Question

Prepare an analysis showing whether the company should eliminate the line. Instructions Calculate net income under variable costing for each year. Calculate net income under

Prepare an analysis showing whether the company should eliminate the line.

Instructions

Calculate net income under variable costing for each year.

Calculate net income under absorption costing for each year.

Reconcile the differences each year in income from operations under the two costing approaches.

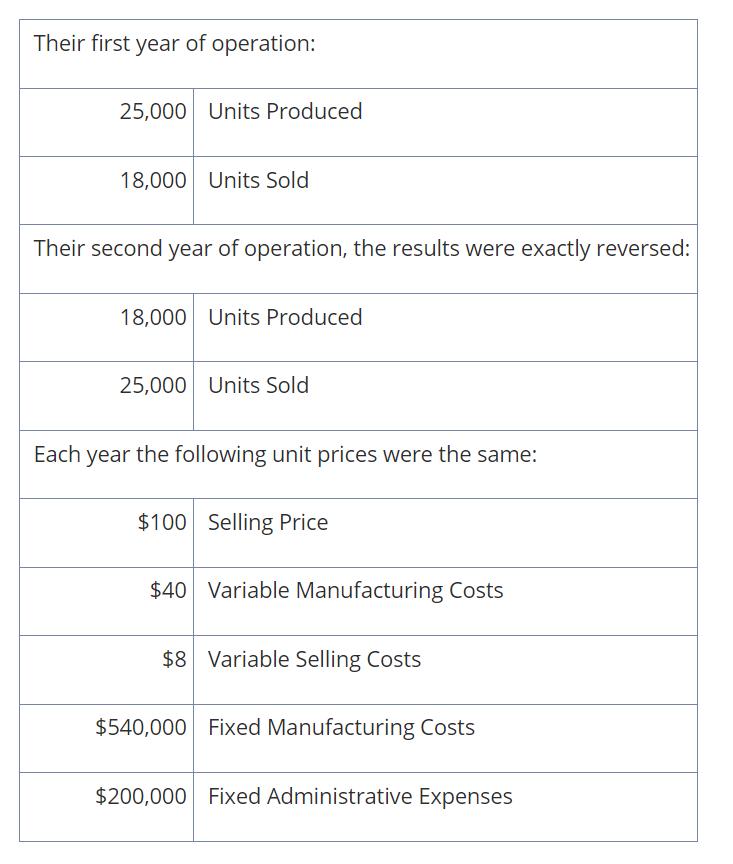

Their first year of operation: 25,000 Units Produced 18,000 Units Sold Their second year of operation, the results were exactly reversed: 18,000 Units Produced 25,000 Units Sold Each year the following unit prices were the same: $100 Selling Price $40 Variable Manufacturing Costs $8 Variable Selling Costs $540,000 Fixed Manufacturing Costs $200,000 Fixed Administrative Expenses

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management Measuring Monitoring And Motivating Performance

Authors: Leslie G. Eldenburg, Susan Wolcott, Liang Hsuan Chen, Gail Cook

2nd Canadian Edition

1118168879, 9781118168875

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App