Answered step by step

Verified Expert Solution

Question

1 Approved Answer

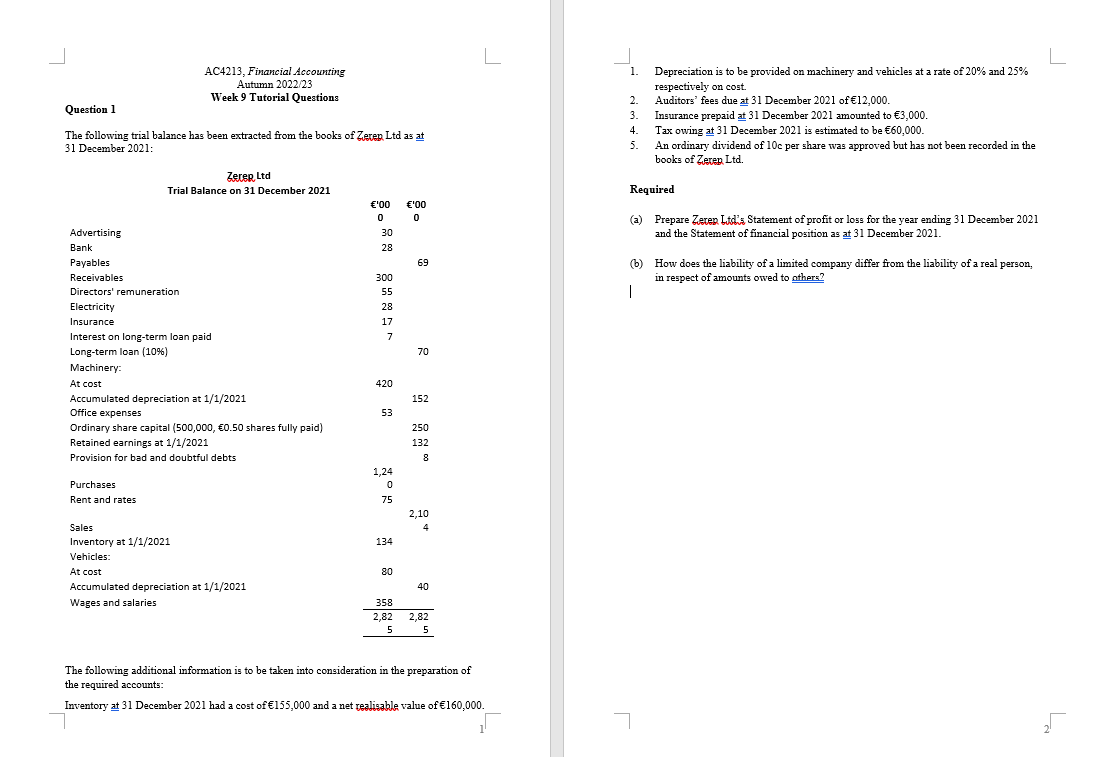

Prepare a Statement of profit or loss and a Statement of financial position for Zerep Ltd for the year ended 31 December 2021. AC4213, Financial

Prepare a Statement of profit or loss and a Statement of financial position for Zerep Ltd for the year ended 31 December 2021.

AC4213, Financial Accounting 1. Depreciation is to be provided on machinery and vehicles at a rate of 20% and 25% Autumn 2022/23 respectively on cost. Question 1 Week 9 Tutorial Questions 2. Auditors' fees due at 31 December 2021 of 12,000. 3. Insurance prepaid at 31 December 2021 amounted to 3,000. The following trial balance has been extracted from the books of Zerep Ltd as at 4. Tax owing at 31 December 2021 is estimated to be 60,000. 31 December 2021 : 5. An ordinary dividend of 10c per share was approved but has not been recorded in the books of Zerep Ltd. Required (a) Prepare Zerep I.tdis Statement of profit or loss for the year ending 31 December 2021 and the Statement of financial position as at 31 December 2021. (b) How does the liability of a limited company differ from the liability of a real person, in respect of amounts owed to others? The following additional information is to be taken into consideration in the preparation of the required accounts: Inventory at 31 December 2021 had a cost of 155,000 and a net realiaable value of 160,000. AC4213, Financial Accounting 1. Depreciation is to be provided on machinery and vehicles at a rate of 20% and 25% Autumn 2022/23 respectively on cost. Question 1 Week 9 Tutorial Questions 2. Auditors' fees due at 31 December 2021 of 12,000. 3. Insurance prepaid at 31 December 2021 amounted to 3,000. The following trial balance has been extracted from the books of Zerep Ltd as at 4. Tax owing at 31 December 2021 is estimated to be 60,000. 31 December 2021 : 5. An ordinary dividend of 10c per share was approved but has not been recorded in the books of Zerep Ltd. Required (a) Prepare Zerep I.tdis Statement of profit or loss for the year ending 31 December 2021 and the Statement of financial position as at 31 December 2021. (b) How does the liability of a limited company differ from the liability of a real person, in respect of amounts owed to others? The following additional information is to be taken into consideration in the preparation of the required accounts: Inventory at 31 December 2021 had a cost of 155,000 and a net realiaable value of 160,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started