Answered step by step

Verified Expert Solution

Question

1 Approved Answer

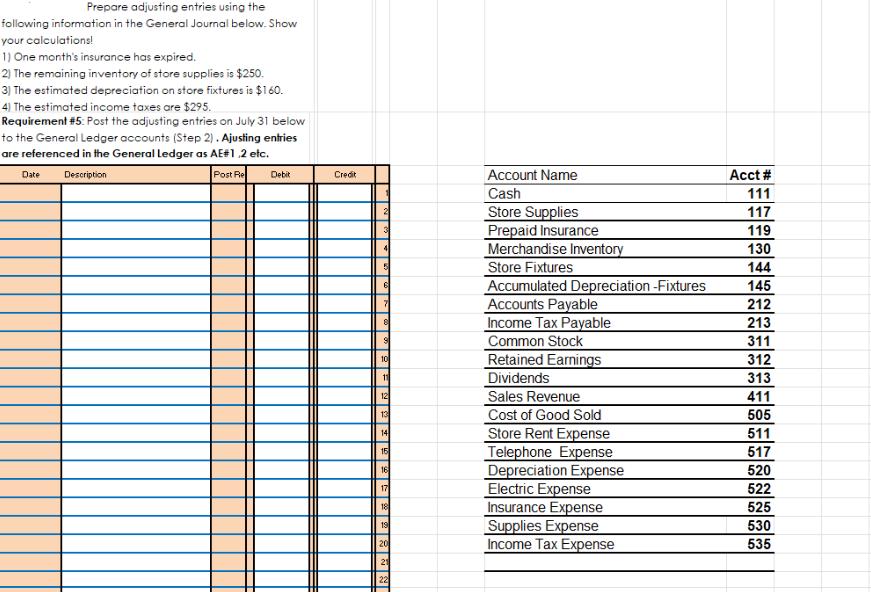

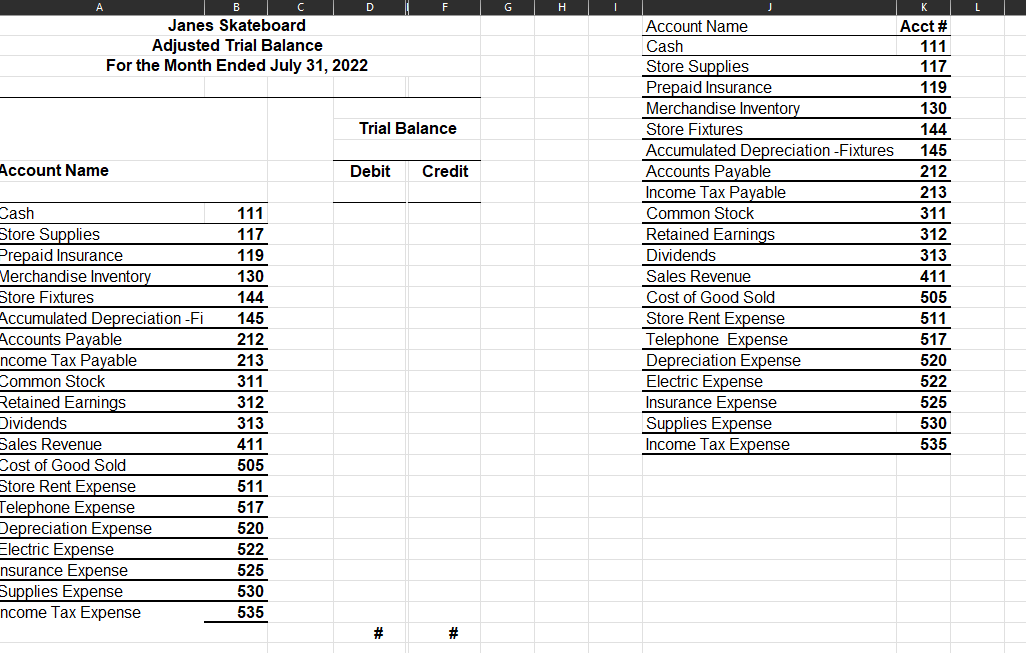

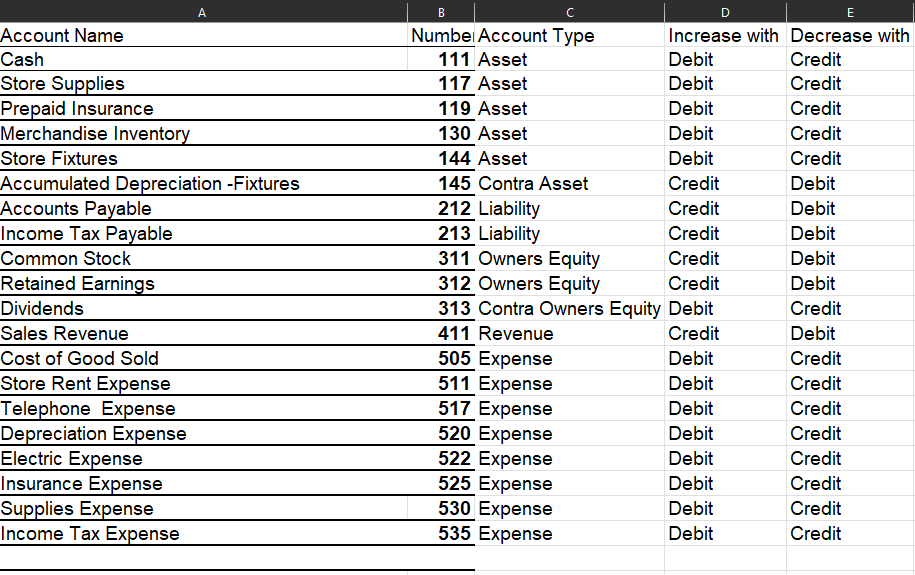

