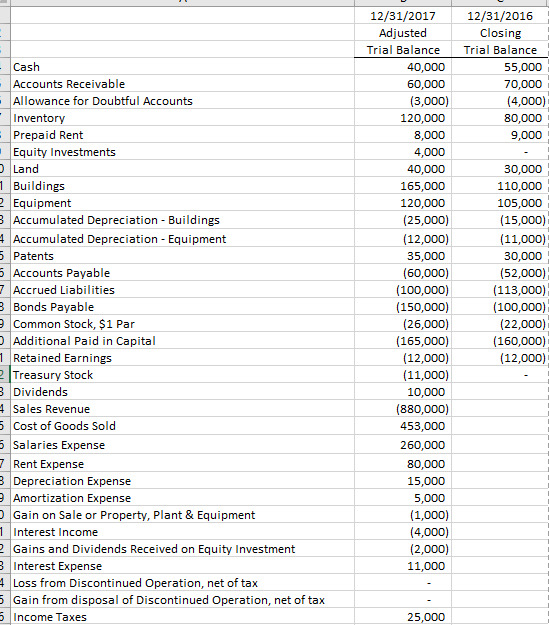

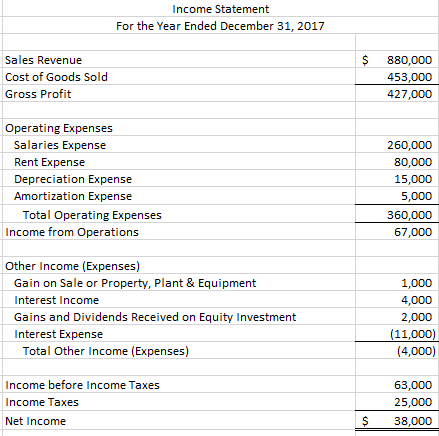

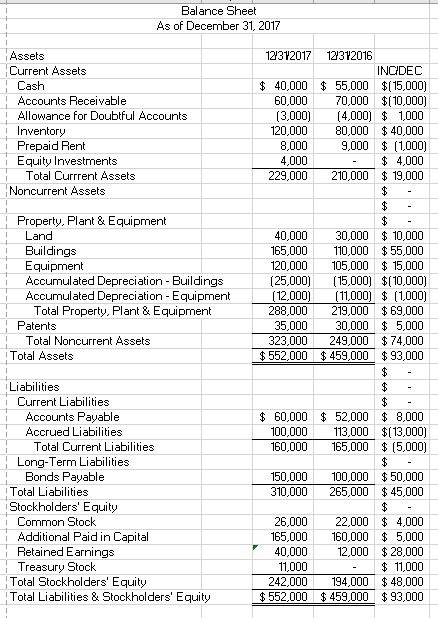

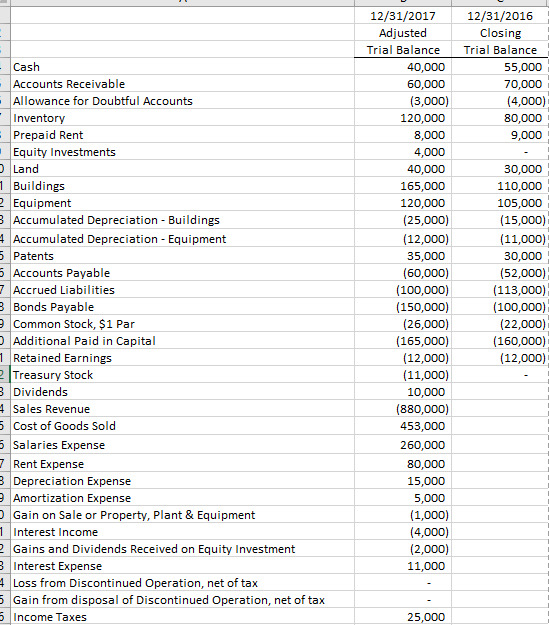

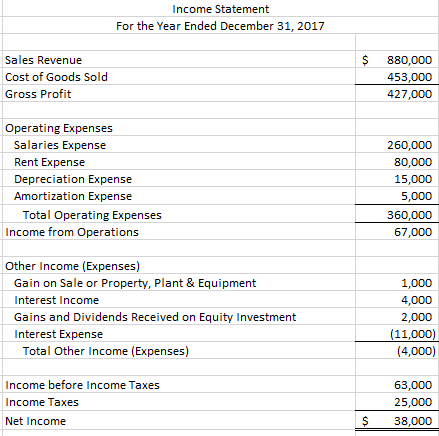

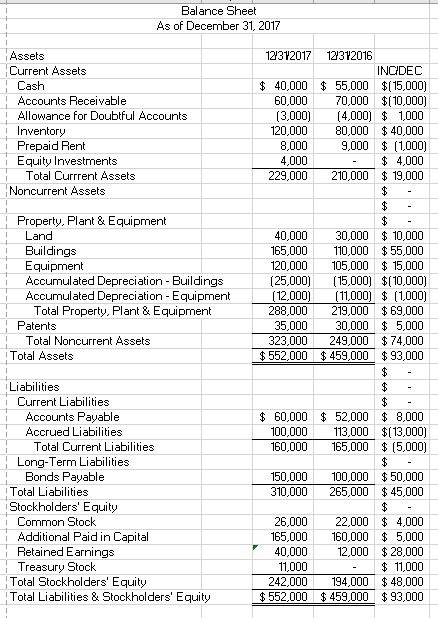

12/31/2016 Closing Trial Balance 55,000 70,000 (4,000) 80,000 9,000 - Cash Accounts Receivable Allowance for Doubtful Accounts Inventory - Prepaid Rent Equity Investments Land 1 Buildings 2 Equipment B Accumulated Depreciation - Buildings 4 Accumulated Depreciation - Equipment 5 Patents 5 Accounts Payable 7 Accrued Liabilities 3 Bonds Payable - Common Stock, $1 Par Additional Paid in Capital 1 Retained Earnings 2 Treasury Stock 3 Dividends 4 Sales Revenue 5 Cost of Goods Sold 5 Salaries Expense 7 Rent Expense 3 Depreciation Expense Amortization Expense Gain on Sale or Property, Plant & Equipment 1 Interest Income 2 Gains and Dividends Received on Equity Investment 3 Interest Expense 4 Loss from Discontinued Operation, net of tax 5 Gain from disposal of Discontinued Operation, net of tax 5 Income Taxes 12/31/2017 Adjusted Trial Balance 40,000 60,000 (3,000) 120,000 8,000 4,000 40,000 165,000 120,000 (25,000) (12,000) 35,000 (60,000) (100,000) (150,000) (26,000) (165,000) (12,000) (11,000) 10,000 (880,000) 453,000 260,000 80,000 15,000 5,000 (1,000) (4,000) (2,000) 11,000 30,000 110,000 105,000 (15,000) (11,000) 30,000 (52,000) (113,000) (100,000) (22,000) (160,000) (12,000) 25,000 Income Statement For the Year Ended December 31, 2017 $ Sales Revenue Cost of Goods Sold Gross Profit 880,000 453,000 427,000 Operating Expenses Salaries Expense Rent Expense Depreciation Expense Amortization Expense Total Operating Expenses Income from