Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare a written case study analysis for the above-assigned research case, a minimum of 2 pages. Please help on this assignment, thank you in advance!!!

Prepare a written case study analysis for the above-assigned research case, a minimum of 2 pages.

Please help on this assignment, thank you in advance!!!

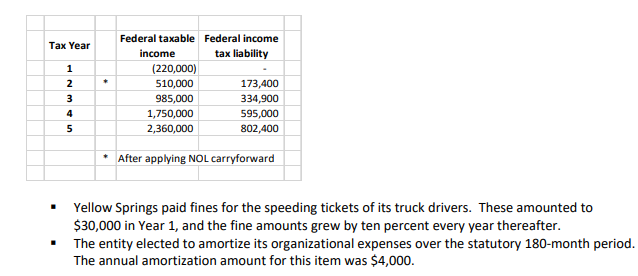

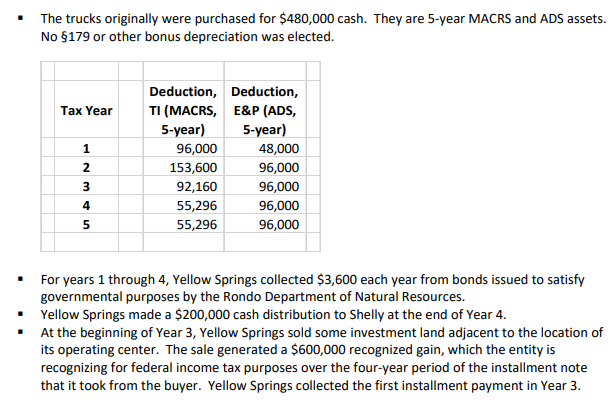

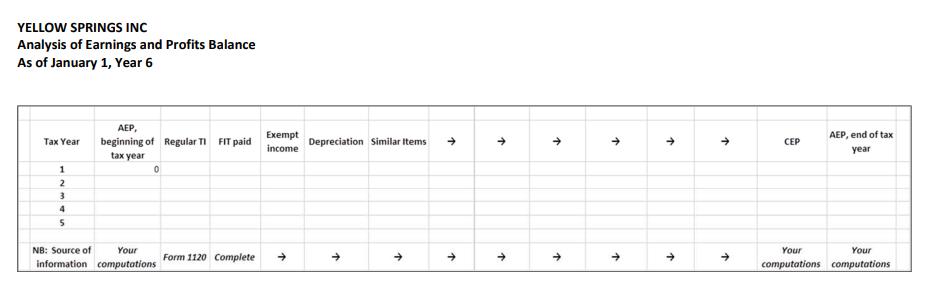

YELLOW SPRINGS INC Shelly Springs is the sole shareholder of Yellow Springs Inc, a C corporation that is organized in the state of Rondo. Yellow was incorporated many years ago, but this is the first tax year for which you have been engaged as the entity's tax adviser - you are taking the engagement at the beginning of Year 6 of the entity's life. Yellow's tax returns have been filed on a timely basis throughout its life by Allison Winger, a local accountant who has retired and continues to live in Purile Township, Rondo, where Shelly and Yellow Springs both reside. Winger's tax files are in good shape, and Yellow obtained copies thereof, which are now in your possession. Taxrelated schedules and worksheets appear to be complete, and they are a good source of information for you. Also available for your use are Yellow's annual cash-basis, calendar-year financial statements, prepared chiefly for the Purile Community Bank, which has outstanding a workingcapital loan to Yellow. Yellow Springs uses a fleet of trucks and a five-person full-time workforce to provide construction, repair, and installation services for the regional provider of cable and internet services to Purile area businesses and residences. It acquired its trucks early in the first year of operations (Year 1) and has maintained them in very good working condition; sometime in Year 6 a replacement schedule for individual trucks will commence, using a local dealership to purchase new vehicles. Rondo offers incentives for the growth of tech-oriented employers like Yellow Springs. Several of these incentives are comprised of tax exclusions, deductions, and credits, such that Yellow Springs has reported a zero state income tax liability in each of its five operating years, and it holds a small credit carryforward going into Year 6. Your review of the Yellow financial records and Winger's files reveal the following additional facts. All of Yellow Springs operations produce only trade or business income. - Yellow Springs paid fines for the speeding tickets of its truck drivers. These amounted to $30,000 in Year 1, and the fine amounts grew by ten percent every year thereafter. - The entity elected to amortize its organizational expenses over the statutory 180-month period. The annual amortization amount for this item was $4,000. The trucks originally were purchased for $480,000 cash. They are 5-year MACRS and ADS assets. No 179 or other bonus depreciation was elected. For years 1 through 4, Yellow Springs collected \$3,600 each year from bonds issued to satisfy governmental purposes by the Rondo Department of Natural Resources. Yellow Springs made a $200,000 cash distribution to Shelly at the end of Year 4. At the beginning of Year 3, Yellow Springs sold some investment land adjacent to the location of its operating center. The sale generated a $600,000 recognized gain, which the entity is recognizing for federal income tax purposes over the four-year period of the installment note that it took from the buyer. Yellow Springs collected the first installment payment in Year 3. The first step in your engagement is to reconstruct the computations of annual E\&P balances for Yellow Springs. There is no record of any E\&P spreadsheets in the file, and you have found a note to the file from Winger that says "Next summer, hire an intern to conduct an E\&P study for client." That project appears not to have been completed. Knowledge of the E\&P balance is critical, because Shelly has told you that she wants to put into place a plan for biennial cash distributions from the corporation to her, the first distribution to occur at the end of the current year (Year 6). In carrying out your task, your work plan is as follows. - Refresh your knowledge of the various E\&P adjustments that a C corporation makes. - Determine where you will find the information needed to compute these adjustments for the client. - Construct a spreadsheet in good format to become part of the Yellow Springs permanent file, i.e., your sheet will determine the AEP balance as of the beginning of