Question

Prepare adjusting entries for the seven items described below. 1. Drew Carey Company borrowed $15,000 by signing a 13%, one-year note on September 1, 2010.

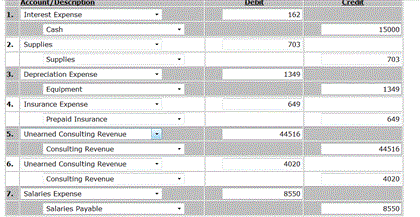

Prepare adjusting entries for the seven items described below. 1. Drew Carey Company borrowed $15,000 by signing a 13%, one-year note on September 1, 2010. 2. A count of supplies on December 31, 2010, indicates that supplies of $703 are on hand. 3. Depreciation on the equipment for 2010 is $1,349. 4. Drew Carey Company paid $7,788 for 12 months of insurance coverage on June 1, 2010. 5. On December 1, 2010, Drew Carey collected $44,516 for consulting services to be performed from December 1, 2010, through March 31, 2011. 6. Drew Carey performed consulting services for a client in December 2010. The client will be billed $4,020. 7. Drew Carey Company pays its employees total salaries of $8,550 every Monday for the preceding 5-day week (Monday through Friday). On Monday, December 29, employees were paid for the week ending December 26. All employees worked the last 3 days of 2010.

This is what I have, needs checked. Thanks

This is what I have, needs checked. Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started