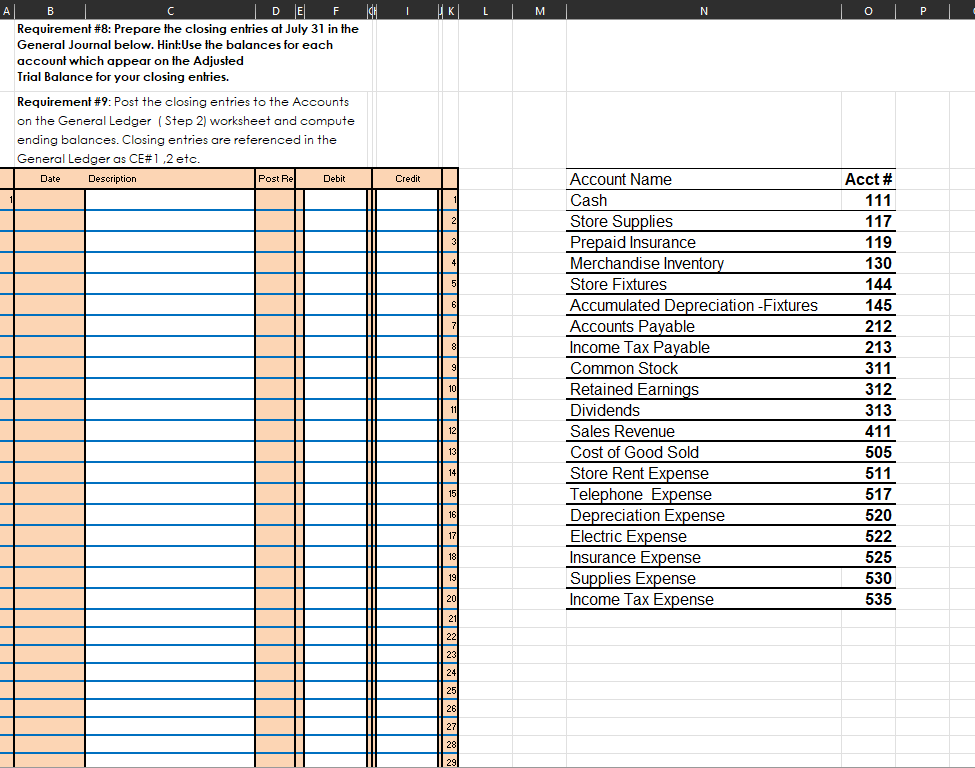

Prepare adjusting entries using the following information in the General Journal below. Show your calculations! 1) One month's insurance has expired. 2) The remaining

