Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare Adjusted trial balance, Balance sheet, Income statement and Closing JE & TB. Dec. 1st - Collected $ 550 from Franklin from a previous engagement

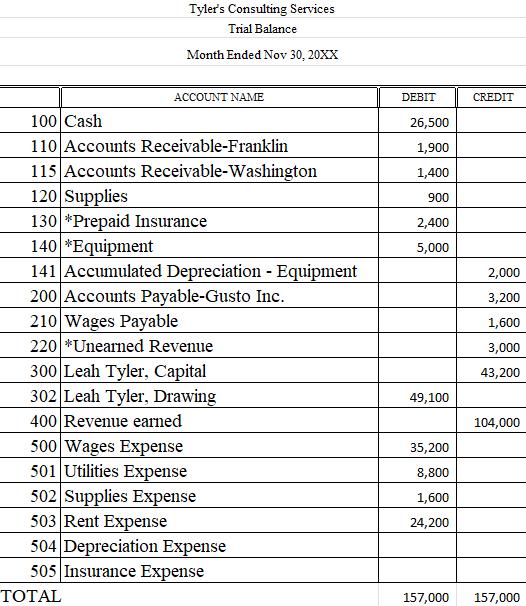

Prepare Adjusted trial balance, Balance sheet, Income statement and Closing JE & TB.

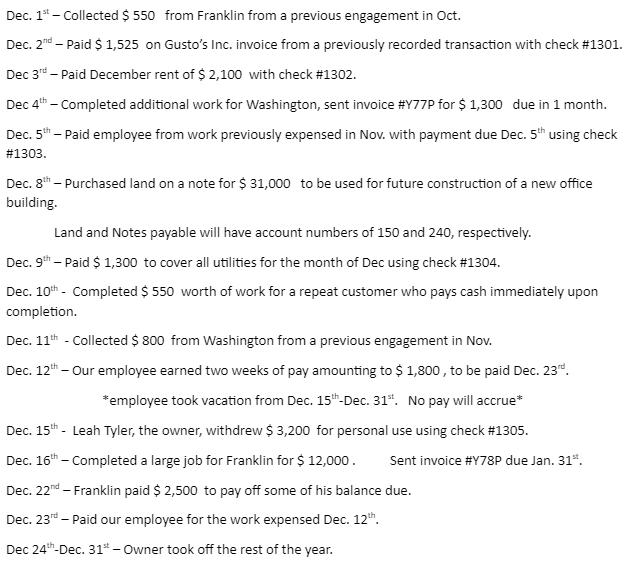

Dec. 1st - Collected $ 550 from Franklin from a previous engagement in Oct. Dec. 2d - Paid $ 1,525 on Gusto's Inc. invoice from a previously recorded transaction with check #1301. Dec 3rd - Paid December rent of $2,100 with check # 1302. Dec 4th - Completed additional work for Washington, sent invoice #Y77P for $ 1,300 due in 1 month. Dec. 5th - Paid employee from work previously expensed in Nov. with payment due Dec. 5th using check #1303. Dec. 8th - Purchased land on a note for $ 31,000 to be used for future construction of a new office building. Land and Notes payable will have account numbers of 150 and 240, respectively. Dec. 9th - Paid $ 1,300 to cover all utilities for the month of Dec using check #1304. Dec. 10th - Completed $ 550 worth of work for a repeat customer who pays cash immediately upon completion. Dec. 11th - Collected $ 800 from Washington from a previous engagement in Nov. Dec. 12th - Our employee earned two weeks of pay amounting to $ 1,800, to be paid Dec. 23rd. *employee took vacation from Dec. 15th-Dec. 31st. No pay will accrue* Dec. 15th - Leah Tyler, the owner, withdrew $ 3,200 for personal use using check # 1305. Dec. 16th - Completed a large job for Franklin for $ 12,000. Sent invoice #Y78P due Jan. 31*. Dec. 22nd - Franklin paid $ 2,500 to pay off some of his balance due. Dec. 23rd - Paid our employee for the work expensed Dec. 12th. Dec 24th-Dec. 31" - Owner took off the rest of the year.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started