Operations 260,000 80,000 15,000 5,000 360,000 67,000 Other Income (Expenses) Gain on Sale or Property, Plant & Equipment Interest Income Gains and Dividends Received on Equity Investment Interest Expense Total Other Income (Expenses) 1,000 4,000 2,000 (11,000) (4,000) Income before Income Taxes Income Taxes Net Income 63,000 25,000 38,000 $ Balance Sheet As of December 31, 2017 12312017 Assets Current Assets Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Prepaid Rent Equity Investments Total Current Assets Noncurrent Assets $ 40,000 60,000 (3.000) 120,000 8,000 4,000 229,000 12/312016 INCIDEC $ 55,000 $(15,000) 70,000 $(10,000) (4,000) $ 1,000 80,000 $ 40,000 9,000 $ (1,000) $ 4,000 210,000 $ 19,000 Property, Plant & Equipment Land Buildings Equipment Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Total Property, Plant & Equipment Patents Total Noncurrent Assets Total Assets 40,000 165,000 120,000 (25,000) (12,000) 288,000 35,000 323,000 $ 552,000 30,000 $10,000 110,000 $ 55,000 105,000 $ 15,000 (15,000) $110,000) (11,000) $ (1,000) 219,000 $69,000 30,000 $ 5,000 249,000 $74,000 $ 459,000 $93,000 $ 60,000 100,000 160,000 $ 52,000 113,000 165,000 $ 8,000 $(13,000) $ (5,000) Liabilities Current Liabilities Accounts Payable Accrued Liabilities Total Current Liabilities Long-Term Liabilities Bonds Payable Total Liabilities Stockholders' Equity Common Stock Additional Paid in Capital Retained Earnings | Treasury Stock Total Stockholders' Equity Total Liabilities & Stockholders' Equity 150,000 310,000 100,000 265,000 $50,000 $ 45,000 26,000 165,000 40,000 11,000 242,000 $ 552,000 22,000 160,000 12,000 - 194,000 $ 459,000 $ 4,000 $ 5,000 $28,000 $ 11,000 $ 48,000 $93,000