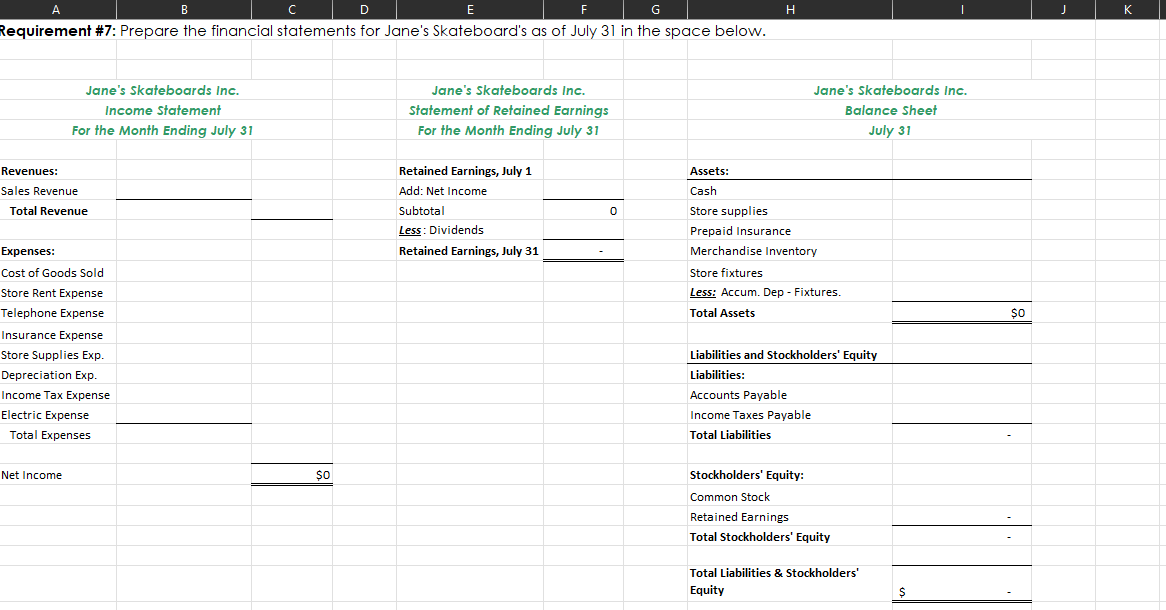

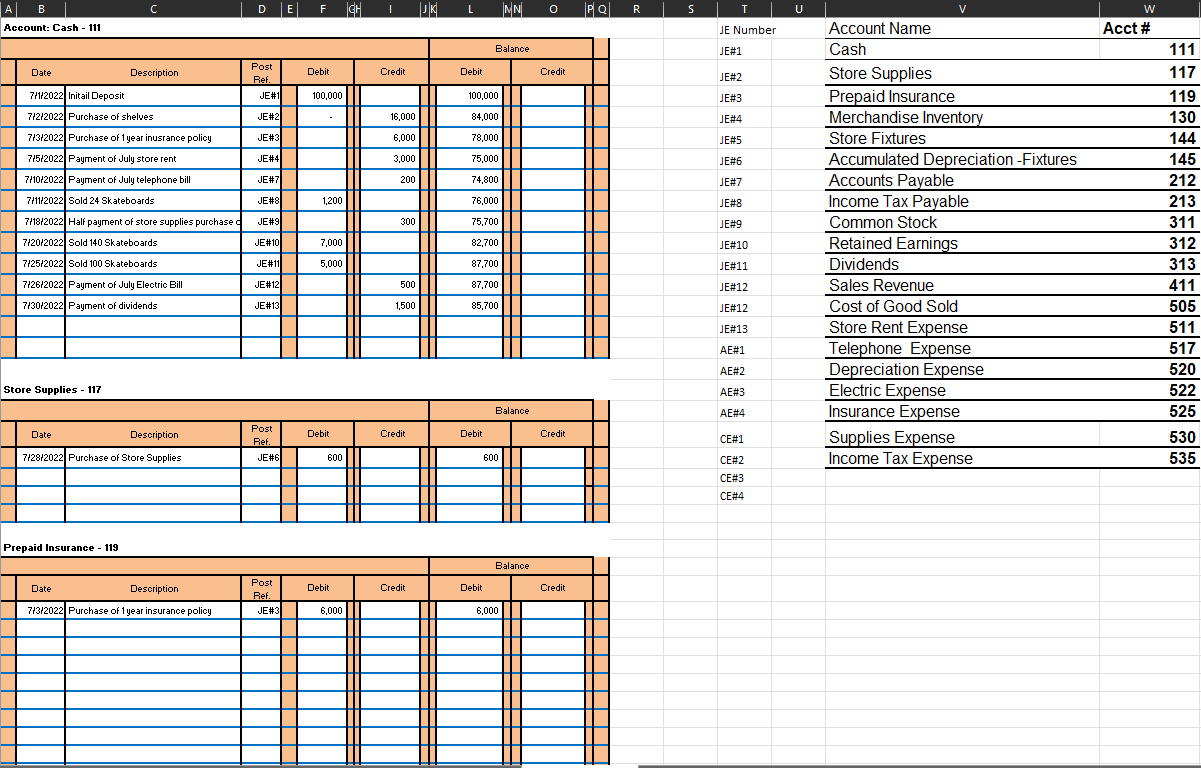

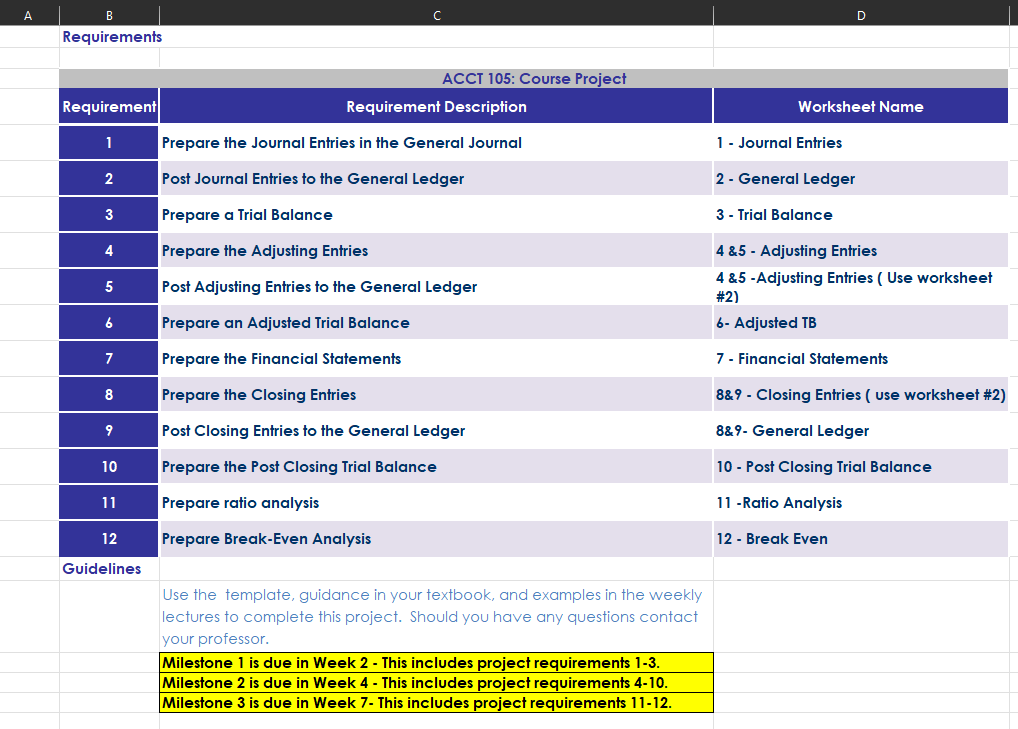

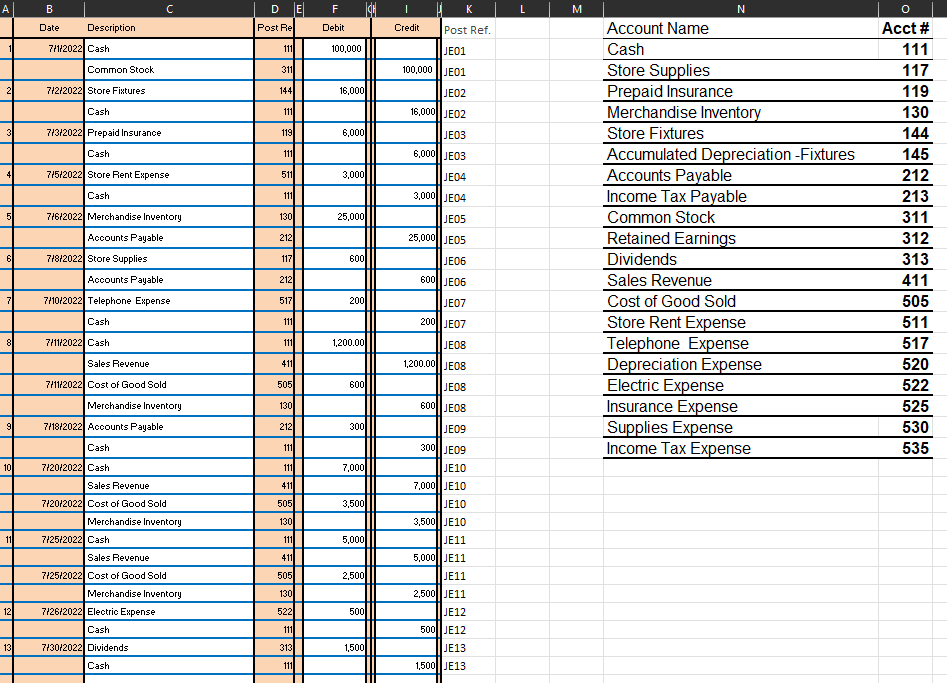

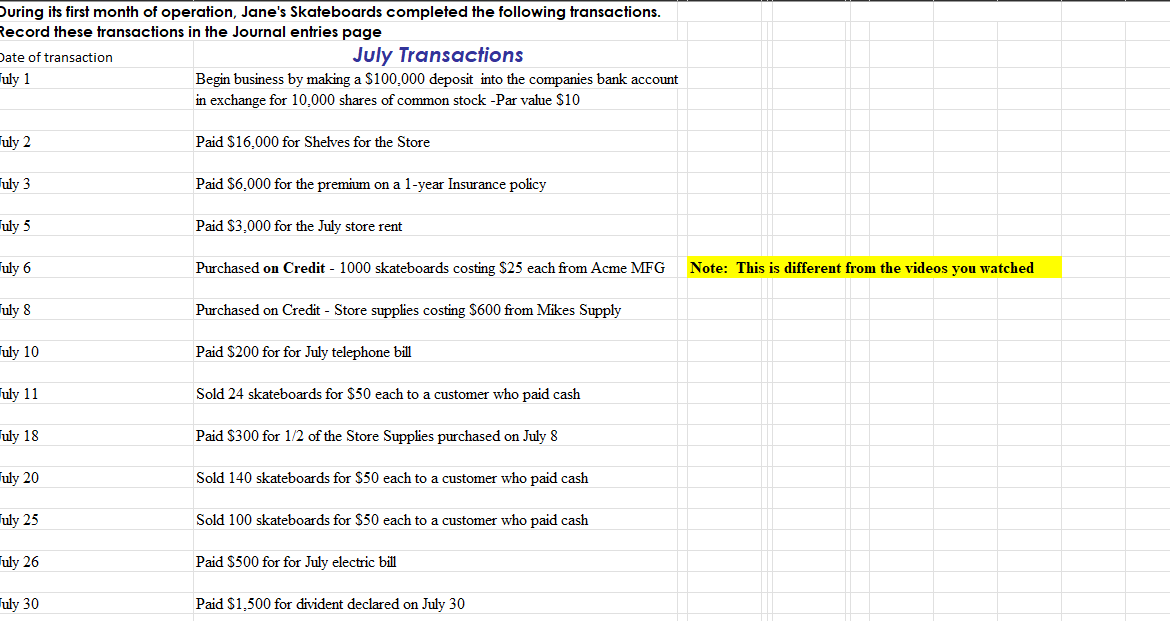

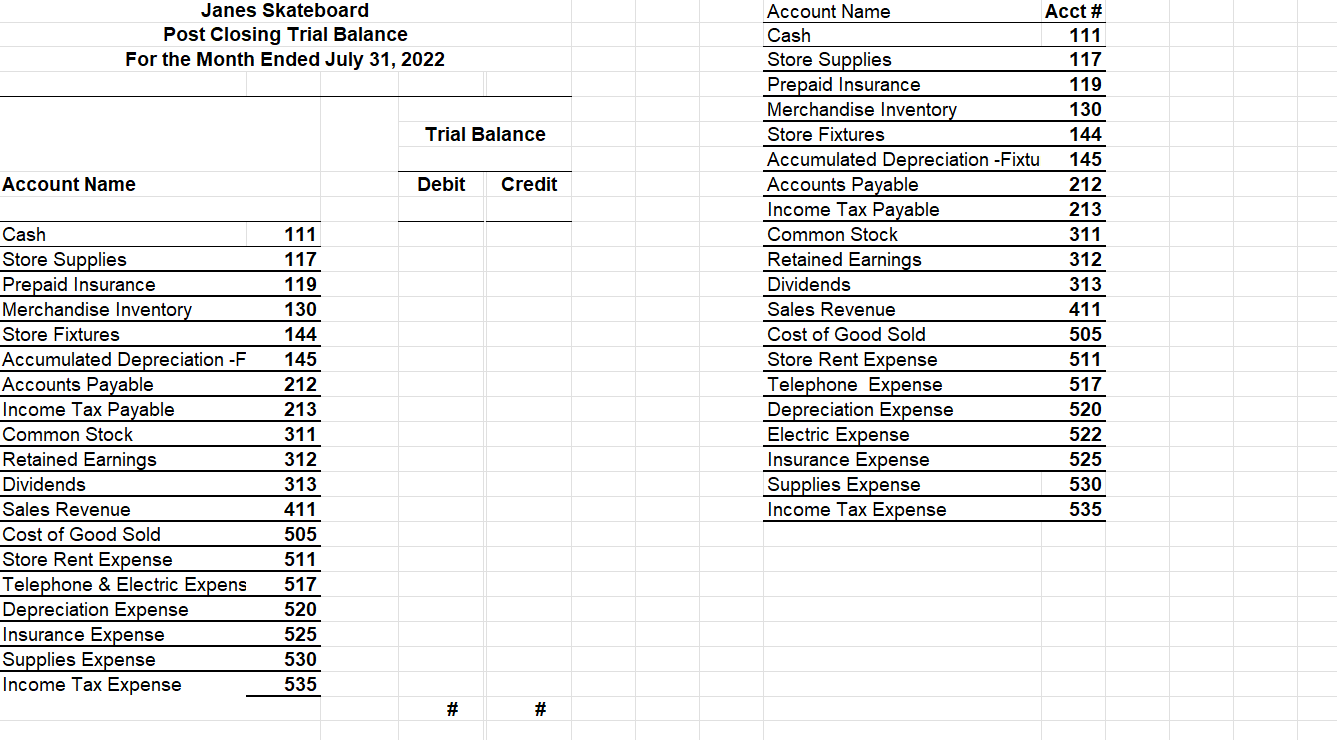

Prepare adjusting entries using the following information in the General Journal below. Show your calculations! 1) One month's insurance has expired. 2) The remaining inventory of store supplies is $250. 3) The estimated depreciation on store fixtures is $160. 4) The estimated income taxes are $295. Requirement #5: Post the adjusting entries on July 31 below to the General Ledger accounts (Step 2). Ajusting entries are referenced in the General Ledger as AE#1.2 etc. Date Description Post Re Debit Credit Account Name Cash Acct # 111 Store Supplies 117 Prepaid Insurance 119 4 Merchandise Inventory 130 5 Store Fixtures 144 6 Accumulated Depreciation -Fixtures 145 7 Accounts Payable 212 8 Income Tax Payable 213 S Common Stock 311 10 Retained Earnings 312 11 Dividends 313 12 Sales Revenue 411 13 Cost of Good Sold 505 14 Store Rent Expense 511 15 Telephone Expense 517 16 Depreciation Expense 520 17 Electric Expense 522 18 Insurance Expense 525 19 Supplies Expense 530 20 Income Tax Expense 535 21 22 A B Janes Skateboard Adjusted Trial Balance For the Month Ended July 31, 2022 D F G H K Account Name Cash Acct # 111 Store Supplies 117 Prepaid Insurance 119 Merchandise Inventory 130 Trial Balance Store Fixtures 144 Accumulated Depreciation -Fixtures 145 Account Name Cash Debit Credit Accounts Payable 212 Income Tax Payable 213 111 Common Stock 311 Store Supplies 117 Retained Earnings 312 Prepaid Insurance 119 Dividends 313 Merchandise Inventory 130 Sales Revenue 411 Store Fixtures 144 Cost of Good Sold 505 Accumulated Depreciation -Fi 145 Store Rent Expense 511 Accounts Payable 212 Telephone Expense 517 ncome Tax Payable 213 Depreciation