Answered step by step

Verified Expert Solution

Question

1 Approved Answer

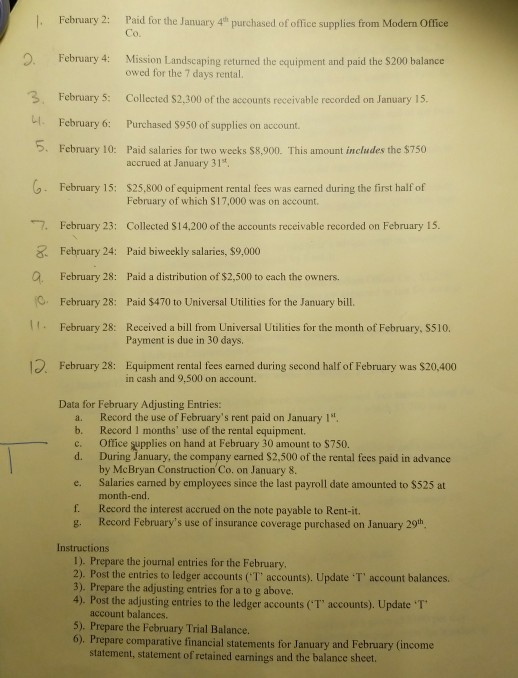

prepare an adjusted trial balance for February l. February 2: Paid for the January 4 purchased of office supplies from Modern Office Co. February 4:

prepare an adjusted

trial balance for February

l. February 2: Paid for the January 4 purchased of office supplies from Modern Office Co. February 4: Mission Landscaping returned the equipment and paid the S200 balance owed for the 7 days rental. 3 February S: Collected $2,300 of the accounts receivable recorded on January 15. 4. February 6: Purchased S950 of supplies on account. 5. February 10: Paid salaries for two weeks S8,900. This amount includes the $750 accrued at January 31* G. February 15: S25,800 of equipment rental fees was earned during the first half of February of which S17,000 was on account. 7. February 23: Collected S14,.200 of the accounts receivable recorded on February 15. & February 24: Paid biweekly salaries, $9,000 Q. February 28: Paid a distribution of $2,500 to cach the ownens. February 28: Paid $470 to Universal Utilities for the January bill. February 28: Received a bill from Universal Utilities for the month of February, Ss10. February 28: Equipment rental fees eaned during second half of February was $20,400 Data for February Adjusting Entries: Payment is due in 30 days. in cash and 9,500 on account. Record the use of February's rent paid on January 1't, Office kupplies on hand at February 30 amount to $750. by McBryan Construction Co. on January 8. month-end. a. b. Record 1 months' use of the rental equipment. d. During January, the company earned $2,500 of the rental fees paid in advance e. Salaries carned by employees since the last payroll date amounted to $525 at f. Record the interest accrued on the note payable to Rent-it. -c. g. Record February's use of insurance coverage purchased on January 29h Instructions I). Prepare the journal entries for the February. 2). Post the entries to ledger accounts (T accounts). Update 'T" account balances. 3). Prepare the adjusting entries for a to g above. 4). Post the adjusting entries to the ledger accounts (T' accounts). Update T account balances. 5). Prepare the February Trial Balance. 6). Prepare comparative financial statements for January and February (income statement, statement of retained earnings and the balance sheet. l. February 2: Paid for the January 4 purchased of office supplies from Modern Office Co. February 4: Mission Landscaping returned the equipment and paid the S200 balance owed for the 7 days rental. 3 February S: Collected $2,300 of the accounts receivable recorded on January 15. 4. February 6: Purchased S950 of supplies on account. 5. February 10: Paid salaries for two weeks S8,900. This amount includes the $750 accrued at January 31* G. February 15: S25,800 of equipment rental fees was earned during the first half of February of which S17,000 was on account. 7. February 23: Collected S14,.200 of the accounts receivable recorded on February 15. & February 24: Paid biweekly salaries, $9,000 Q. February 28: Paid a distribution of $2,500 to cach the ownens. February 28: Paid $470 to Universal Utilities for the January bill. February 28: Received a bill from Universal Utilities for the month of February, Ss10. February 28: Equipment rental fees eaned during second half of February was $20,400 Data for February Adjusting Entries: Payment is due in 30 days. in cash and 9,500 on account. Record the use of February's rent paid on January 1't, Office kupplies on hand at February 30 amount to $750. by McBryan Construction Co. on January 8. month-end. a. b. Record 1 months' use of the rental equipment. d. During January, the company earned $2,500 of the rental fees paid in advance e. Salaries carned by employees since the last payroll date amounted to $525 at f. Record the interest accrued on the note payable to Rent-it. -c. g. Record February's use of insurance coverage purchased on January 29h Instructions I). Prepare the journal entries for the February. 2). Post the entries to ledger accounts (T accounts). Update 'T" account balances. 3). Prepare the adjusting entries for a to g above. 4). Post the adjusting entries to the ledger accounts (T' accounts). Update T account balances. 5). Prepare the February Trial Balance. 6). Prepare comparative financial statements for January and February (income statement, statement of retained earnings and the balance sheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started