Question

Prepare adjusting journal entries and work sheet for the given company. The data available for adjustment as of December 31, 2020 are: a. The final

Prepare adjusting journal entries and work sheet for the given company.

The data available for adjustment as of December 31, 2020 are:

The data available for adjustment as of December 31, 2020 are:

a. The final value of the adjustment is IDR 57.200.000

b. The remaining shop equipment is IDR 3,300,000

c. The land value is IDR 35,000,000, while the price of the office building is IDR 95,000,000, which was obtained on January 1, 2018. The office building is estimated to have an economic life of 20 years with a residual value or residual value of IDR 5,000,000

d. Shop and office equipment are depreciated at IDR 10,080,000, and IDR 6,480,000

e. The employee wage rate is IDR 30,000, per person for 1 day. In 1 week there are 6 working days and payments are made every Saturday. The number of store employees is 10 people and office employees are 6 people. December 31, 2020 is far away on a thursday.

f. Prepaid insurance is a payment on an insurance policy for the coverage period from 01 May 2020 to 01 May 2021. This insurance expense is borne by the general and administrative divisions

g. Unearned rental income arises from the rental of unused office space to other parties, for the period 01 March 2020 to 01 September 2021

h. The company rented a room from another party which was used as a shop room for UD. be healthy. The rent for this shop space is paid for a period of 3 months, starting on December 01, 2020.

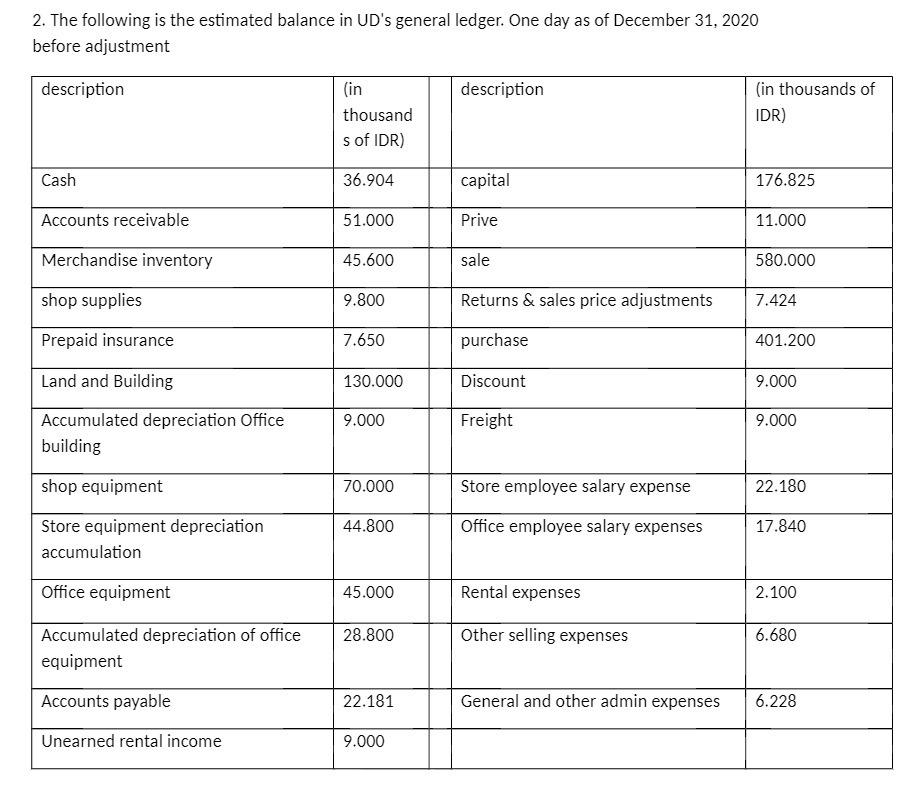

2. The following is the estimated balance in UD's general ledger. One day as of December 31, 2020 before adjustment description Cash Accounts receivable Merchandise inventory shop supplies Prepaid insurance Land and Building Accumulated depreciation Office building shop equipment Store equipment depreciation accumulation Office equipment Accumulated depreciation of office equipment Accounts payable Unearned rental income (in thousand s of IDR) 36.904 51.000 45.600 9.800 7.650 130.000 9.000 70.000 44.800 45.000 28.800 22.181 9.000 description capital Prive sale Returns & sales price adjustments purchase Discount Freight Store employee salary expense Office employee salary expenses Rental expenses Other selling expenses General and other admin expenses (in thousands of IDR) 176.825 11.000 580.000 7.424 401.200 9.000 9.000 22.180 17.840 2.100 6.680 6.228

Step by Step Solution

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Shop Equipment Depreciation Adjustment The remaining shop equipment value is IDR 3300000 Therefore the depreciation for the period can be calculated a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started