Expense 520 Common Stock 311 Electric Expense 522 Retained Earnings 312 Insurance Expense 525 Dividends 313 Supplies Expense 530 Sales Revenue 411 Income Tax Expense 535 Cost of Good Sold 505 Store Rent Expense 511 Telephone Expense 517 Depreciation Expense 520 Electric Expense 522 nsurance Expense 525 Supplies Expense 530 ncome Tax Expense 535 # # A B C D E Account Name Cash Store Supplies Prepaid Insurance Number Account Type Increase with Decrease with 111 Asset Debit Credit 117 Asset Debit Credit 119 Asset Debit Credit Merchandise Inventory 130 Asset Debit Credit Store Fixtures 144 Asset Debit Credit Accumulated Depreciation -Fixtures 145 Contra Asset Credit Debit Accounts Payable 212 Liability Credit Debit Income Tax Payable 213 Liability Credit Debit Common Stock Retained Earnings Dividends Sales Revenue 311 Owners Equity Credit Debit 312 Owners Equity Credit Debit 313 Contra Owners Equity Debit Credit 411 Revenue Credit Debit Cost of Good Sold 505 Expense Debit Credit Store Rent Expense Telephone Expense 511 Expense Debit Credit 517 Expense Debit Credit Depreciation Expense 520 Expense Debit Credit Electric Expense 522 Expense Debit Credit Insurance Expense 525 Expense Debit Credit Supplies Expense 530 Expense Debit Credit Income Tax Expense 535 Expense Debit Credit B DE F Requirement #8: Prepare the closing entries at July 31 in the General Journal below. Hint:Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the Accounts on the General Ledger (Step 2) worksheet and compute ending balances. Closing entries are referenced in the General Ledger as CE #1,2 etc. Date Description Post Re Debit Credit K L M N P Account Name Cash Acct # 111 2 Store Supplies 117 3 Prepaid Insurance 119 4 Merchandise Inventory 130 5 Store Fixtures 144 6 Accumulated Depreciation -Fixtures 145 7 Accounts Payable 212 8 Income Tax Payable 213 9 Common Stock 311 10 Retained Earnings 