Answered step by step

Verified Expert Solution

Question

1 Approved Answer

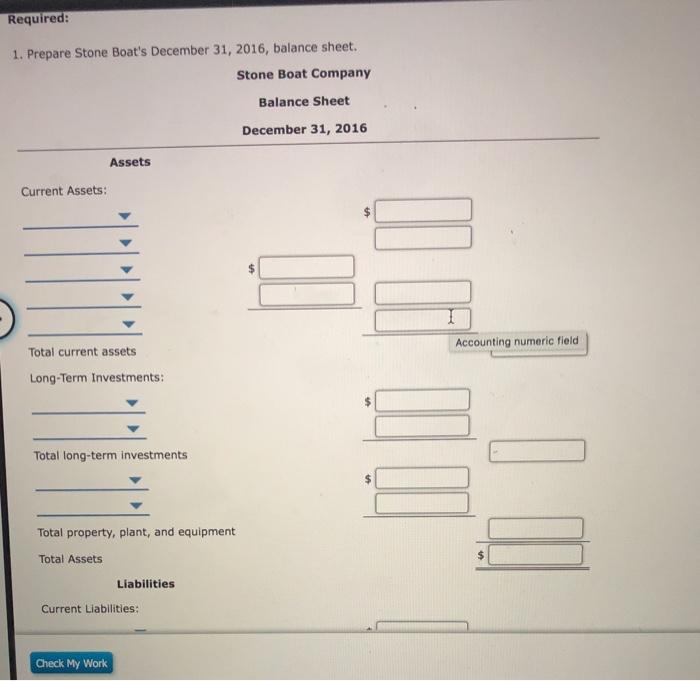

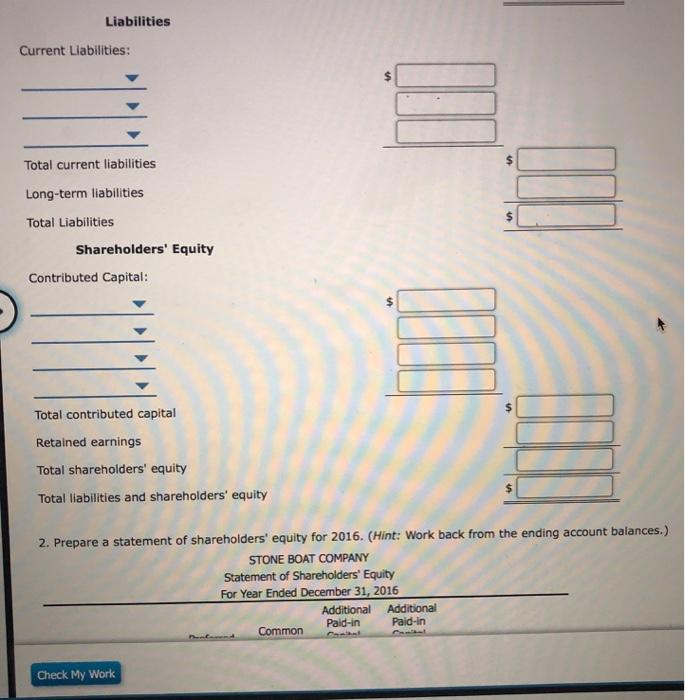

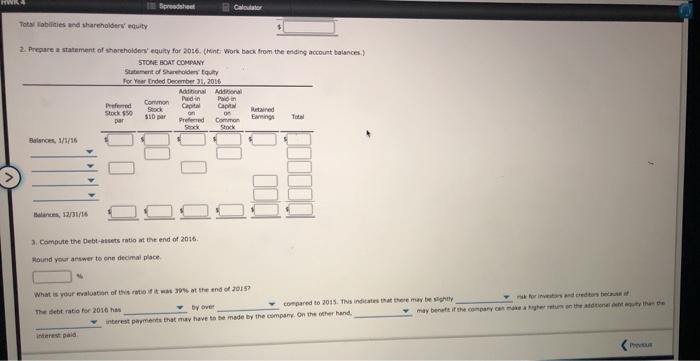

1.Prepare stone boats December 31, 2016 balance sheet 2. Prepare a statement of shareholders equity for 2016 ( hint: work back from the ending account

