Answered step by step

Verified Expert Solution

Question

1 Approved Answer

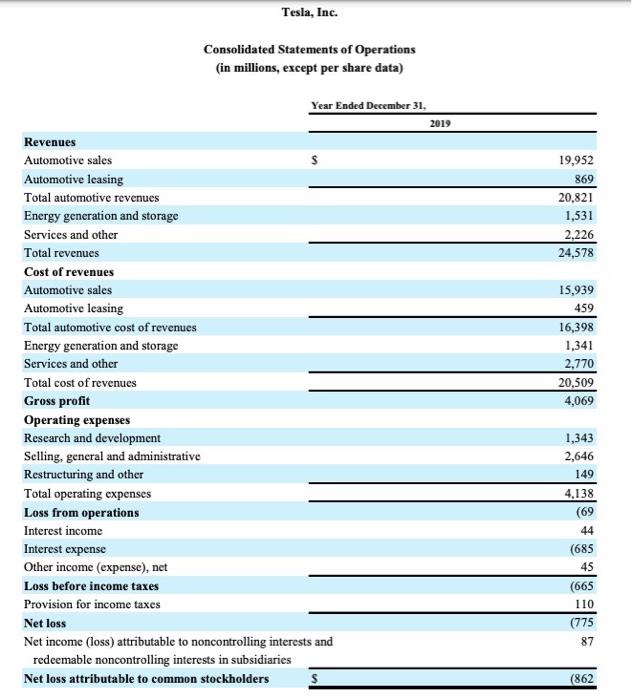

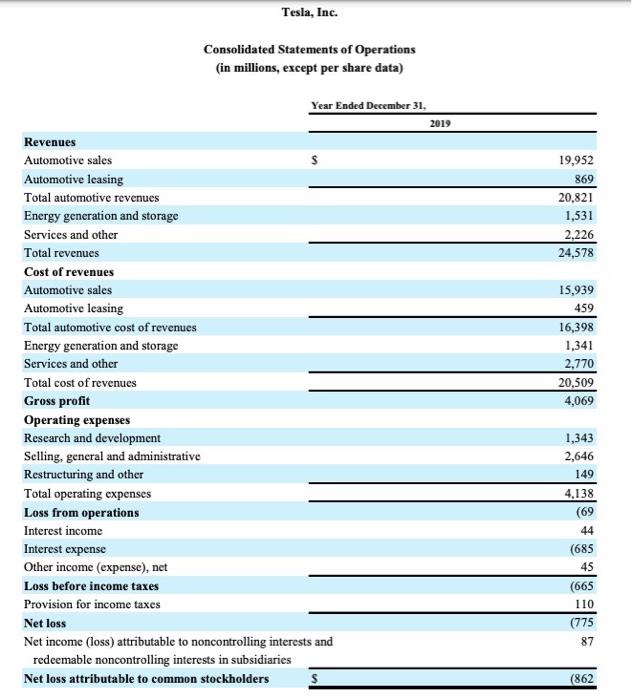

Prepare a written response: Use the attached income statement to answer the following questions. a. How much did the company spend to create the goods

Prepare a written response:

Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) 19,952 869 20.821 1,531 2.226 24,578 Year Ended December 31, 2019 Revenues Automotive sales Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling, general and administrative Restructuring and other Total operating expenses Loss from operations Interest income Interest expense Other income (expense), net Loss before income taxes Provision for income taxes Net loss Net income (loss) attributable to noncontrolling interests and redeemable noncontrolling interests in subsidiaries Net loss attributable to common stockholders $ 15,939 459 16,398 1,341 2,770 20,509 4,069 1,343 2,646 149 4,138 (69 44 (685 45 (665 110 (775 87 (862 Use the attached income statement to answer the following questions.

a. How much did the company spend to create the goods and services it sold?

b. Does the company have debt? Why or why not?

c. How much income is available to common stockholders?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started