312 11 Dividends 313 12 Sales Revenue 411 13 Cost of Good Sold 505 14 Store Rent Expense 511 15 Telephone Expense 517 16 Depreciation Expense 520 17 Electric Expense 522 18 Insurance Expense 525 19 Supplies Expense 530 20 Income Tax Expense 535 21 22 23 24 25 26 27 28 29 A B D E F Requirement #7: Prepare the financial statements for Jane's Skateboard's as of July 31 in the space below. Jane's Skateboards Inc. Income Statement For the Month Ending July 31 Revenues: Sales Revenue Total Revenue Expenses: Cost of Goods Sold Store Rent Expense Telephone Expense Insurance Expense Store Supplies Exp. Depreciation Exp. Income Tax Expense Electric Expense Total Expenses Net Income $0 Jane's Skateboards Inc. Statement of Retained Earnings For the Month Ending July 31 Retained Earnings, July 1 Add: Net Income Subtotal Less: Dividends Retained Earnings, July 31 Assets: Cash 0 Store supplies H Jane's Skateboards Inc. Balance Sheet July 31 Prepaid Insurance Merchandise Inventory Store fixtures Less: Accum. Dep - Fixtures. Total Assets Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity $ $0 J K B Account: Cash - 111 D E F GH JK L MN PQ R S T U W JE Number Account Name Acct # Balance JE#1 Cash 111 Post Description Debit Credit Debit Credit Ref. JE#2 Store Supplies 117 7/1/2022 Initail Deposit JE#1 100,000 100,000 JE#3 Prepaid Insurance 119 7/2/2022 Purchase of shelves JE#2 16,000 84,000 JE#4 Merchandise Inventory 130 7/3/2022 Purchase of 1 year inusrance policy JE#3 6,000 78,000 JE#5 Store Fixtures 144 7/5/2022 Payment of July store rent JE#4 3,000 75,000 JE#6 Accumulated Depreciation -Fixtures 145 7/10/2022 Payment of July telephone bill JE#7 200 74,800 JE#7 Accounts Payable 212 7/11/2022 Sold 24 Skateboards JE#8 1,200 76,000 JE#8 Income Tax Payable 213 7/18/2022 Half payment of store supplies purchase c JE#9 300 75,700 JE#9 Common Stock 311 7/20/2022 Sold 140 Skateboards JE#10 