Answered step by step

Verified Expert Solution

Question

1 Approved Answer

prepare an adjusted balance sheet for February ACFI-200 Financial Accounting cmi.Jelal rolerat Spring 2018 Financial Statement Project On January 1, 2018 Xavier and Brianne formed

prepare an adjusted balance sheet for February

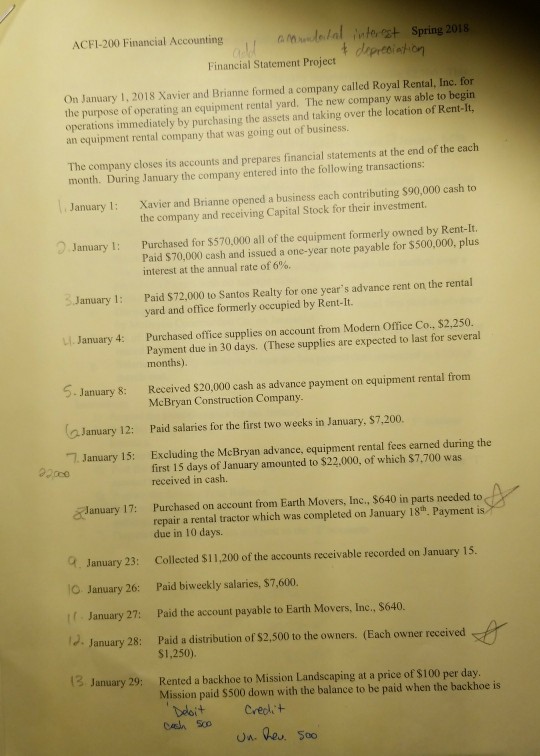

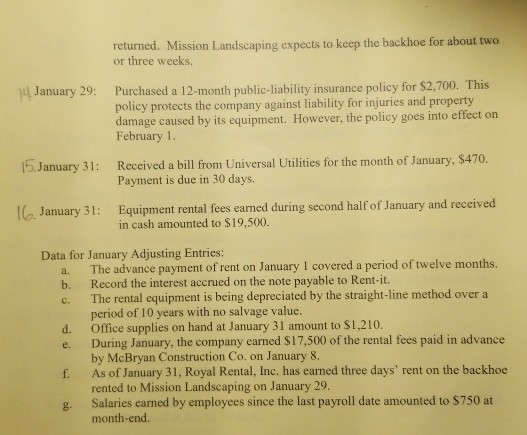

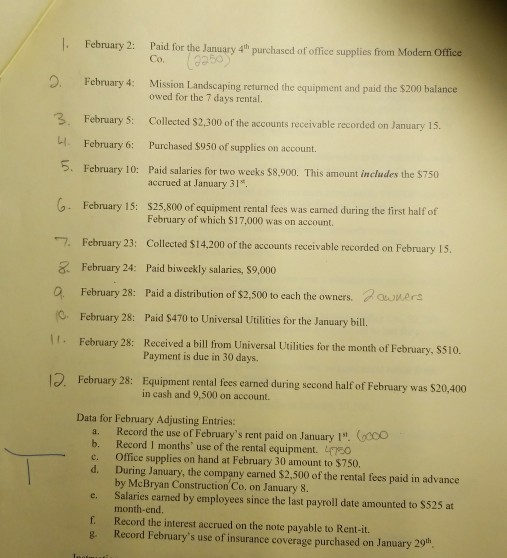

ACFI-200 Financial Accounting cmi.Jelal rolerat Spring 2018 Financial Statement Project On January 1, 2018 Xavier and Brianne formed a company called Royal Rental, Inc. for the purpose of operating an equipment rental yard. The new company was able to begin operations immediately by purchasing the assets and taking over the location of Rent-It, an equipment rental company that was going out of business. The company closes its accounts and prepares financial statements at the end of the each month. During January the company entered into the following transactions: January 1: Xavier and Brianne opened a business each contributing $90,000 cash to the company and receiving Capital Stock for their investment January 1: Purchased for $570,000 all of the equipment formerly owned by Rent-It. Paid $70,000 cash and issued a one-year note payable for $500,000, plus interest at the annual rate of 6%. 3January 1: Paid $72,000 to Santos Realty for one year's advance rent on the rental LI. January 4: Purchased office supplies on account from Modern Office Co., $2,250. 5. January 8: Received S20,000 cash as advance payment on equipment rental from yard and office formerly occupied by Rent-It. Payment due in 30 days. (These supplies are expected to last for several months) McBryan Construction Company January 12: Paid salaries for the first two weeks in January, S7.200. 7 January 15: Excluding the McBryan advance, equipment rental fees earned during the first 15 days of January amounted to $22.000, of which $7,700 was received in cash. January 17: Purchased on account from Earth Movers, Inc., $640 in parts needed to repair a rental tractor which was completed on January 18th. Payment is due in 10 days. Q January 23: Collected $11,200 of the accounts receivable recorded on January 15. O January 26: Paid biweekly salaries, $7,600. January 27: Paid the account payable to Earth Movers, Inc., $640. J. January 28: Paid a distribution of S2,500 to the owners. (Each owner received S1,250). 13 January 29: Rented a backhoe to Mission Landscaping at a price of S100 per day Mission paid S500 down with the balance to be paid when the backhoe isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started