Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare all of the financial ratios including: Liquidity Ratios: Current ratio Quick ratio Cash flow liquidity Average collection period Days inventory held Days payable outstanding

prepare all of the financial ratios including:

Liquidity Ratios:

Current ratio

Quick ratio

Cash flow liquidity

Average collection period

Days inventory held

Days payable outstanding

Cash conversion cycle

Activity Ratios:

Accounts receivable turnover

Inventory turnover

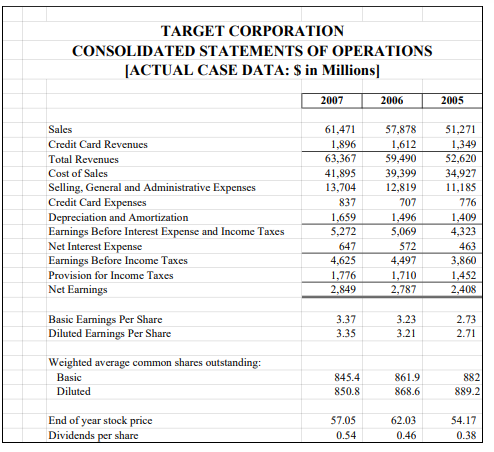

TARGET CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS [ACTUAL CASE DATA: $ in Millions] 2007 2006 2005 Sales 61,471 57,878 51,271 Credit Card Revenues 1,896 1,612 1,349 Total Revenues 63,367 59,490 52,620 Cost of Sales 41,895 39,399 34,927 Selling, General and Administrative Expenses 13,704 12,819 11,185 Credit Card Expenses 837 707 776 Depreciation and Amortization 1,659 1,496 1,409 Earnings Before Interest Expense and Income Taxes 5,272 5,069 4,323 Net Interest Expense 647 572 463 Earnings Before Income Taxes 4,625 4,497 3,860 Provision for Income Taxes 1,776 1,710 1,452 Net Earnings 2,849 2,787 2,408 Basic Earnings Per Share 3.37 3.23 2.73 Diluted Earnings Per Share 3.35 3.21 2.71 Weighted average common shares outstanding: Basic 845.4 861.9 882 Diluted 850.8 868.6 889.2 End of year stock price 57.05 62.03 54.17 Dividends per share 0.54 0.46 0.38

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started