7,000 82,700 JE#10 Retained Earnings 312 7/25/2022 Sold 100 Skateboards JE#11 5,000 87,700 JE#11 Dividends 313 7/26/2022 Payment of July Electric Bill JE#12 500 87,700 JE#12 Sales Revenue 411 7/30/2022 Payment of dividends JE#13 1,500 85,700 JE#12 Cost of Good Sold 505 JE#13 Store Rent Expense 511 AE#1 Telephone Expense 517 AE#2 Depreciation Expense 520 Store Supplies - 117 AE#3 Electric Expense 522 Balance AE#4 Insurance Expense 525 Post Date Description Debit Credit Debit Credit CE#1 Ref. Supplies Expense 530 7/28/2022 Purchase of Store Supplies JE#6 600 600 CE#2 Income Tax Expense 535 CE#3 CE#4 Prepaid Insurance -119 Date Description 7/3/2022 Purchase of 1 year insurance policy Balance Post Ref. Debit Credit Debit Credit JE#3 6,000 6,000 A B Requirements C D Requirement ACCT 105: Course Project Requirement Description 1 Prepare the Journal Entries in the General Journal 2 Post Journal Entries to the General Ledger 3 Prepare a Trial Balance 4 Prepare the Adjusting Entries 5 Post Adjusting Entries to the General Ledger 6 Prepare an Adjusted Trial Balance 7 Prepare the Financial Statements 8 Prepare the Closing Entries Post Closing Entries to the General Ledger 9 10 Prepare the Post Closing Trial Balance 11 Prepare ratio analysis 12 Prepare Break-Even Analysis Worksheet Name 1 - Journal Entries 2- General Ledger 3 - Trial Balance 4&5 - Adjusting Entries 4 &5 -Adjusting Entries (Use worksheet #2) 6- Adjusted TB 7 - Financial Statements 8&9 - Closing Entries ( use worksheet #2) 8&9- General Ledger 10 - Post Closing Trial Balance 11 -Ratio Analysis 12 - Break Even Guidelines Use the template, guidance in your textbook, and examples in the weekly lectures to complete this project. Should you have any questions contact your professor. Milestone 1 is due in Week 2 - This includes project requirements 1-3. Milestone 2 is due in Week 4 - This includes project requirements 