1.Prepare stone boats December 31, 2016 balance sheet

2. Prepare a statement of shareholders equity for 2016 ( hint: work back from the ending account balances)

3.compute the debt-assets ratio at the end of 2016

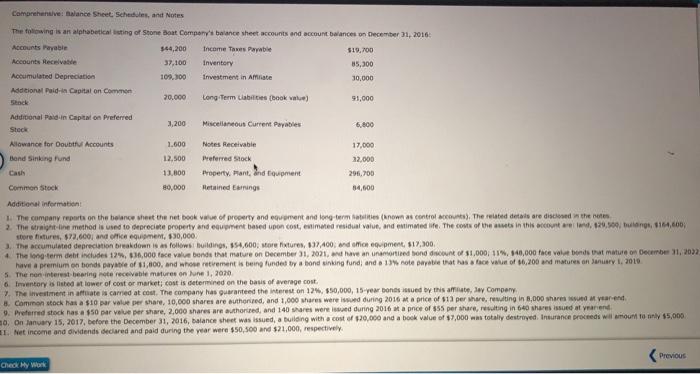

Comprehensive: Balance Sheet. Schedules, and Notes The following is an alphabetical isting of Stone Boat Company's balance sheet accounts and account balances on December 31, 2016 Accounts Payable $44,200 Income Tases Payable S19,700 Accounts Recelvatle 37,100 Inventory 85,300 Accumulated Depreciation 109,300 Investment in Amiate 30,000 Addtional Paid-in Capital on Common 20.000 Long Term Liabiltes (book value) 91,000 Stock Additonal Paid-in Capital on Preferred 3,200 Miscellaneous Current Payables 6,800 Stock Allowance for Doubthu Accounts Bend Sinking fund 1.600 Notes Receivable 17,000 12.500 Preferred Stock 22,000 Cash 13.800 Property, Pant, drd tquoment 296,700 Common Stock 80,000 Retained Earnings 84,600 Additional infermation L The company reports on the belance sheet the net book value of property and equement and long-term atities (known as control aceounts). The related details are disclosed the netes 2. The straight-line method is used to depreciete property and equipment based upon cost, estimated residual value, and estimated ife. The costs of the assets in this account are land, 129,500, buldings, $164,600, store fistures, $73,600, and office equipment, $30,000. 3. The accumulated depreciation breakdown is as follows huildings, 54,600, store fixtures, 137,400, and amicn eqipment, S17,300. 4. The long-term debt includes 12%, 36,000 face value bonds that mature on December 31, 2021, and have an unamortied bond discount of $1,000, 11%, 140,000 face value bonds that mature on December 31, 2022 have a premium on bonds payatle of $1,800, and whose retirement is being funded by a bond sinking fund, and a 13% note payatie that has a face valun of 6,200 and matures on January 1. 2010 5. The non-interest-bearing note receiveble matures on Jurne 1, 2020 6. Inventory is listed at lower of cost or market; cost is determined on the basis of average cost. 7. The investment in affate is carmed at cost. The company has guaranteed the interest on 12%, 50,000, 15-year bones issued by this afmate, Jay Compeny 8. Common stock has a $10 par value per share, 10,000 shares are euthorized, and 1,000 shares were issued during 2016 t a price of s13 per share, resulting in 8,000 shares sued at year end 9. Preferred stock has a $50 par velue per share, 2,000 shares are authorized, and 140 shares were issued during 2016 at a pnce of $55 per share, resulting in 640 shares issued at yeariend 0. On January 15, 2017, before the December 31, 2016, balance sheet was issued, a building with a cost of $20,000 and a book value of $7,000 was totally destroved. Insurance proceeds will amount to nnly $5,000 EL. Net income and dividends deciared and paid during the year were $50,500 and $21,000, respectively. Previous Check Hy Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Stone Boat Company Balance Sheet December 31 2016 Assets Current Assets Cash 13800 Notes receivable 17000 Accounts receivable 37100 Allowance for do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started