Answered step by step

Verified Expert Solution

Question

1 Approved Answer

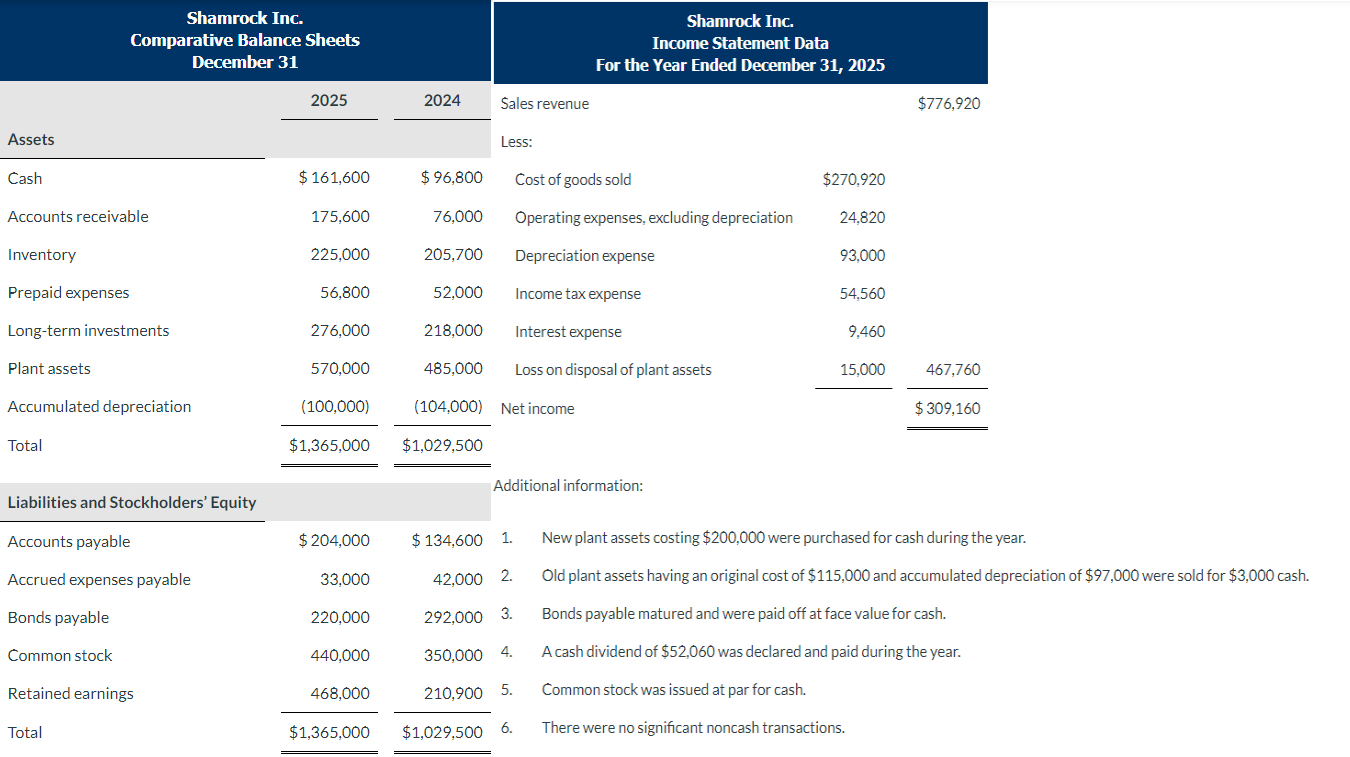

PREPARE A STATEMENT OF CASH FLOWS USING THE INDIRECT METHOD Shamrock Inc. Comparative Balance December 31 Shamrock Inc. Income Statement Data For the Year Ended

PREPARE A STATEMENT OF CASH FLOWS USING THE INDIRECT METHOD

Shamrock Inc. Comparative Balance December 31 Shamrock Inc. Income Statement Data For the Year Ended December 31, 2025 Assets Cash Accounts receivable Inventory Prepaid expenses Long-term investments Plant assets Accumulated depreciation Total Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock Retained earnings Total 2025 $ 161,600 175,600 225,000 56,800 276,000 570,000 (100,000) $1,365,000 $ 204,000 33,000 220,000 440,000 468,000 2024 $ 96,800 76,000 205,700 52,000 218,000 485,000 (104,000) $1,029,500 $ 134,600 42,000 292,000 350,000 210,900 $1,029,500 Sales revenue Less: Cost of goods sold Operating expenses, excluding depreciation Depreciation expense Income tax expense Interest expense Loss on disposal of plant assets Net income Additional information: $270,920 24,820 93,000 54,560 15,000 $776,920 467,760 $309,160 1. 2. 3. 4. 5. 6. New plant assets costing $200,000 were purchased for cash during the year. Old plant assets having an original cost of Sl 15,000 and accumulated depreciation of $97 ,OOO were sold for $3,000 cash. Bonds payable matured and were paid off at face value for cash. A cash dividend of $52,060 was declared and paid during the year. Common stock was issued at par for cash. There were no significant noncash transactions. Shamrock Inc. Comparative Balance December 31 Shamrock Inc. Income Statement Data For the Year Ended December 31, 2025 Assets Cash Accounts receivable Inventory Prepaid expenses Long-term investments Plant assets Accumulated depreciation Total Liabilities and Stockholders' Equity Accounts payable Accrued expenses payable Bonds payable Common stock Retained earnings Total 2025 $ 161,600 175,600 225,000 56,800 276,000 570,000 (100,000) $1,365,000 $ 204,000 33,000 220,000 440,000 468,000 2024 $ 96,800 76,000 205,700 52,000 218,000 485,000 (104,000) $1,029,500 $ 134,600 42,000 292,000 350,000 210,900 $1,029,500 Sales revenue Less: Cost of goods sold Operating expenses, excluding depreciation Depreciation expense Income tax expense Interest expense Loss on disposal of plant assets Net income Additional information: $270,920 24,820 93,000 54,560 15,000 $776,920 467,760 $309,160 1. 2. 3. 4. 5. 6. New plant assets costing $200,000 were purchased for cash during the year. Old plant assets having an original cost of Sl 15,000 and accumulated depreciation of $97 ,OOO were sold for $3,000 cash. Bonds payable matured and were paid off at face value for cash. A cash dividend of $52,060 was declared and paid during the year. Common stock was issued at par for cash. There were no significant noncash transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started