4-10. Milestone 3 is due in Week 7- This includes project requirements 11-12. A B C DE F CH K L M N Date Description Post Re Debit Credit Post Ref. Account Name Acct # 1 7/1/2022 Cash 111 100,000 JE01 Cash 111 Common Stock 311 100,000 JE01 Store Supplies 117 2 7/2/2022 Store Fixtures 144 16,000 JE02 Prepaid Insurance 119 Cash 111 16,000 JE02 Merchandise Inventory 130 3 7/3/2022 Prepaid Insurance 119 6,000 JE03 Store Fixtures 144 Cash 111 6,000 JE03 Accumulated Depreciation -Fixtures 145 4 7/5/2022 Store Rent Expense 511 3,000 JE04 Accounts Payable 212 Cash 111 3,000 JE04 Income Tax Payable 213 5 7/6/2022 Merchandise Inventory 130 25,000 JE05 Common Stock 311 Accounts Payable 212 25,000 JE05 Retained Earnings 312 6 7/8/2022 Store Supplies 117 600 JE06 Dividends 313 Accounts Payable 212 600 JE06 Sales Revenue 411 7 7/10/2022 Telephone Expense 517 200 JE07 Cost of Good Sold 505 Cash 111 200 JE07 Store Rent Expense 511 8 7/11/2022 Cash 111 1,200.00 JE08 Telephone Expense 517 Sales Revenue 411 7/11/2022 Cost of Good Sold 505 600 JE08 Merchandise Inventory 130 9 7/18/2022 Accounts Payable 212 300 Cash 111 300 JE09 1,200.00 JE08 600 JE08 JE09 Income Tax Expense Depreciation Expense 520 Electric Expense 522 Insurance Expense 525 Supplies Expense 530 535 10 7/20/2022 Cash 111 7,000 JE10 Sales Revenue 411 7,000 JE10 7/20/2022 Cost of Good Sold 505 3,500 JE10 Merchandise Inventory 130 3,500 JE10 11 7/25/2022 Cash 111 5,000 JE11 Sales Revenue 411 5,000 JE11 7/25/2022 Cost of Good Sold 505 2,500 Merchandise Inventory 130 JE11 2,500 JE11 12 7/26/2022 Electric Expense 522 500 JE12 Cash 111 500 JE12 13 7/30/2022 Dividends 313 1,500 JE13 Cash 111 1,500 JE13 During its first month of operation, Jane's Skateboards completed the following transactions. Record these transactions in the Journal entries page Date of transaction uly 1 July 2 Tuly 3 July 5 Tuly 6 July 8 uly 10 uly 11 Tuly 18 uly 20 