Year 6, and allow for annual entries by you in all coming tax years. Your spreadsheet might take a format similar to the following. YELLOW SPRINGS INC Analysis of Earnings and Profits Balance As of January 1, Year 6 YELLOW SPRINGS INC Shelly Springs is the sole shareholder of Yellow Springs Inc, a C corporation that is organized in the state of Rondo. Yellow was incorporated many years ago, but this is the first tax year for which you have been engaged as the entity's tax adviser - you are taking the engagement at the beginning of Year 6 of the entity's life. Yellow's tax returns have been filed on a timely basis throughout its life by Allison Winger, a local accountant who has retired and continues to live in Purile Township, Rondo, where Shelly and Yellow Springs both reside. Winger's tax files are in good shape, and Yellow obtained copies thereof, which are now in your possession. Taxrelated schedules and worksheets appear to be complete, and they are a good source of information for you. Also available for your use are Yellow's annual cash-basis, calendar-year financial statements, prepared chiefly for the Purile Community Bank, which has outstanding a workingcapital loan to Yellow. Yellow Springs uses a fleet of trucks and a five-person full-time workforce to provide construction, repair, and installation services for the regional provider of cable and internet services to Purile area businesses and residences. It acquired its trucks early in the first year of operations (Year 1) and has maintained them in very good working condition; sometime in Year 6 a replacement schedule for individual trucks will commence, using a local dealership to purchase new vehicles. Rondo offers incentives for the growth of tech-oriented employers like Yellow Springs. Several of these incentives are comprised of tax exclusions, deductions, and credits, such that Yellow Springs has reported a zero state income tax liability in each of its five operating years, and it holds a small credit carryforward going into Year 6. Your review of the Yellow financial records and Winger's files reveal the following additional facts. All of Yellow Springs operations produce only trade or business income. - Yellow Springs paid fines for the speeding tickets of its truck drivers. These amounted to $30,000 in Year 1, and the fine amounts grew by ten percent every year thereafter. - The entity elected to amortize its organizational expenses over the statutory 180-month period. The annual amortization amount for this item was $4,000. The trucks originally were purchased for $480,000 cash. They are 5-year MACRS and ADS assets. No 179 or other bonus depreciation was elected. For years 1 through 4, Yellow Springs collected \$3,600 each year from bonds issued to satisfy governmental purposes by the Rondo Department of Natural Resources. Yellow Springs made a $200,000 cash distribution to Shelly at the end of Year 4. At the beginning of Year 3, Yellow Springs sold some investment land adjacent to the location of its operating center. The sale generated a $600,000 recognized gain, which the entity is recognizing for federal income tax purposes over the four-year period of the installment note that it took from the buyer. Yellow Springs collected the first installment payment in Year 3. The first step in your engagement is to reconstruct the computations of annual E\&P balances for Yellow Springs. There is no record of any E\&P spreadsheets in the file, and you have found a note to the file from Winger that says "Next summer, hire an intern to conduct an E\&P study for client." That project appears not to have been completed. Knowledge of the E\&P balance is critical, because Shelly has told you that she wants to put into place a plan for biennial cash distributions from the corporation to her, the first distribution to occur at the end of the current year (Year 6). In carrying out your task, your work plan is as follows. - Refresh your knowledge of the various E\&P adjustments that a C corporation makes. - Determine where you will find the information needed to compute these adjustments for the client. - Construct a spreadsheet in good format to become part of the Yellow Springs permanent file, i.e., your sheet will determine the AEP balance as of the beginning of Year 6, and allow for annual entries by you in all coming tax years. Your spreadsheet might take a format similar to the following. YELLOW SPRINGS INC Analysis of Earnings and Profits Balance As of January 1, Year 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started