uly 25 Tuly 26 Tuly 30 July Transactions Begin business by making a $100,000 deposit into the companies bank account in exchange for 10,000 shares of common stock -Par value $10 Paid $16,000 for Shelves for the Store Paid $6,000 for the premium on a 1-year Insurance policy Paid $3,000 for the July store rent Purchased on Credit - 1000 skateboards costing $25 each from Acme MFG Note: This is different from the videos you watched Purchased on Credit - Store supplies costing $600 from Mikes Supply Paid $200 for for July telephone bill Sold 24 skateboards for $50 each to a customer who paid cash Paid $300 for 1/2 of the Store Supplies purchased on July 8 Sold 140 skateboards for $50 each to a customer who paid cash Sold 100 skateboards for $50 each to a customer who paid cash Paid $500 for for July electric bill Paid $1,500 for divident declared on July 30 Janes Skateboard Post Closing Trial Balance For the Month Ended July 31, 2022 Account Name Acct # Cash 111 Store Supplies 117 Prepaid Insurance 119 Merchandise Inventory 130 Trial Balance Store Fixtures 144 Accumulated Depreciation -Fixtu 145 Account Name Cash Debit Credit Accounts Payable 212 Income Tax Payable 213 111 Common Stock 311 Store Supplies 117 Retained Earnings 312 Prepaid Insurance 119 Dividends 313 Merchandise Inventory 130 Sales Revenue 411 Store Fixtures 144 Cost of Good Sold 505 Accumulated Depreciation -F 145 Store Rent Expense 511 Accounts Payable 212 Telephone Expense 517 Income Tax Payable 213 Depreciation Expense 520 Common Stock 311 Electric Expense 522 Retained Earnings 312 Insurance Expense 525 Dividends 313 Supplies Expense 530 Sales Revenue 411 Income Tax Expense 535 Cost of Good Sold 505 Store Rent Expense 511 Telephone & Electric Expens 517 Depreciation Expense 520 Insurance Expense 525 Supplies Expense 530 Income Tax Expense 535 # #

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started